A host of investors bet on Twitter stock as the shares fell after Elon Musk pulled away from his initial offer to buy the social media giant. Why? Record profits stood to be made.

The outcome of the deal remains in doubt, even after Mr. Musk's surprising proposal earlier this week to close it as originally approved after months trying to step away. Some investors have already cashed in.

But the opportunity for those willing to bet Twitter might get the full price after all was massive, according to Morgan Ricks, a Vanderbilt Law School professor who specializes in financial regulation:

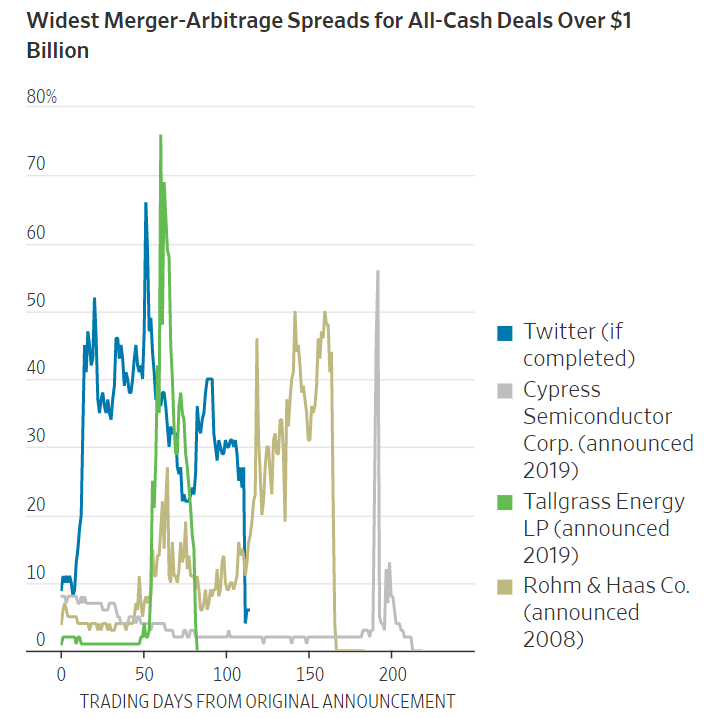

-- Should the Twitter-Musk saga end with a buyout at the proposed price, $54.20, according to Mr. Ricks, it'll mark the second-biggest arbitrage opportunity for a cash buyout of at least $1 billion since at least 1996.

"Prior to Tuesday, the market had been pricing in a roughly 50/50 chance of the deal going through," Mr. Ricks said.

At one point, the difference between Twitter's stock price and Mr. Musk's original offer was 66%, below the 76% record set by Blackstone Group's 2019 purchase of Tallgrass Energy.

The cost of that deal, however, was roughly $3.5 billion, far from the potential $44 billion bill for Twitter.

Investors like Carl Icahn, Daniel Loeb's Third Point LLC, and D.E. Shaw Group have already profited from wagers on Twitter shares], which give the right to purchase shares at a specific price by a certain date. Some investors took a third route: convertible-bond arbitrage.

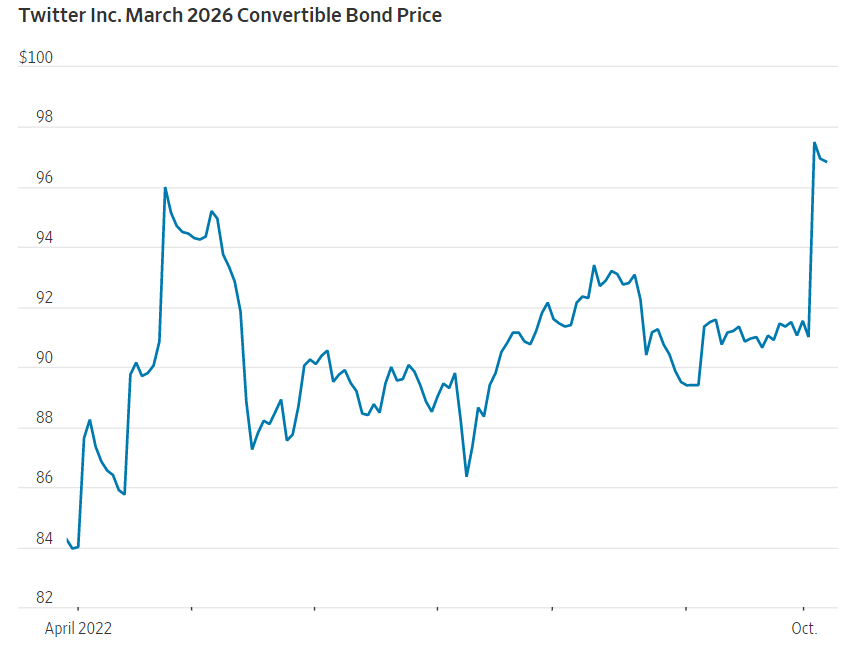

Doug Fincher, a portfolio manager at $3.8 billion hedge fund group Ionic Capital Management, said his fund bought Twitter's low-yielding convertible bonds, which could be changed into stock if Musk's deal went through.

-- Ionic's trade bet that the price of a bond expiring in 2026 would increase from the the mid-$80s, where it sat in April after cracks emerged in the likelihood of closure, to near $100 should the deal complete. Mr. Fincher said his firm sold its bonds when the price hit $98 on Tuesday after reports that Musk was willing to purchase the company at the original price.

Comments