Wonder Group, the food-delivery startup led by former Walmart executive Marc Lore, has struck a deal to acquire meal-kit company Blue Apron.

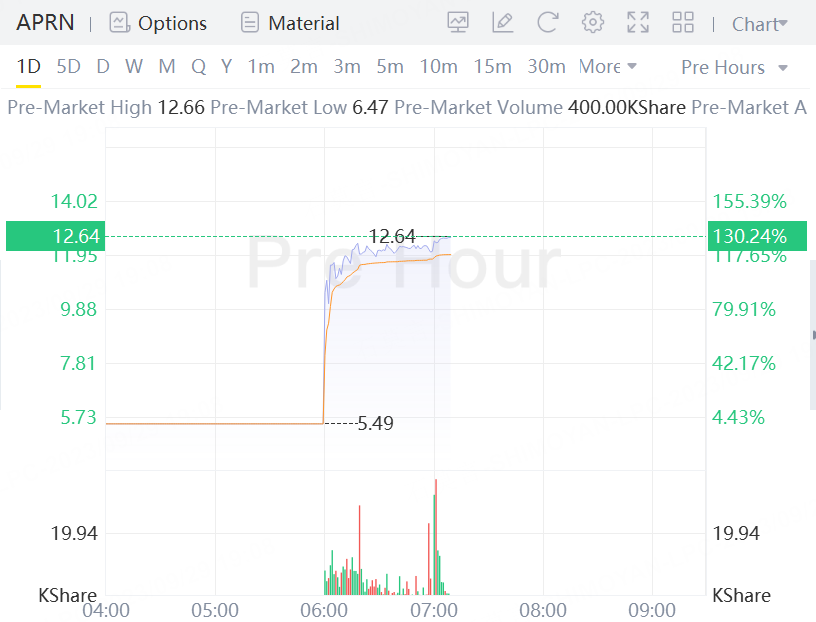

Blue Apron Inc. shares were surging more than 130% in premarket trading Friday.

Blue Apron shareholders are set to receive $13 per share of Class A common stock through a tender offer, valuing the company at about $103 million, executives of Wonder and Blue Apron told The Wall Street Journal.

That represents a more-than 130% premium to Thursday’s closing price of $5.49 but is a fraction of the price the stock was priced at when Blue Apron went public in June 2017.

New York-based Blue Apron was a pioneer in packaging fresh ingredients for easy-to-make meals sold online and in some retail locations. But after getting off to a buzzy start in 2012, the company struggled to juice sales and retain customers.

Supply-chain challenges and unstable ingredient costs have taken a toll on the business, as has an increasingly saturated meal-kit market, with rivals ranging from grocer Kroger to Amazon.

Blue Apron conducted a strategic review after the onset of the Covid-19 pandemic in 2020, but opted not to pursue a sale at the time.

In late 2022, the company said it would lay off about 10% of its corporate workforce.

Blue Apron in June closed a deal with FreshRealm, which delivers fresh meals to retailers, transferring its fulfillment centers, equipment and some staff in return for a much-needed cash infusion of up to $50 million.

FreshRealm, which owns about 16.5% of Blue Apron’s outstanding shares of Class A common stock as a result of the deal, has agreed to exercise its warrant as part of the Wonder transaction and tender its shares.

FreshRealm Chief Executive Michael Lippold said the company remains dedicated to supporting Blue Apron’s continuing growth and delivering its meals.

Wonder has experienced its own ups and downs. The startup, founded in 2018, initially set out to build a network of truck-based restaurants preparing hot curbside meals drawn from popular chef-inspired menus.

But after a brief go across the New Jersey and New York suburbs, Lore earlier this year said he was scrapping plans to roll out the service nationwide and moving instead to a less-expensive restaurant-delivery model involving a network of kitchens. Wonder currently runs four bricks-and-mortar locations and will end the year with 10.

The closely held company had been valued at roughly $3.5 billion following a $350 million funding round in June of 2022, the Journal reported at the time.

Lore said the deal for Blue Apron will bring him one step closer to achieving his goal of creating a “super-app” for meal time.

“Making great food more accessible was something that really bonded us early on in the discussions,” he said. Wonder plans to continue Blue Apron’s current operations and keep the brand.

Lore has made a name for himself in the retail industry by selling startups to industry behemoths. He sold Quidsi, an e-commerce site for diapers and other household goods, to Amazon for $500 million in 2010. Jet.com, another internet venture he founded, was sold to Walmart in 2016 for $3.3 billion. Lore joined Walmart to oversee the retailer’s e-commerce business in the U.S.

Walmart eventually wound down Jet, folding the operation into its broader e-commerce business, and Lore left in early 2021 and took over as chief executive of Wonder later that year.

Lore has been beefing up Wonder’s executive ranks, recently bringing on Blackstone alum Kelley Morrell as chief financial officer. He also recently hired former Sweetgreen executive Daniel Shlossman as its first chief growth and marketing officer.

Comments