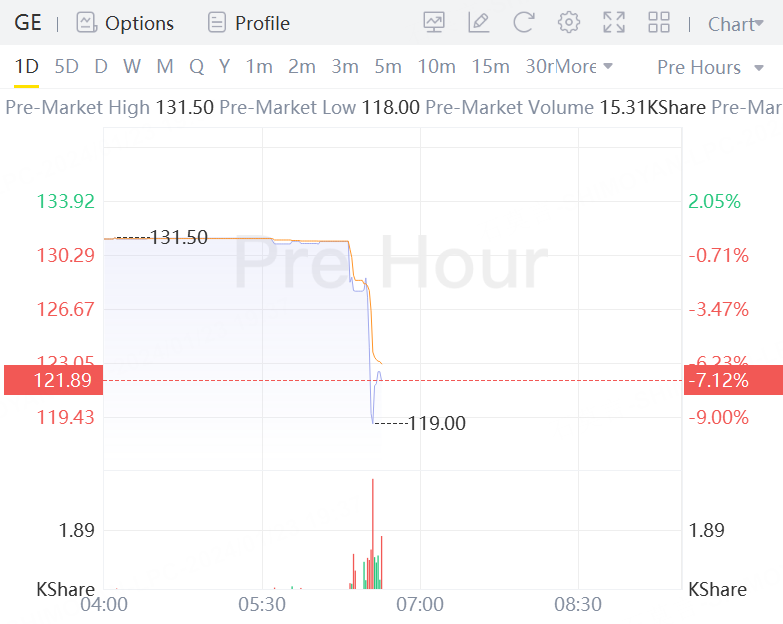

Shares of General Electric Co. $(GE)$ slumped 7.12% in premarket trading Tuesday, after the aerospace, power and renewable energy company reported fourth-quarter earnings that beat expectations, but provided a downbeat outlook.

Net income fell to $1.59 billion, or $1.45 a share, from $2.10 billion, or $1.90 a share, in the year-ago period. Excluding nonrecurring items, adjusted earnings per share of $1.03 beat the FactSet consensus of 90 cents.

Total revenue grew 15.4% to $19.42 billion, well above the FactSet consensus of $17.27 billion. Among GE's business segments, Aerospace revenue grew 11.9% to $8.52 billion, Power revenue rose 15% to $5.79 billion and Renewable Energy revenue jumped 23.4% to $4.21 billion. Free cash flow of $3.0 billion was above the average estimate of two analysts surveyed by FactSet of $2.77 billion.

For the first quarter of 2024, the company expects adjusted EPS of 60 cents to 65 cents, below the FactSet consensus of 70 cents. GE's stock, which closed Monday at the highest price since October 2017, has run up 23% over the past three months through Monday, while the S&P 500 has climbed 15%.

Comments