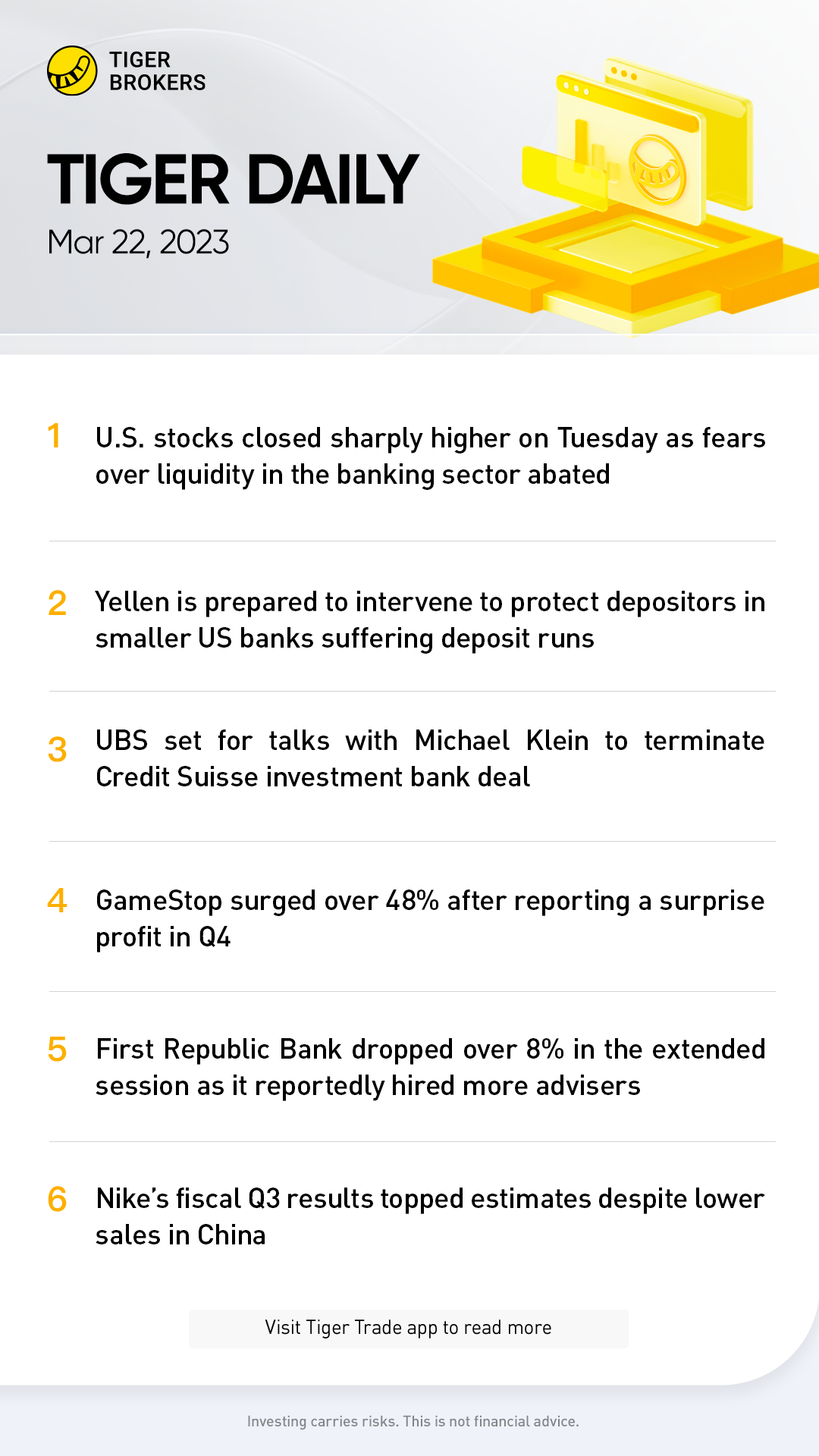

Wall Street closed sharply higher on Tuesday as widespread fears over liquidity in the banking sector abated and market participants eyed the Federal Reserve, which is expected to conclude its two-day policy meeting on Wednesday with a 25 basis-point hike to its policy rate.

All three major U.S. stock indexes were bright green as the session closed, with smallcaps, energy and financials enjoying the most sizable gains.

A one-two punch of regional bank failures last week, followed by the rescue of $First Republic Bank(FRC-N)$ and the takeover of Credit Suisse, sparked a rout in banking stocks and fueled worries of contagion in the financial sector which, in turn, heightened global anxieties over the growing possibility of recession.

But banking stocks bounced back on Tuesday, building on Monday's reversal. Still, despite its recent resurgence, the S&P banks index has lost nearly 18% of its value just this month.

Both the SPXBK and the KBW Regional Banking index marked their biggest one-day percentage jumps in months.

"The stock market is coming to a recognition that the banking crisis wasn't a crisis after all, and was isolated to a handful of banks," said Oliver Pursche, senior vice president at Wealthspire Advisors in New York. "Both the public and the private sector have shown they are more than able to backstop and shore up weak institutions."

Treasury Secretary Janet Yellen, in prepared remarks before the American Bankers Association, said the U.S. banking system has stabilized due to decisive actions from regulators, but warned more action might be required.

Attention now shifts to the Fed, which has gathered for its two-day monetary policy meeting, at which the members of the Federal Open Markets Committee $(FOMC)$ will revisit their economic projections and, in all likelihood, implement another increase to the Fed funds target rate in their ongoing battle against inflation.

"The Fed will raise interest rates by 25 basis points and the market won't care," Pursche added. "It will all be about (Chairman Jerome) Powell's statement on the economy and inflation, and if he can do a good enough job convincing the public that the banking noise" can be attributed to bad management on the part of a few banks.

At last glance, financial markets have now priced in an 83.4% likelihood of a 25 basis-point rate hike, and a 16.6% probability that the central bank will leave its policy rate unchanged, according to CME's FedWatch tool.

Economic data released early in the session showed a 14.5% jump in existing home sales, blasting past expectations and snapping a 12-month losing streak.

According to preliminary data, the S&P 500 gained 50.84 points, or 1.29%, to end at 4,002.41 points, while the Nasdaq Composite gained 181.47 points, or 1.55%, to 11,860.04. The Dow Jones Industrial Average rose 313.36 points, or 0.97%, to 32,566.44.

Shares of First Republic Bank saw their biggest-ever one-day percentage jump as JPMorgan CEO Jamie Dimon leads talks with other big banks aimed at investing in the lender, according to the Wall Street Journal. Peers PacWest Bancorp and Western Alliance Bancorp also surged.

Tesla Inc advanced after the electric automaker appeared on track to report one of its best quarters in China, according to car registration data.

Comments