Earnings season is set to cause a reshuffling among the ranks of the largest U.S. companies.

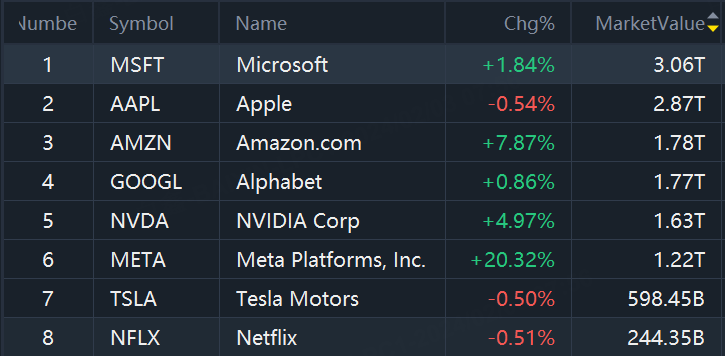

Amazon.com Inc. $(AMZN)$ overtakes Alphabet Inc. $(GOOG)$ $(GOOGL)$ and become the third-largest U.S. public company after jumping 8% on Friday. Amazon’s results were well received by Wall Street and Alphabet's earlier in the week got panned. The race is tight, however, with Amazon having a $1.78 trillion valuation and Alphabet having a $1.77 trillion market capitalization.

The e-commerce giant hasn't been valued above the Google parent company since Sept. 30, 2022, according to Dow Jones Market Data. That was also the last time Amazon was the third-largest by market cap.

Wall Street found plenty to like in Amazon's latest report, including drastic improvement in operating income, upbeat commentary on the cloud and momentum within the retail business. Meanwhile, Alphabet's earnings were met with a chillier reception as the company talked up heavy spending plans linked to its artificial-intelligence ambitions.

Alphabet's stock, however, sits closer to its all-time high than does Amazon's. Shares of the Google parent are off 3.5% from their closing high of $153.51, set Jan. 29. Amazon's stock is down 7.8% from its record finish of $186.57, established in July 2021.

The very top of the market-cap ranks has changed up as well lately, though admittedly with less of a tie to earnings. Microsoft Corp.'s $(MSFT)$ closing valuation surpassed Apple Inc.'s $(AAPL)$ on Jan. 12 for the first time since November 2021. While the two traded around the top spot in January, Microsoft has been sitting there since Jan. 25.

Microsoft also rests alone in the $3 trillion club, with Apple, the only other U.S. company to ever claim membership, having fallen out of it.

Comments