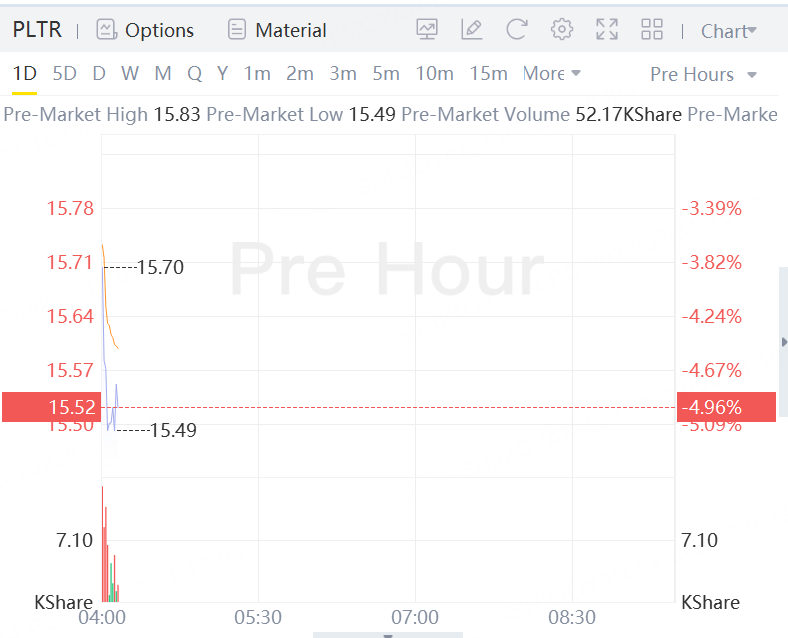

Palantir stock slides 5% in premarket trading on Thursday.

Morgan Stanley downgraded Palantir Technologies to Underweight and raised the price target on the stock to $9 from $8

The analysts said that near-term optimism in AI product cycle and valuation premium creates an unfavorable risk-reward in the stock, as visibility on AIP monetization still remains low, the government segment seems unlikely to provide an offset and estimates already imply a H2 re-acceleration.

The analysts noted that their view is based on — expected delays in AIP revenue contribution given management commentary which Palantir has yet to figure out how to monetize it; risk that the government business may not be able to offset a top-line deceleration, after recently beginning to deteriorate;

In addition, the analysts view is also predicated on — a difficult setup into the H2 as revenue outlook already implies an acceleration in estimated organic revenue growth (ex-strategic investments and Japan JV contribution), which sets a higher bar for the positive estimate revision needed to justify valuation.

Palantir has a Strong Buy rating at Seeking Alpha's Quant Rating system, which consistently beats the market. Meanwhile, Seeking Alpha authors' average rating is Hold, and the average Wall Street analysts' rating is also Hold.

Comments