Two technology sector AI plays — Arista Networks Inc (NYSE:ANET) and Globalfoundries Inc (NASDAQ:GFS) — will be reporting their first-quarter earnings on Tuesday. Globalfoundries will report before the market opens, Arista will report after market hours.

Arista Networks: Powering Ahead With AI

Arista Networks is known for its high-performance, software-driven networking solutions for large data centers and cloud computing environments.

In late April, the company introduced a new network identity service for enterprise security and IT operations. The service is powered by AI and delivered via the cloud.

Wall Street expects Arista Networks to report $1.75 in EPS and $1.552 billion in revenue.

Globalfoundries: $1.5B Funding to Support Further Growth

Globalfoundries is known for manufacturing semiconductor chips for a variety of industries, including automotive, communications and computing.

The company has secured $1.5 billion in funding for a new facility in Malta, New York. The funding has been secured to expand its manufacturing capacity for chips used in automotive, IoT, aerospace, defense and other markets. The funding is part of the U.S. CHIPS and Science Act.

Wall Street expects GlobalFoundries to report 23 cents in EPS and $1.523 billion in revenue.

With the rise in AI use cases and applications promising growth for all stocks in the field, let’s look at which of these two stocks is currently the better buy, according to analysts.

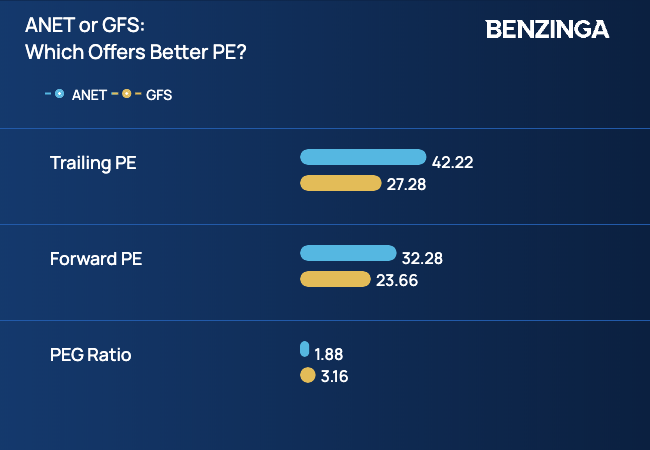

With Optimism Already Priced Into Arista Stock, Globalfoundries Offers The Better P/E

Arista Networks’ stock is up over 110% over the past year, about 18.4% YTD. The stock has had a good run, as evidenced by its premium valuation at 42.22 trailing P/E.

Globalfoundries’ stock on the other hand, has declined 16% over the past year and is down 17.71% YTD. Consequently, it is one of the two semiconductor MANGO stocks that recently have been trading near their 52-week lows.

MANGO is a novel grouping of seven companies in the semiconductor sector. The term was introduced by BofA Securities analyst Vivek Arya in a bid to mirror the success of FAANG stocks. Other members of the group include: Marvell Technology Inc (NASDAQ:MRVL), Advanced Micro Devices (NASDAQ:AMD), Broadcom Inc (NASDAQ:AVGO), Analog Devices Inc (NASDAQ:ADI), Nvidia Corp (NASDAQ:NVDA) and ON Semiconductor (NASDAQ:ON).

Notably, Globalfoundries is the most undervalued MANGO stock right now, a comparison of the P/E FWD and EV/Sales multiples, revealed.

Data Source: Yahoo Finance, Compiled by Benzinga

Consequently, Globalfoundries sports a more favorable forward P/E of 23.66 compared to Arista Networks’ 32.28.

Let’s now take a dig at the upside potential.

Related: What Is The Most Undervalued MANGO (Semiconductor) Stock Right Now?

Analysts See More Upside Ahead For Globalfoundries Stock

Looking at Wall Street consensus analysts’ estimates of price targets on both these stocks reveals which stock has more upside from current price levels.

Data Source: Yahoo Finance, Compiled by Benzinga

Arista Networks’s stock has seen good gains over the past year. Consequently, much optimism has already been priced into the stock. Globalfoundries, on the other hand, now shines in more favorable light from current price levels. Analysts see 22.62% upside associated with its stock, relative to 6.69% with Arista Networks’ stock.

Based on valuation multiples and consensus analysts rating, Globalfoundries appears to be the better AI stock pick at current price levels.

Read Next: 2 Semiconductor MANGO Stocks Trading Near 52-Week Lows As They Head Into Q1 Earnings

Photo: Courtesy Globalfoundries

Comments