Executives cite 'evolving dynamics' of software business, report that large customers are using their security software less and sales cycles are getting longer

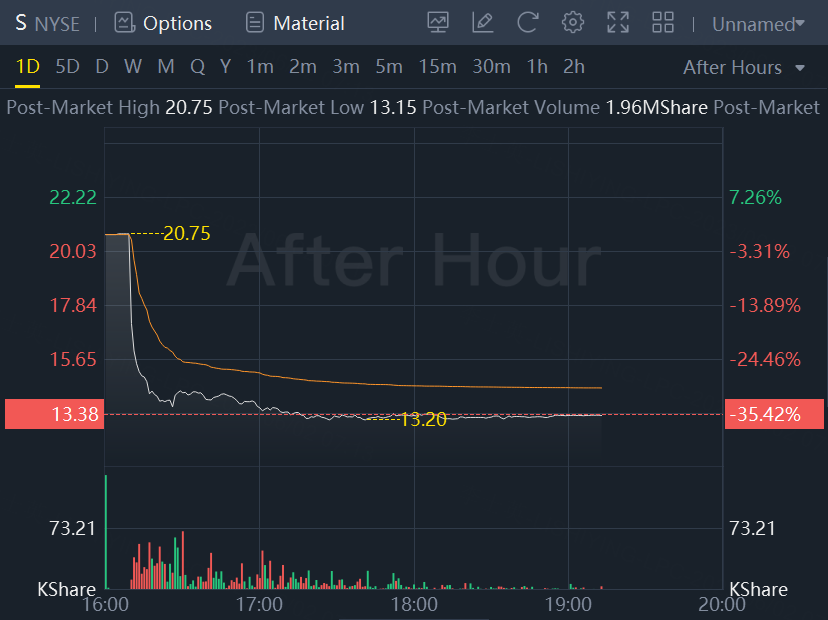

SentinelOne Inc. shares dove more than 35% in after-hours trading Thursday, after the security-software company missed expectations with its financial results and executives slashed their annual guidance while planning layoffs.

SentinelOne (S) reported a loss of $106.9 million, or 37 cents a share, on sales of $133.4 million, up from $78.3 million a year ago. After adjusting for stock compensation and other effects, the company reported a loss of 15 cents a share, improving from an adjusted loss of 21 cents a share a year ago.

Analysts on average expected an adjusted loss of 17 cents a share on sales of $136.6 million, according to FactSet. Shares plunged toward $14 after closing with a 3.1% decline at $20.72.

Executives also slashed their full-year guidance from three months ago, pointing to a slowdown in business spending that has showed up regularly this year for software companies and others selling tech to large enterprises.

"Macroeconomic pressures continue to impact deal sizes, sales cycles, and pipeline conversion rates. While not entirely new, the impact from these factors was more pronounced in Q1," executives wrote in a letter to shareholders. "Together, these evolving dynamics also impacted our expectations for Q2 and fiscal year 24."

For the second quarter, executives guided for revenue of $141 million, while analysts on average were expecting $152.1 million, according to FactSet. For the year, they now expect sales of $590 million to $600 million, after stating $631 million to $640 million previously.

In addition to issues with landing new deals, executives also said that businesses were using their software less, which affects revenue that is based on consumption. As a result, they shaved about 5% off their previously stated annualized recurring revenue, or ARR, an important metric for cloud software that allows executives and investors to model future revenue. SentinelOne reported ARR of $563.6 million after adjusting for the new methodology, while analysts on average were expecting $594.4 million, according to FactSet.

SentinelOne executives also suggested cost cuts were being made, telling investors that they are "taking actions to fortify our business by improving our cost structure and ensuring our path to profitability."

A SentinelOne spokeswoman confirmed that the cost cuts will include layoffs of about 5% of the company, which she said would equal fewer than 100 employees. In its most recent annual filing with the Securities and Exchange Commission, the company reported having 2,100 employees as of Jan. 31.

SentinelOne's stock had been a big gainer so far this year, as the company played up its efforts to use artificial intelligence to bolster its cybersecurity offerings. Shares had increased 42% so far in 2023, as the S&P 500 index gained 8.9%.

Comments