U.S. stock futures hovered close to flat, while government bonds continued to sell off, ahead of more congressional testimony by Fed Chair Jerome Powell and new data on the labor market. In recent market action:

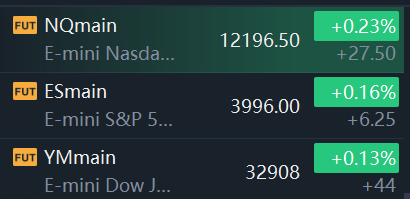

-- Futures wavered. S&P 500, Nasdaq-100 and Dow industrials futures were all recently up about 0.1%.

-- Bond yields rose. The benchmark 10-year Treasury yield edged up to 3.989% from 3.974% Tuesday. Two-year yields climbed to 5.049% from 5.011%.

-- A recession indicator kept flashing. On Tuesday, 2-year Treasury yields exceeded 10-year yields by more than a percentage point for the first time since 1981. In intraday trading Wednesday, the gap widened further.

-- Mr. Powell is headed back to Congress. His testimony is set to begin at 10 a.m. ET.

-- Jobs data is due: ADP's national employment report is due at 8:15 a.m., followed by the JOLTS job openings report at 10 a.m.

A high ADP number would prompt discussions about whether the labor market remained very hot, said John Roe, head of multiasset funds at Legal & General Investment Management.

"There's this growing concern about a 'no landing' scenario, effectively where it turns out that the Fed and other central banks have just not done anywhere near enough," he said.

Comments