A handful of 'magnificent' tech stocks have been driving the stock market. Could that concentration turn into a problem for your 401(k) or stock portfolio?

The Trillionaires rescued the S&P 500 in 2023, and they are now in full control of the market - for better or worse.

By "Trillionaires," I mean the seven U.S. companies that have been valued at $1 trillion or more by the public markets -- Google parent Alphabet Inc. $(GOOGL)$ $(GOOG)$, Amazon.com Inc. $(AMZN)$, Apple Inc. $(AAPL)$, Facebook parent Meta Platforms Inc. (META), Microsoft Corp. $(MSFT)$, Nvidia Corp. $(NVDA)$ and Tesla Inc. $(TSLA)$. Their influence over the entire market has won them a different, "magnificent" nickname, but MarketWatch likes numbers, and a valuation of a trillion dollars seems a more appropriate reference than an old western movie.

A focus on these companies' valuations would also help convey just how important they are to the market. In 2023, the Trillionaires lived up to their name and added more than $5 trillion to the S&P 500's SPX market capitalization, nearly 65% of the annual gain that stuffed our retirement accounts and index-fund statements. Dow Jones Market Data could only find one other example of such a concentration of annual market gains, in 2020 - and it was the same group of companies.

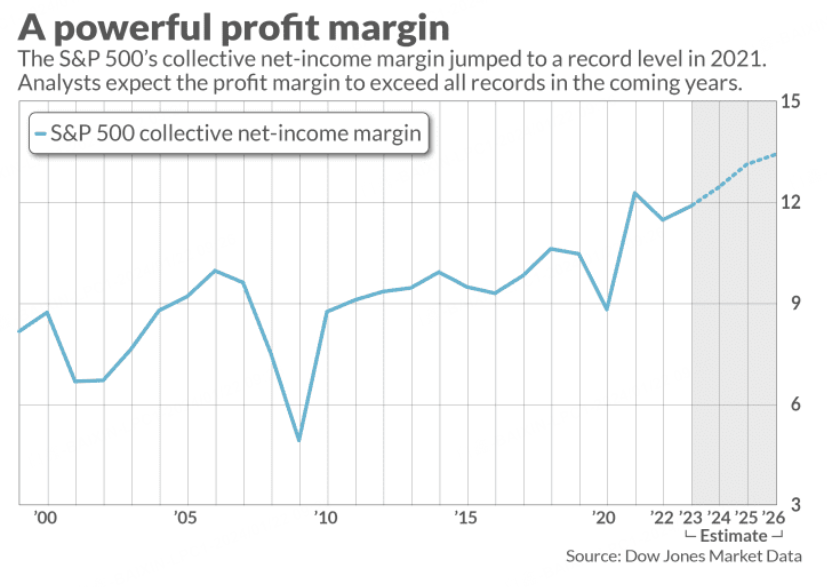

Their power within the index also goes well beyond market-cap growth, at least if you toss out Tesla. Nvidia ended the S&P 500's earnings recession last year, and Big Tech's layoffs saved corporate America's record profit margins from declining along with inflation rates. In every way, this small group of companies was responsible for the market rebound in 2023, and it's also at the core of expectations for 2024 and beyond.

Looking at all of the numbers that show the Trillionaires' influence in the S&P 500, I wondered if the investment thesis behind the decades-long rise in S&P 500 index funds - strength in random diversification and numbers, basically - was being threatened. On MarketWatch's new "On Watch" podcast, which premieres today, Deep Dive investing columnist Phil Van Doorn told me not to worry.

"The S&P 500 is self-correcting. It rewards success," Van Doorn said. "Nvidia, which popped last year because it essentially dominated a new category of important tech products, is taking up a much larger portion of the index than it did before. Over time, if that changes, its weighting will go down and other companies' weightings will go up, presumably as they take market share from Nvidia."

That could be true for the long term, but it will be hard for any new rivals to compete against such powerfully entrenched and well-capitalized incumbents. And there could be short-term pain in store. I've voiced my doubts about an immediate artificial-intelligence windfall beyond Nvidia in 2024, with most fresh revenue that cloud providers Amazon, Microsoft and Google collect being matched by the cost of building out their AI capabilities. If those costs squeeze Big Tech's margins as many other sectors lose the inflation bump that sent profits to record highs, Wall Street's expectations that margins will grow beyond their record levels in the AI era would be delayed at best.

And then there are the existential questions: Do we want the market and economy to reflect these companies? As they lay off employees while using AI to automate more functions, much of Silicon Valley is developing software that would allow other sectors to do the same. Are higher profit margins a worthwhile trade-off for a potentially decimated labor market?

Companies that make you ponder questions like that deserve a nickname that's more appropriate than a reference to a bunch of Hollywood gunslingers. The Trillionaires also deserve scrutiny as they push the market into an uncertain future. Antitrust law does not apply to the stock market, but it really does seem like these companies are monopolizing public markets.

Comments