Expectations for the Federal Reserve will push interest rates even higher this year have helped to put a lid on U.S. stocks' rebound rally in 2023, but the outlook for interest rates, and with it stocks, could shift once again if Wednesday's consumer-price index for June shows inflation has ebbed more quickly than economists had expected.

It is a notion that's some analysts are embracing, especially after Tuesday's reading on used-car prices via the Manheim Used Car Index declined 10.3% over the past year, the 10th straight monthly decline and the biggest on record for June.

The report made a splash in markets, sending shares of troubled used-car sales platform Carvana Co. (CVNA) surging 16% on Monday, and another nearly 3% on Tuesday to $36 a share, according to FactSet.

Brightening expectations for Wednesday's CPI report helped push U.S. stocks higher on Tuesday, analysts told MarketWatch.

Expectations for inflation to fall more quickly than expected played into the call this week by Fundstrat's Tom Lee latest for the S&P 500 to gain 100 points, or 2.3% this week.

Lee's reasoning was simple enough: waning inflation takes the pressure off the Fed to keep hiking interest rates, potentially allowing the central bank to shift back to cutting interest-rates more quickly, or at least not push rates as high.

Jason Draho, head of asset allocation for the Americas at UBS Global Wealth Management, described what a sudden retreat in inflation might mean for markets in emailed commentary.

"Both headline and core CPI for June are expected to fall quite a bit, and the 3 month annualized core measures could be down to 2%," he said.

"A few months of that level could convince enough investors that inflation is 'solved'. If that happens, the Fed will have less reason to keep rates higher-for-longer, thereby reducing recession risk."

Economists polled by The Wall Street Journal expect headline year-on-year inflation to fall to 3.1% from 4.0% and year-on-year core inflation to slow to 5.0% from 5.3%.

In the scramble to try to anticipate what might happen, analysts are focusing on a handful of leading indicators like the Manheim Used Car Index, which has become increasingly popular on Wall Street as a reliable inflation prognosticator.

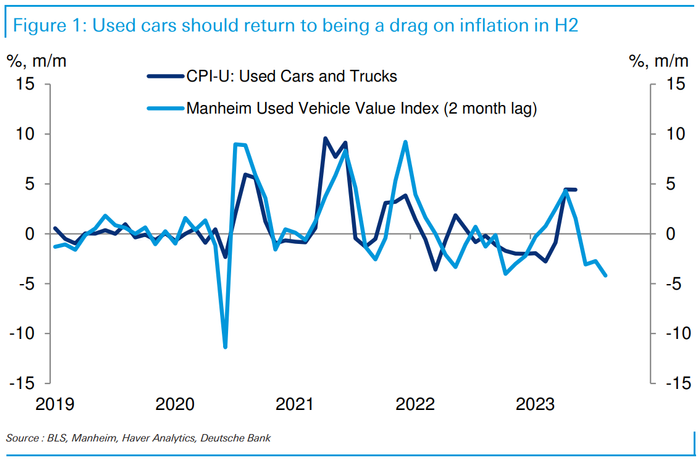

Deutsche Bank's Jim Reid shared a chart illustrating the relationship between the Manheim Index and the used cars and trucks component of CPI, showing that the latter closely tracks the former.

If this relationship holds, it could mean core goods prices could drag on broader measures of inflation during the second half.

Goldman Sachs Group Chief Economist Jan Hatzius said in a note to clients that he believes core CPI could undershoot the consensus by coming in at 0.2% for the month, citing the decline in used car prices as one of the reason for slashing his estimate.

"Going forward, we expect monthly core CPI inflation to remain in the 0.2-0.3%range on average in the next few months, reflecting continued moderation inshelter inflation, lower used car prices, and slower non-housing services inflationas labor demand continues to moderate," he said in the note.

To be sure, some believe the Manheim index's utility has already waned. Brent Donnelly of Spectra Markets showed that Manheim was a reliable prognosticator of core inflation between 2020 and 2022 as price pressures started to pick up after a decade of almost no inflation in the U.S. However, its reliability started to weaken as inflation has cooled from its highest level in more than four decades from last summer.

Economists' median estimates have been fairly accurate since the start of the year in predicting inflation, Donnelly said, which diminishes the odds of a substantial downside surprise.

Investors will learn at 8:30 a.m. Eastern on Wednesday what the exact inflation numbers for June were according to CPI. Meanwhile, the Fed's preferred PCE Price Index will be released later this month.

So far, U.S. stocks appear to be doing better this week, as the S&P 500 , Nasdaq Composite and Dow Jones Industrial Average all finished higher on Tuesday thanks in part to optimism surrounding the inflation report. The S&P 500 gained 0.4% to 4,428 just before the close, according to FactSet data

Markets have experienced some turbulence as of late. The S&P 500 has fallen during two of the past three weeks, following a streak of five straight weekly gains that marked the longest such winning streak since late 2021, according to FactSet data.

Comments