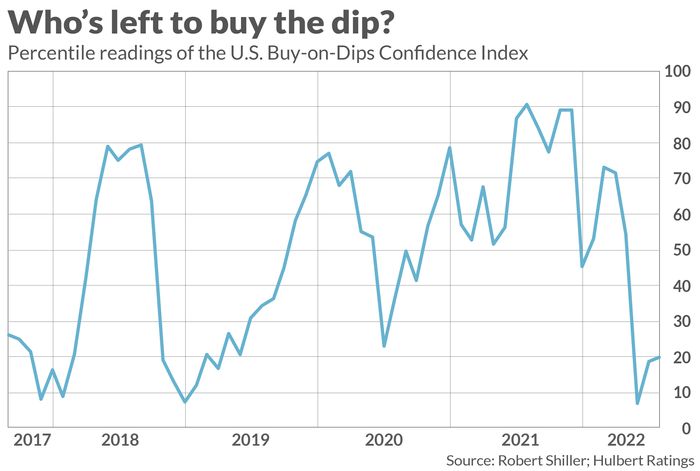

Yet another piece of the investor-sentiment puzzle is falling into place to support a sizeable U.S. stock-market rally. I'm referring to an index that measures investors' confidence that any market dip will be soon followed by a recovery. The index, called the "U.S. Buy-on-Dips Confidence Index," was created two decades ago by Yale University's Robert Shiller. It is based on a monthly survey in which investors are asked to guess the market's direction the day after a 3% market decline.

My analysis of the data indicates that the index has contrarian significance. That is, high readings -- high confidence that any market drop will be followed by a quick recovery -- is a bad sign. Low readings, in contrast, are bullish.

This past summer the index got lower than 7% of all other monthly readings since Shiller began this survey in the 1990s. While that in itself is low enough to impress contrarians, it's also encouraging that the index hasn't jumped more since then. The normal pattern is for bullishness to jump whenever the market begins to rally. But the index currently stands at just the 20 percentile of the historical distribution.

In fact, the latest reading is even lower than the one registered in March 2020, at the bottom of the waterfall decline that accompanied the initial lockdowns of the COVID-19 pandemic. But as for the summer of 2022, you have to go back to late 2018 and early 2019 to find another time when the Buy-on-Dips Confidence Index was lower than where it stands now. Those months coincided with the bottom of the 19%+ correction (bear market) caused by the Fed's late 2018 rate-hike cycle.

This index's highest reading in recent years came in August 2021, when it rose to the 91 percentile of the historical distribution. As if we need any reminding, that came just two months before the top of the secondary market and four months before the broad market hit its top.

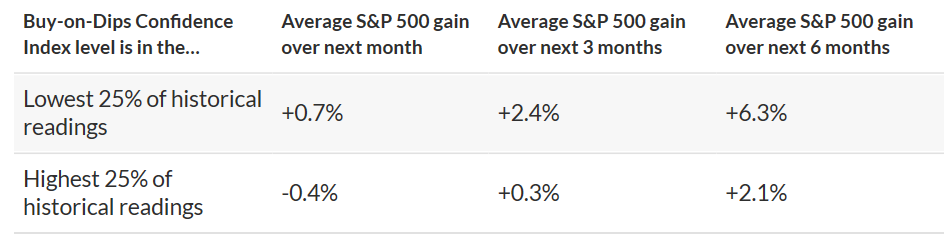

These two are just data points. A more comprehensive analysis is reflected in the table below, based on monthly data for the U.S. Buy-on-Dips Confidence Index over the last two decades.

Though these differences in average returns are statistically significant, it's important to emphasize that there are no guarantees. Sentiment is not the only factor that moves the market, after all.

Furthermore, even if a strong rally materializes, we can't know if it will be the beginning of a new bull market or just a bear-market rally. The answer will depend at least partly on how slowly or quickly investors regain their confidence that market dips will be quickly followed by a recovery. For the moment, contrarian analysis suggests that a strong rally is likely in coming weeks.

Comments