Rocket Companies, Inc. (NYSE:RKT) reported worse-than-expected third-quarter revenue results, after the closing bell on Tuesday.

Rocket Companies reported quarterly earnings of eight cents per share, which met the analyst consensus estimate. Quarterly revenue of $647 million missed the analyst consensus estimate of $1.28 billion and is a decrease from sales of $1 billion from the same period last year.

"We delivered strong third-quarter results, expanding purchase and refinance market share, and increasing adjusted revenue by 32% year-over-year. Our adjusted EBITDA was the highest in two years," said Varun Krishna, CEO and director of Rocket Companies. "These achievements highlight the strength and resilience of the Rocket Superstack — our competitive advantage that combines our ecosystem, experience, technology and brand. We've demonstrated that whatever the market brings, we will drive a bright future in helping more Americans achieve the dream of homeownership."

Rocket Companies shares fell 9.1% to close at $14.13 on Wednesday.

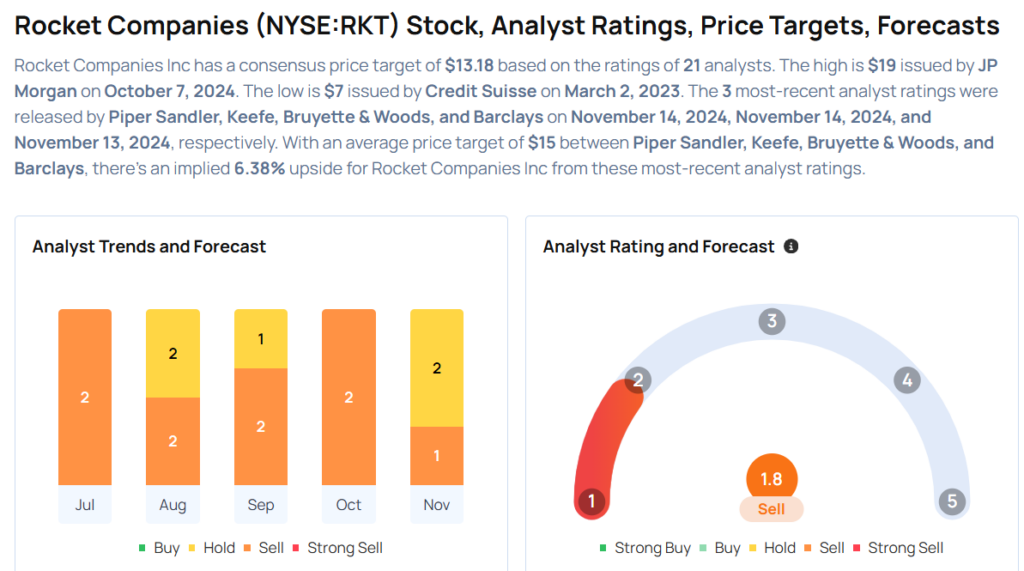

These analysts made changes to their price targets on Rocket Companies following earnings announcement.

- Keefe, Bruyette & Woods analyst Bose George maintained Rocket Companies with a Market Perform and lowered the price target from $20 to $16.

- Piper Sandler analyst Brad Capuzzi maintained the stock with a Neutral and lowered the price target from $17 to $16.

- On Wednesday, Barclays analyst Mark Devries maintained Rocket Companies with an Underweight and cut the price target from $14 to $13.

- RBC Capital analyst Daniel Perlin maintained Rocket Companies with a Sector Perform and lowered the price target from $20 to $18 on Wednesday.

Considering buying RKT stock? Here’s what analysts think:

Read More:

- US Stocks Settle Mixed Following Inflation Data: Investor Sentiment Improves, But Fear Index Remains In ‘Greed’ Zone

Comments