ZoomInfo Technologies Inc. (NASDAQ:ZI) reported better-than-expected earnings for its third quarter on Tuesday.

On Tuesday, the company reported revenueof $303.6 million, beating estimates of $299.4 million, and adjusted EPS of 28cents, exceeding the consensus of 22 cents.

Total revenue was down 3% on a year-over-year basis in the quarter. ZoomInfo ended the quarter with 1,809 customers generating $100,000 or more in annual contract value, marking an increase of 12 customers compared to the previous quarter.

Henry Schuck, ZoomInfo founder and CEO said, "Net revenue retention was stable for the third consecutive quarter and we again grew our $100k and million dollar customer cohorts."

ZoomInfo said it sees fourth-quarter revenue in the range of $296 million to $299 million versus estimates of $296.8 million and adjusted EPS of $0.22 – $0.23 (vs. consensus of $0.23), according to Benzinga Pro.

The company revised FY24 revenue outlook to $1.201 billion – $1.204 billion (from $1.190 – $1.205 billion) vs $1.198 billion estimate and adjusted EPS to $0.92 – $0.93 (from $0.86 – $0.88) vs. consensus of $0.88.

ZoomInfo shares dipped 16.9% to trade at $10.87 on Wednesday.

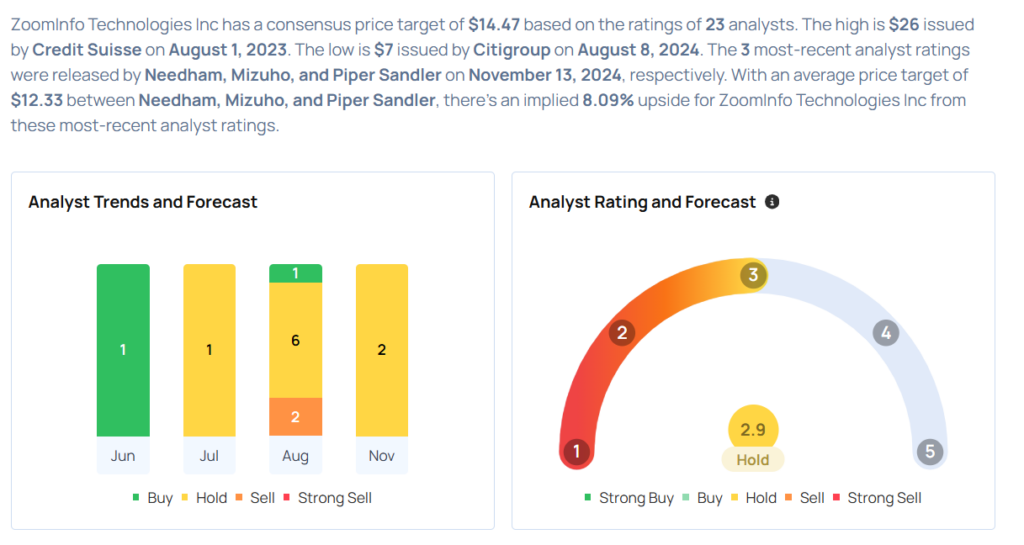

These analysts made changes to their price targets on ZoomInfo following earnings announcement.

- Piper Sandler analyst Brent Bracelin maintained ZoomInfo Technologies with a Neutral and raised the price target from $10 to $11.

- Mizuho analyst Siti Panigrahi maintained ZoomInfo with a Neutral and raised the price target from $9 to $11.

- Needham analyst Joshua Reilly reiterated the stock with a Buy and maintained a $15 price target.

Considering buying ZI stock? Here’s what analysts think:

Read More:

- This Caterpillar Analyst Turns Bearish; Here Are Top 5 Downgrades For Wednesday

Comments