The company isn’t alone among relatively new public companies doing buybacks, though most of the other notable examples are from last year’s tech selloff

‘ We believe in ourselves, which is why we’ve authorized a buyback to align with this belief in ourselves, our belief that profitability aligns with our desire to be [in the S&P 500]. We are going to invest in ourselves and not at a small scale.’

— Palantir CEO Alex Karp

Less than three years after going public, Palantir Technologies Inc. has taken its latest step toward maturity with the announcement of a $1 billion buyback program.

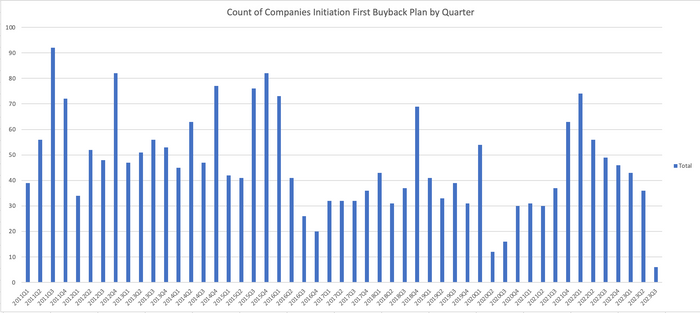

Palantir is hardly the first among relatively new public companies to institute a buyback program, notes Ali Ragih, a senior research analyst at VerityData, though many of the other high-profile examples are from early 2022, when tech stocks were falling. Zoom Video Communications Inc., DocuSign Inc., DoorDash Inc. and Airbnb Inc. all adopted programs in the first half of that year.

The buyback announcement from Palantir, however, comes during a roaring year for tech stocks, with Palantir’s in particular up more than 160% so far in 2023. Still, Ragih doesn’t see the move as unusual for a company like Palantir that’s still early in its life on the public markets.

“At some point in the game, companies have to shift from investing all their money in [capital expenditures] to returning capital through buybacks,” which tend to precede dividends, he said.

The billion-dollar buyback program may seem like “quite a large number” in the abstract, he said, but it’s smaller on a relative basis, representing 2.8% of Palantir’s market capitalization. Typically, marketwide, buyback programs are about 5% of a company’s valuation, he added.

Palantir Chief Executive Alex Karp, meanwhile, said on the earnings call Monday afternoon that the buyback was a signal of the company’s “belief in ourselves.” Chief Financial Officer David Glazer added in a conversation with MarketWatch that the buyback also shows the company’s belief that it has a large opportunity ahead of it in artificial intelligence.

Announcing a buyback program is one thing. Next up is whether management indeed ends up repurchasing stock.

“This is a volatile stock, which in some ways gives management the opportunity to pick their spots,” Ragih said. “It’s important to see if they’re actually going to follow through and retire some shares.”

Comments