Lumentum Holdings Inc. (NASDAQ:LITE) reported better-than-expected first-quarter financial results and issued second-quarter guidance above estimates on Thursday.

Lumentum reported quarterly earnings of 18 cents per share which beat the analyst consensus estimate of 12 cents per share. The company reported quarterly sales of $336.900 million which beat the analyst consensus estimate of $324.977 million.

“In the first quarter, we exceeded the high end of our guidance for both revenue and earnings per share,” said Alan Lowe, President and CEO. “We set a new record for datacom laser chip orders, including substantial 200G EML orders, reflecting strong demand from multiple customers, including an AI infrastructure customer. Based on expanding cloud demand and improving trends in the broader networking market, we expect double-digit sequential revenue growth in the second quarter.”

Lumentum said it sees second-quarter adjusted EPS of 30 cents-40 cents, versus market estimates of 27 cents. The company sees sales of $380.000 million-400.000 million, versus expectations of $354.32 million.

Lumentum shares gained 13.2% to trade at $83.82 on Friday.

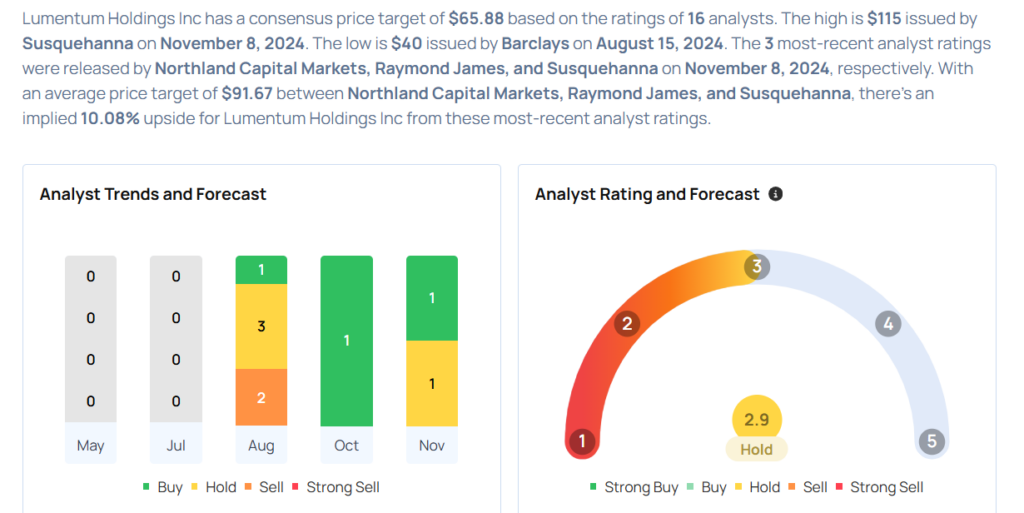

These analysts made changes to their price targets on Lumentum following earnings announcement.

- Susquehanna analyst Christopher Rolland maintained Lumentum with a Positive and raised the price target from $80 to $115.

- Raymond James analyst Simon Leopold maintained Lumentum with an Outperform and raised the price target from $70 to $100.

- Northland Capital Markets analyst Tim Savageaux maintained the stock with a Market Perform and raised the price target from $45 to $60.

Considering buying LITE stock? Here’s what analysts think:

Read More:

- How To Earn $500 A Month From Nvidia Stock After Trump Win

Comments