Tesla stock enjoys biggest gain in 8 months, as EV maker’s lack of labor union distractions may be emboldening investors

Tesla Inc.’s bulls finally succeeded on Monday, after multiple attempts over nearly two weeks, to get the electric-vehicle giant’s stock past upside technical resistance and into fresh bull-market territory.

A couple of bullish fundamental catalysts, like an analyst upgrade and a labor battle that Tesla’s rivals are facing, helped bulls get the stock over the line.

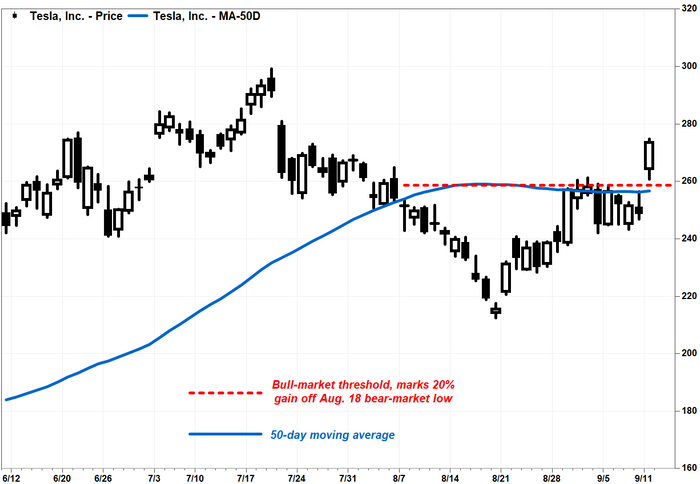

The technical set up was, after closing at a 10-month high of $293.34 on July 18, the stock tumbled 26.5% to a 2 1/2-month closing low of $215.49 on Aug. 18. Many on Wall Street believe a bear market is defined by a decline of at least 20% from a significant bull-market high.

Since then, the stock rallied as much as 19.8% to a four-week high of $258.08 on Aug. 31, just missing the bull-market threshold, before pulling back.

The stock also had to contend with what developed into strong resistance at the 50-day moving average line, which is widely viewed as a short-term trend tracker. Over the past eight sessions, the stock traded above that line six times on an intraday basis, and even closed slightly above it four times, but failed to sustain to sustain those gains.

Until Monday.

The stock powered up 10.1% to close at $273.58, or 27.0% above the Aug. 18 close.

The rally, which marked the best one-day performance for the stock since it climbed 11.0% on Jan. 27., left resistance at the 50-DMA, which was at $256.63, in the dust.

Tesla shares also got a fundamental boost from an upgrade at Morgan Stanley, with analyst Adam Jonas setting a Street-high target of $400, citing an artificial-intelligence opportunity for the electric-vehicle company.

Wedbush’s Dan Ives said the fact that Tesla’s workforce isn’t unionized means the company won’t have to deal with the likely labor strike facing rival automakers General Motors Co., Ford Motor Co. and Stellantis N.V., Chrysler’s parent.

As Ives explained, if a strike happens, GM, Ford and Stellantis would fall further behind Tesla as their EV roadmap could be pushed out into 2024.

“However, if negotiations take place and some of these major proposals come through, the billions of incremental annual costs [for Tesla’s rivals] will be damaging and ultimately increase the prices of EVs rolling out over the next 12 to 18 months to consumers,” Ives wrote in a note to clients.

Tesla’s stock, which paced the S&P 500 index’s SPX gainers on Monday, has rallied 11.9% over the past three months and has soared 122.1% year to date.

Comments