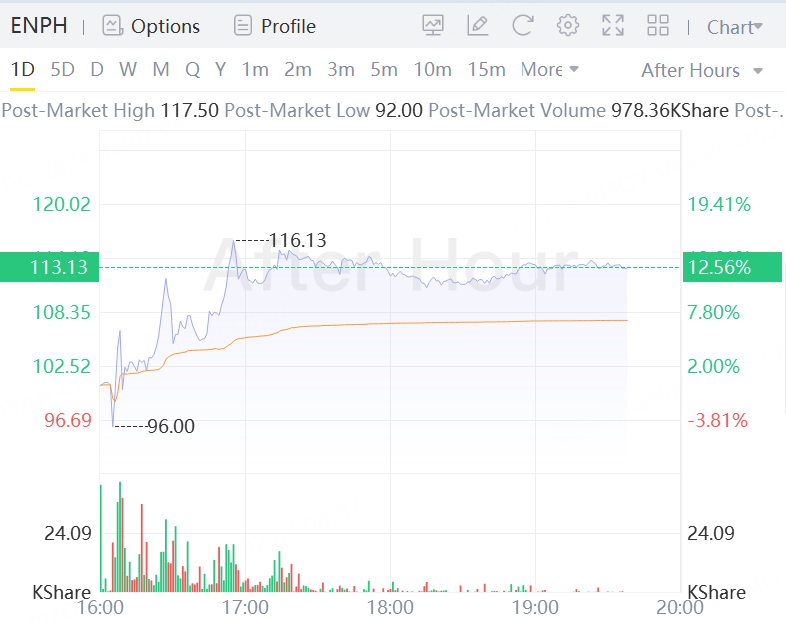

(Reuters) - Solar inverter maker Enphase Energy said on Tuesday it expects inventory levels to normalize and demand for its products to pick up by the end of the second quarter, sending its shares up nearly 13% in extended trading.

Solar firms have been facing rising inventory levels in Europe as well as softening customer demand in the U.S. due to the metering reform in California and high lending rates. The metering reform has lowered credit that households with rooftop solar panels received for transferring excess power to the grid.

Enphase said revenue in Europe decreased about 70% sequentially in the fourth quarter, as it reduced shipments to manage rising inventory levels at distribution partners.

But the company expects demand and margins for its batteries and micro-invertors to improve throughout 2024.

"We have been managing through a period of slowdown in demand. We think Q1 could be the bottom quarter. Europe is already showing early signs of recovery, and we expect the non-California states to bounce back quickly," said Chief Executive Badri Kothandaraman.

But, for the first quarter sell-through demand is expected to be seasonally down by about 10%. The company forecast first-quarter revenue to be between $260 million and $300 million. Analysts on average expected $318.3 million, according to LSEG data.

Enphase's fourth-quarter revenue stood at $302.6 million, versus analysts' expectations of $327.9 million.

Comments