Qualys, Inc. (NASDAQ:QLYS) reported better-than-expected third-quarter financial results and raised its FY24 guidance on Tuesday.

Qualys reported quarterly earnings of $1.56 per share which beat the analyst consensus estimate of $1.33 per share. The company reported quarterly sales of $153.87 million which beat the analyst consensus estimate of $150.70 million.

“Q3 was another strong quarter of rapid innovation for Qualys, reflecting our ongoing commitment to technology leadership, cybersecurity transformation, and successful outcomes for customers,” said Sumedh Thakar, Qualys’ president and CEO. “With the release of several new capabilities, including our Enterprise TruRisk Management solution, TruRisk Eliminate, and Qualys TotalAI we have further strengthened our strategic position as the partner of choice for customers looking to rearchitect and consolidate their security tools to solve modern security challenges while simplifying their operational defenses. We believe we can continue to grow long-term, maintain best-in-class profitability, and invest in key initiatives aimed at further extending the gap between Qualys and the competition.”

Qualys raised its 2024 adjusted EPS guidance from $5.46- $5.62 to $5.81 – $5.91 and also raised its revenue guidance from $597.5 million – $601.5 million to $602.9 million – $605.9 million.

Qualys shares gained 27.6% to trade at $163.64 on Wednesday.

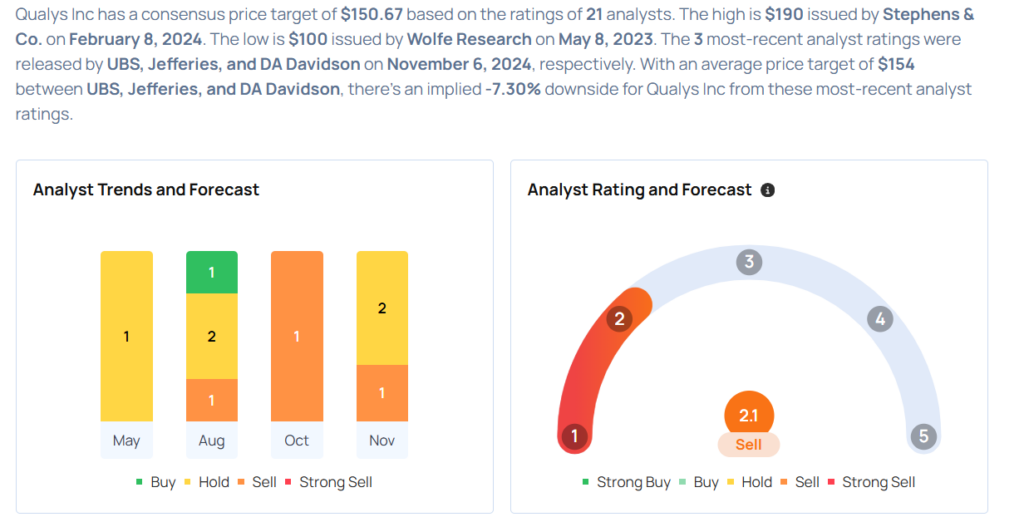

These analysts made changes to their price targets on Qualys following earnings announcement.

- Morgan Stanley analyst Hamza Fodderwala maintained Qualys with an Underweight and raised the price target from $123 to $126.

- TD Cowen analyst Nick Yako maintained Qualys with a Hold and raised the price target from $130 to $150.

- Truist Securities analyst Joel Fishbein maintained the stock with a Hold and increased the price target from $120 to $145.

- RBC Capital analyst Matthew Hedberg maintained Qualys with a Sector Perform and raised the price target from $150 to $162.

- Canaccord Genuity analyst Michael Walkley maintained the stock with a Buy and raised the price target from $160 to $170.

- DA Davidson analyst Rudy Kessinger maintained Qualys with a Neutral and raised the price target from $120 to $147.

- Jefferies analyst Joseph Gallo maintained the stock with a Hold and raised the price target from $135 to $155.

- UBS analyst Roger Boyd maintained Qualys with a Neutral and raised the price target from $140 to $160.

Considering buying QLYS stock? Here’s what analysts think:

Read More:

- Amazon, Disney, DuPont, Leidos And A Financial Stock On CNBC’s ‘Final Trades’

Comments