Monday.com Ltd (NASDAQ:MNDY) reported better-than-expected earnings for its third quarter on Monday.

The company reported fiscal third-quarter 2024 revenue growth of 33% Y/Y to $251.0 million, beating the analyst consensus estimate of $246.1 million. The project management software company's adjusted EPS of 85 cents beat the analyst consensus estimate of 63 cents.

“monday.com had a strong Q3, driven by the team’s consistent execution as we focus on deepening our product capabilities and bolstering the platform to support customers of all sizes,” said monday.com co-founders and co-CEOs, Roy Mann and Eran Zinman. “Reaching $1 billion in ARR marks a major milestone in our journey as a company, and we are more excited than ever to enter this next stage of growth, building on the strong foundation we’ve established.”

Monday.com raised 2024 revenue guidance to $964 million–$966 million (prior $956 million–$961 million) against the consensus of $960.2 million and an adjusted operating margin of 12%–13% (prior 10%-11%)

Monday.com shares fell 3% to trade at $266.95 on Tuesday.

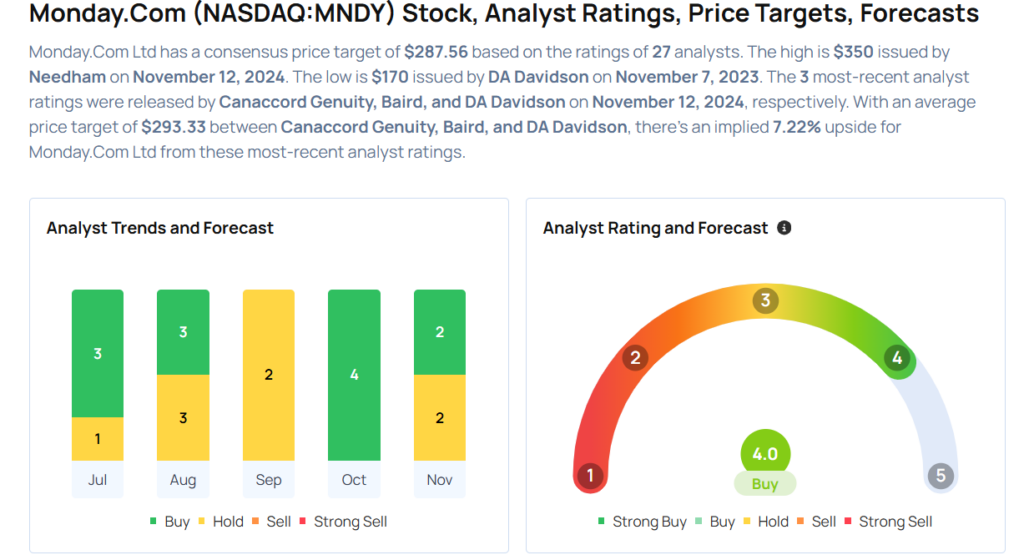

These analysts made changes to their price targets on Monday.com following earnings announcement.

- Needham analyst Scott Berg maintained Monday.Com with a Buy and raised the price target from $300 to $350.

- Baird analyst Rob Oliver maintained the stock with a Neutral and raised the price target from $265 to $270.

- Canaccord Genuity analyst David Hynes maintained Monday.Com with a Buy and raised the price target from $295 to $310..

Considering buying MNDY stock? Here’s what analysts think:

Read More:

- Jim Cramer: This Tech Stock Can ‘Go To 160,’ Recommends Buying Domino’s Pizza

Comments