Ibotta, Inc. (NYSE:IBTA) reported better-than-expected third-quarter sales on Wednesday.

Ibotta posted third-quarter adjusted earnings of 94 cents per share, which may not compare to market estimates of 35 cents per share. The company's sales came in at $98.60 million, beating expectations of $94.05 million.

Ibotta said it sees fourth-quarter revenue of $100 million to $106 million, versus analysts' estimates of $110.29 million. The company expects adjusted EBITDA of $30 million to $34 million.

Ibotta shares fell 2.1% to close at $74.93 on Wednesday.

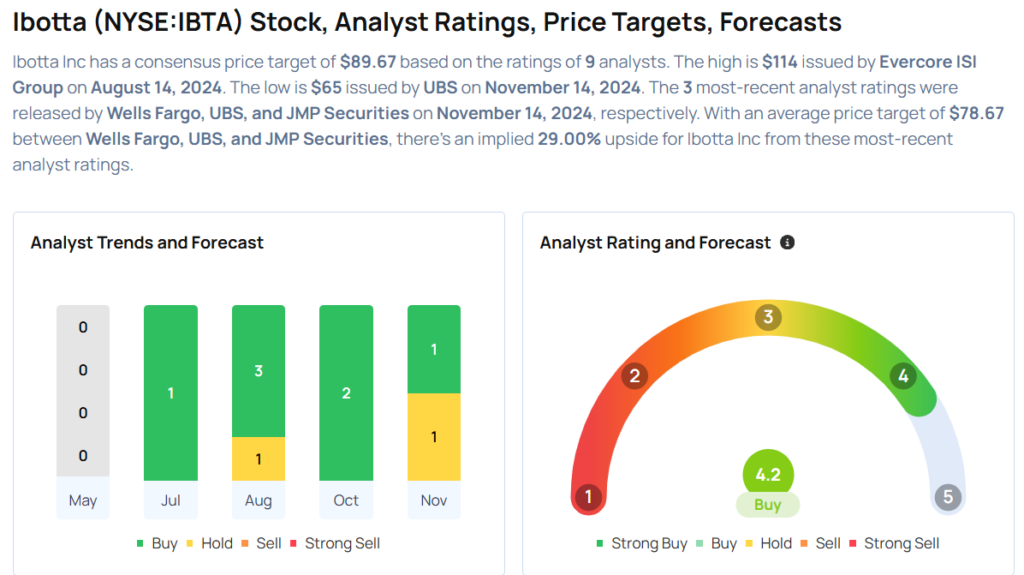

These analysts made changes to their price targets on Ibotta following earnings announcement.

- Needham analyst Bernie McTernan maintained Ibotta with a Buy and lowered the price target from $100 to $80.

- JMP Securities analyst Andrew Boone maintained Ibotta with a Market Outperform and lowered the price target from $111 to $85.

- UBS analyst Chris Kuntarich downgraded Ibotta from Buy to Neutral and lowered the price target from $90 to $65.

- Wells Fargo analyst Ken Gawrelski maintained Ibotta with an Overweight and lowered the price target from $95 to $86.

Considering buying IBTA stock? Here’s what analysts think:

Read More:

- US Stocks Settle Mixed Following Inflation Data: Investor Sentiment Improves, But Fear Index Remains In ‘Greed’ Zone

Comments