This is what the historical data suggest, according to CFRA’s Sam Stovall

One longtime Wall Street strategist believes the S&P 500 still has some gas left in the tank, which could propel the index as much as 5% higher in the coming months.

Following the S&P 500’s first record close in two years, Sam Stovall, chief investment officer at CFRA, crunched the numbers and found that once the S&P 500 has erased all of its bear-market losses, the index typically tacks on an additional “post-high five” — that is, a post-high rally of 5%, or slightly more.

“If history is any guide, for it’s never gospel, investors should prepare for a ‘post-high five,’ or a possible advance of 5% before pausing to digest recent gains,” Stovall said.

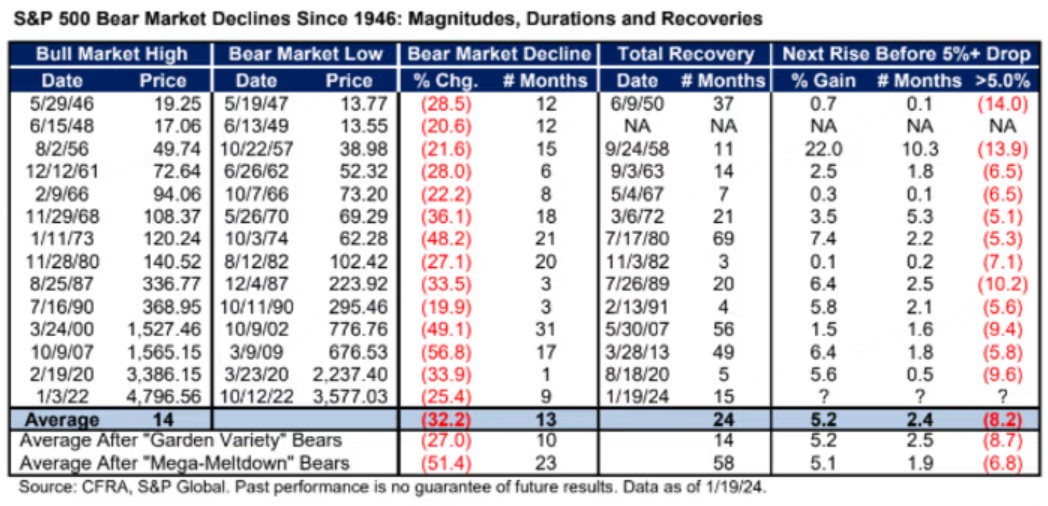

Stovall based his analysis on how markets have behaved following the 14 bear markets that have occurred, by his count, since the end of World War II. Of these, 11 were “garden-variety bear markets,” while three were “mega meltdowns,” Stovall said.

The bear market that ended in October 2022 took nine months to go from the market’s January 2022 peak to its nadir. This is close to the average duration for garden-variety bear markets, which is 10 months, according to Stovall’s numbers. But it is well short of the 23 months, on average, it has taken the market to recover from bigger meltdowns like the great financial crisis, when the S&P 500 fell 38.5% during 2008, according to FactSet data.

This time around, the market took 15 months to recoup all of its bear-market losses, which is slightly longer than the average bear market.

Once U.S. stocks have finally clawed their way back, they reliably rise another 5% on average, according to the data in Stovall’s table. After a bear market like the one that, presumably, has just ended, stocks continue to climb on average 5.2% over the next two and a half months, Stovall said, before experiencing a decline of 5% or greater, which Stovall defined as a period of consolidation.

After that, the S&P 500 typically enters a brief period of decline, with the index seeing a pullback, sometimes as shallow as 5.1% but sometimes as large as 14%, according to Stovall’s data.

Past performance, of course, is no guarantee of future returns.

The S&P 500 finished higher again on Monday, notching a second straight record closing high. The index gained 0.2% to 4,850.43, while the Nasdaq Composite gained 0.3% to 15,360.29.

The Dow Jones Industrial Average, meanwhile, tacked on another 138.01 points, or 0.4%, to close north of 38,000 for the first time ever on Monday. The blue-chip gauge closed at 38,001.81, according to FactSet data.

Comments