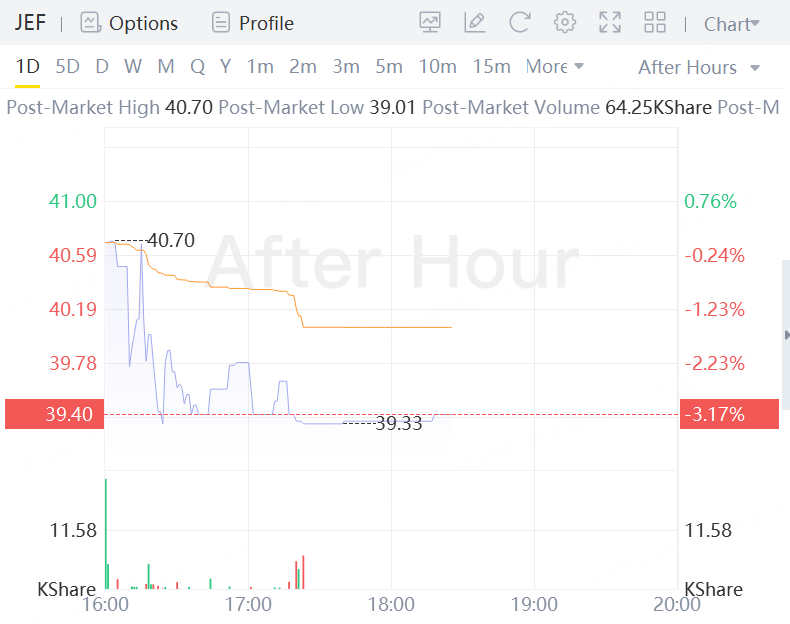

(Reuters) - Jefferies Financial Group reported a smaller-than-expected fourth-quarter profit on Monday, as lingering economic uncertainty kept dealmaking in check, sending its shares down more than 3% in extended trading.

Investment banks struggled last year as rising interest rates and economic gloom weighed on companies' confidence. The uncertainty stalled global mergers and acquisitions, which hit a decade-low.

Still, Jefferies posted investment banking revenue of $2.29 billion for 2023, above levels in 2019, the last "normal" year for investment banking, CEO Richard Handler and President Brian Friedman said in a statement.

"You've got building momentum," Jefferies President Brian Friedman said in an interview.

"There's a lot of reason to believe that M&A activity will pick up" this year from low levels in 2023, along with initial public offerings, he said.

In the fourth quarter, the company's investment banking revenue rose 2.5% to $576.7 million, driven by strong performance in equity and debt underwriting, while capital markets revenue fell 1.8% to $481.3 million due to weaker fixed income performance.

Total quarterly net revenue tumbled nearly 17% to $1.20 billion, missing expectations of $1.24 billion, according to LSEG data.

Profit fell 53% to $65.6 million, or 29 cents per share, in the three months ended Nov. 30, compared with analysts' average estimate of 34 cents per share.

The biggest decline came from asset management, where revenue plunged nearly 64% from last year. It included results from businesses Jefferies has since shed.

Jefferies kicks off the earnings season for U.S. banks, with Wall Street giants JPMorgan Chase, Bank of America , Wells Fargo and Citigroup set to report their results on Friday.

Last month, Jefferies expanded its international presence by setting up an investment banking and capital markets unit in Canada.

Jefferies has added 182 managing directors in investment banking over the last three years, for a total of 364 currently. It expanded in sectors, including municipal healthcare, industrials and energy, while growing in Italy, Brazil, Israel, South Korea and the United Arab Emirates.

That contrasts with Wall Street peers, which have laid off thousands of employees.

"We've made a meaningful investment ... where we think it will have an excellent return," Friedman said, citing recruitment drives after the dotcom bubble, the global financial crisis and the pandemic.

Jefferies has "historically taken advantage of disarray and dislocation," he said. "We make our best investments in the more difficult periods."

Jefferies said in a separate letter to investors that Japan's Sumitomo Mitsui Financial Group (SMFG) plans to increase its equity stake to 15% from 9.1% to become Jefferies' largest shareholder. SMFG will gain a seat on its board after passing the 10% threshold.

The partnership enables Jefferies to arrange deals with larger investment-grade companies with backing from SMFG. For instance, both banks offered loan commitments to door maker Masonite International in a December acquisition, while Jefferies also acted as the company's adviser.

Comments