LONDON, Feb 8 (Reuters) - British American Tobacco said on Thursday it was "actively working" to monetise some of its shareholding in India's ITC, which would move the cigarette giant closer to the resumption of share buybacks.

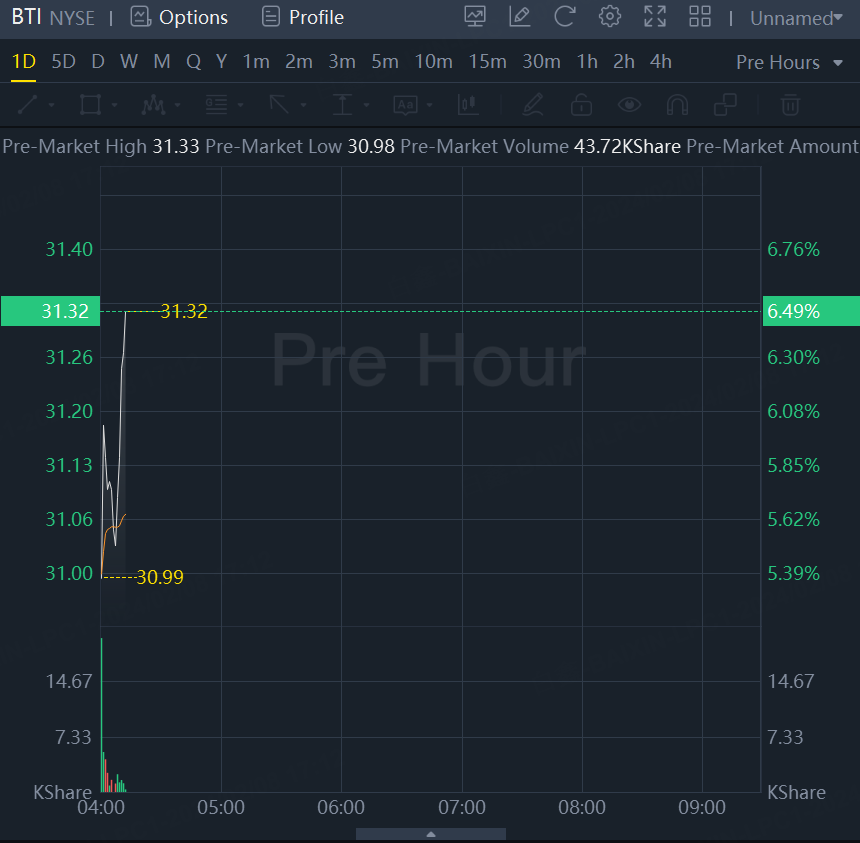

BAT shares jumped 6% on the news.

The maker of Dunhill and Lucky Strike cigarettes disappointed investors when it opted against a fresh buyback programme last year to focus on reducing debt and investing in new products.

As a result, it has come under pressure to sell down its around 29% stake in ITC, an Indian consumer goods giant that makes a large portion of its revenues from cigarettes but also operates hotels, a paper business and more.

Such a sale would allow it to pay down debt and move faster towards the leverage range at which it could resume buybacks.

"We have been actively working for some time on completing the regulatory processes required to give us the flexibility to monetise some of our shareholding and will update you at the earliest opportunity," BAT's Chief Executive Tadeu Marroco said in the company's results statement.

It marks the strongest signal yet the company could dispose of some of its stake.

"This would be a big positive... bringing the all important share buyback timeline closer for investors," RBC analyst James Edward Jones said in a note.

High dividends and share buybacks are a key element of the investment case in highly cash generative tobacco companies.

BAT also reported a 5.2% rise in adjusted diluted earnings per share on Thursday, just beating analyst expectations.

It forecast low single digit organic revenue growth in 2024, adding it expected a slow recovery in the United States economy.

Comments