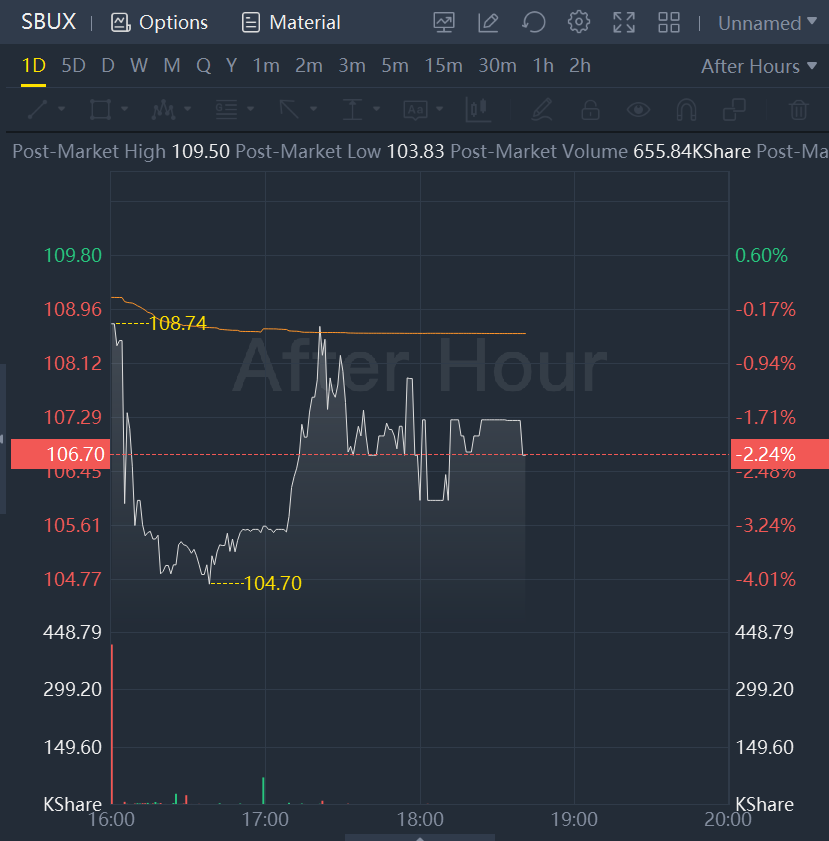

Starbucks stock fell 2% in after-hours trading as its quarterly results came in worse than expected, partly because of a poor performance in China.

For its fiscal first quarter, the three months through Jan. 1, Starbucks (ticker: SBUX) posted adjusted earnings of 75 cents a share, missing estimates for 77 cents a share. Problems in China contributed to a 6-cent decline in earnings per share, the company said.

Sales clocked in at $8.7 billion, a hair below estimates for $8.79 billion. Meanwhile, same-store sales were up 5% globally, under estimates for 6.7%. Same-store sales in China fell 29% compared to the same quarter last year, the company said. Widespread lockdowns, part of the country's former zero-Covid policy, kept people at home for extended periods.

Starbucks stock fell 3.3% to $105.50 in after-hours trading. The stock's decline comes even as the company reiterated its financial forecasts for fiscal 2023.

"I'm pleased to share that our fiscal 2023 guidance remains unchanged, despite the headwinds from China," said Rachel Ruggeri, chief financial officer.

The previous outlook called for comparable-store sales to grow between 7% and 9% in fiscal 2023. Consolidated revenue growth was expected to be between 10% and 12%.

Starbucks will provide more information on its financial targets for fiscal 2023 during its call with investors, scheduled at 5 p.m. Eastern time.

Comments