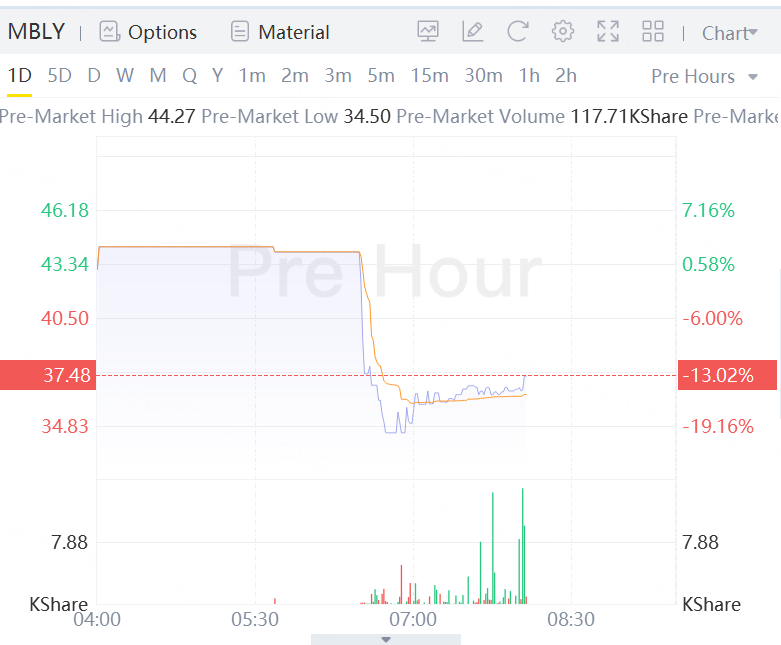

Shares of Mobileye Global Inc. (MBLY) were tumbling 13% in Thursday's premarket action after the maker of autonomous-driving technology cut its forecast for the full year, citing issues with the China market.

The company posted a first-quarter net loss of $79 million, or 10 cents a share, whereas it posted a loss of $60 million, or 8 cents a share, in the year-earlier period. On an adjusted basis, Mobileye earned 14 cents a share, down from 16 cents a share a year before, while analysts surveyed by FactSet were modeling 12 cents a share. Revenue rose to $458 million from $394 million, whereas the FactSet consensus was for $455 million.

The company lowered its full-year forecast and now expects $2.065 billion to $2.114 billion in revenue, along with $548 million to $577 million in adjusted operating income. The prior outlook was for $2.192 billion to $2.282 billion in revenue and $577 million to $627 million in adjusted operating income.

The change reflects "a meaningful reduction in our expectations for SuperVision volumes in 2023" as "the China electric vehicle market has been negatively impacted by meaningful pricing actions by a global EV OEM [original equipment manufacturer], reduction of government electric vehicle subsidies, and general economic weakness in the country," Mobileye said in its release.

Chief Executive Amnon Shashua said in the release that Mobileye sees this as "a temporary issue that should not impact the potential for this business to accelerate our top and bottom-line growth as it scales, diversifies, and becomes more predictable with additional OEMs and vehicle launches."

Comments