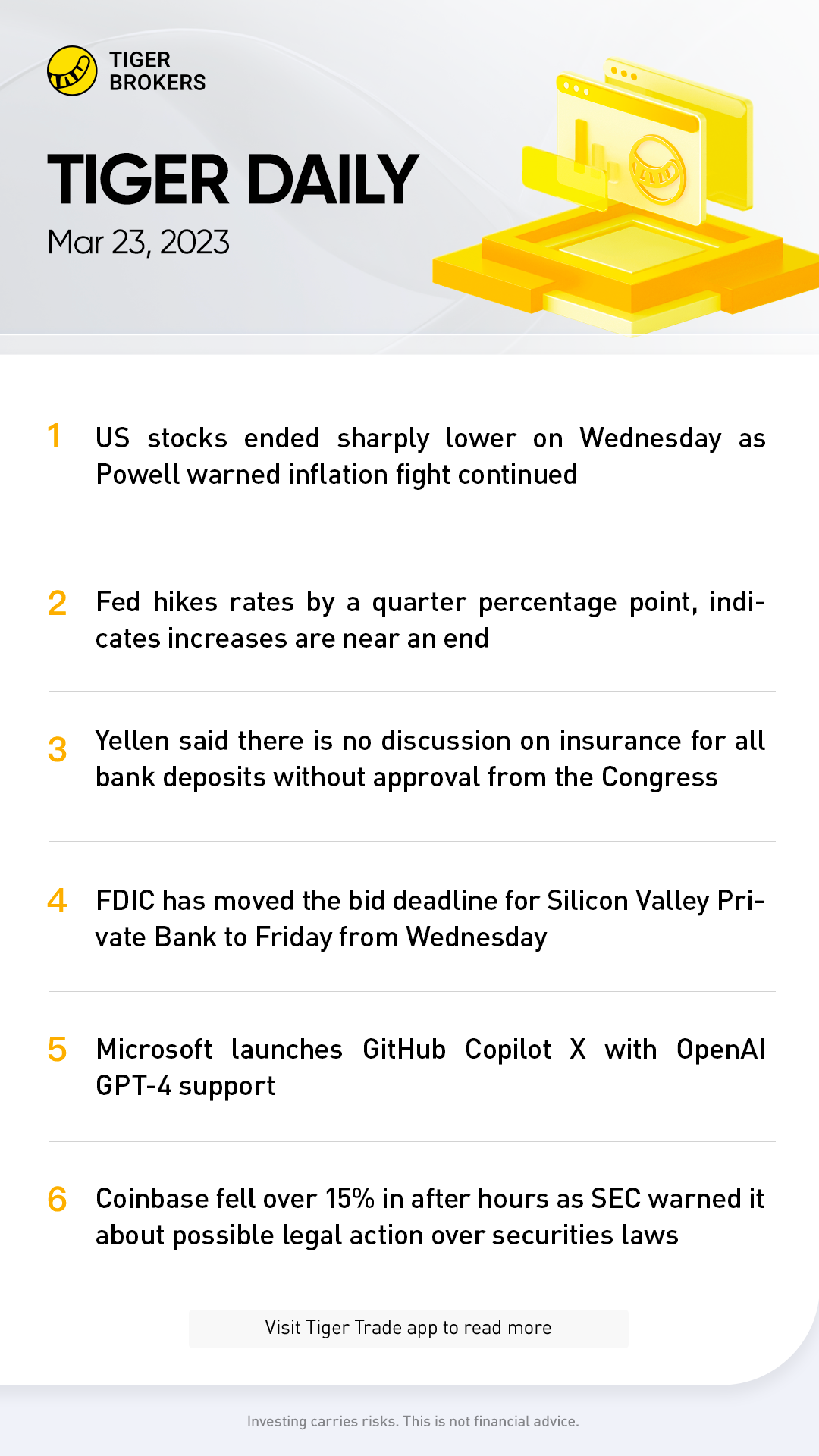

Wall Street gyrated to end sharply lower on Wednesday after the U.S. Federal Reserve delivered a widely expected 25 basis point policy hike, while hinting that it was on the verge of pausing future increases in view of recent turmoil in the financial sector.

The three major U.S. stock indexes, which were mostly directionless prior to the Fed announcement, jumped higher then deflated as investors digested the accompanying statement and Chair Jerome Powell's subsequent Q&A session.

By closing bell, all three indexes were off more than 1.6%.

"The market was encouraged when it heard that the Fed had considered pausing completely and then it was disappointed when Powell clarified that their hands weren’t tied and that they can keep raising rates if they need to," said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance in Charlotte, North Carolina.

In the Fed's statement, the members of the Federal Open Markets Committee $(FOMC)$ said some additional tightening might be possible, but suggested it was on the verge of pausing future hikes in view of recent turmoil in the financial sector.

Gains pared during Powell's remarks and Q&A session in which he vowed to use all available tools to keep the banking system sound, but reiterated the central bank's commitment to reining in inflation.

"The indexes whipsaw because there’s so much at stake, being the first to evaluate the impact of the statement and the subsequent press conference," said Sam Stovall, chief investment strategist of CFRA Research in New York. "Maybe investors were expecting the Fed to stop with this hike, expressing their displeasure that rate hikes might continue for one or two more meetings."

Worries persist that the Fed's aggressive battle against inflation could tip the economy into recession, and recent turmoil in the banking sector, sparked by failures of SVB Financial Group and Signature Bank, have exacerbated those fears.

The sell-off was exacerbated by Treasury Secretary Janet Yellen's remarks before lawmakers that the Federal Deposit Insurance Corporation (FDIC) was not considering "blanket insurance" for deposits arising from recent strife in the sector.

The Dow Jones Industrial Average fell 530.49 points, or 1.63%, to 32,030.11, the S&P 500 lost 65.9 points, or 1.65%, to 3,936.97 and the Nasdaq Composite dropped 190.15 points, or 1.6%, to 11,669.96.

All 11 major sectors of the S&P 500 ended the session deep in negative territory, with real estate suffering the steepest percentage drop, its largest one-day plunge since Sept. 13.

The banking sector reversed course after a two-session rebound, with the S&P Banks index and the KBW Regional Bank index off 3.7% and 5.3%, respectively.

Shares of First Republic slipped 15.5 % in volatile trade amid worries that it may need to downsize or seek government support.

Pacific Western Bank announced it had raised $1.4 billion from investment firm Atlas SP Partners. Its shares dropped 17.1%.

Western Alliance Bancorp fell 5.0%.

Retail darling GameStop Corp surged 35.2% after posting a surprise fourth quarter profit.

Used car e-commerce platform Carvana Co jumped 6.3% following its announcement that it expects a smaller current quarter loss as a result of cost-cutting measures.

Virgin Orbit Holdings Inc soared 33.1% following the satellite launch firm's announcement it is resuming operations.

Nike Inc dropped 4.9% after the sports apparel maker raised its full-year revenue outlook on Tuesday but warned of margin pressures.

Declining issues outnumbered advancing ones on the NYSE by a 2.25-to-1 ratio; on Nasdaq, a 2.57-to-1 ratio favored decliners.

The S&P 500 posted six new 52-week highs and 13 new lows; the Nasdaq Composite recorded 44 new highs and 179 new lows.

Volume on U.S. exchanges was 11.84 billion shares, compared with the 12.70 billion average over the last 20 trading days.

Comments