Taiwan Semiconductor Manufacturing Co (NYSE:TSM) reported a topline growth of 34% year-on-year to $8.55 billion in November 2024.

Revenue for January through November 2024 grew by 31.8% year over year to $81.05 billion, testimony to the continued artificial intelligence frenzy.

The contract chipmaker’s market share grew to 64.9%, up from 62.3% Q/Q, helping it retain the top position in the global wafer foundry business. This is due to the smartphone and AI-related demand for its 3nm and 5nm technologies thanks to clients like Apple Inc (NASDAQ:AAPL) and Nvidia Corp (NASDAQ:NVDA).

Also Read: Google Quantum AI’s New Willow Chip Can Do in Minutes That Supercomputers Would Take 10 Septillion Years

Taiwan Semiconductor’s performance reflects the chipmaker’s production capacity utilization and wafer shipment boost.

Meanwhile, Samsung Electronics (OTC:SSNLF) bore the brunt of competition from Chinese rivals for advanced technology, with its market share falling to 9.3% in the quarter, down from 11.5% Q/Q.

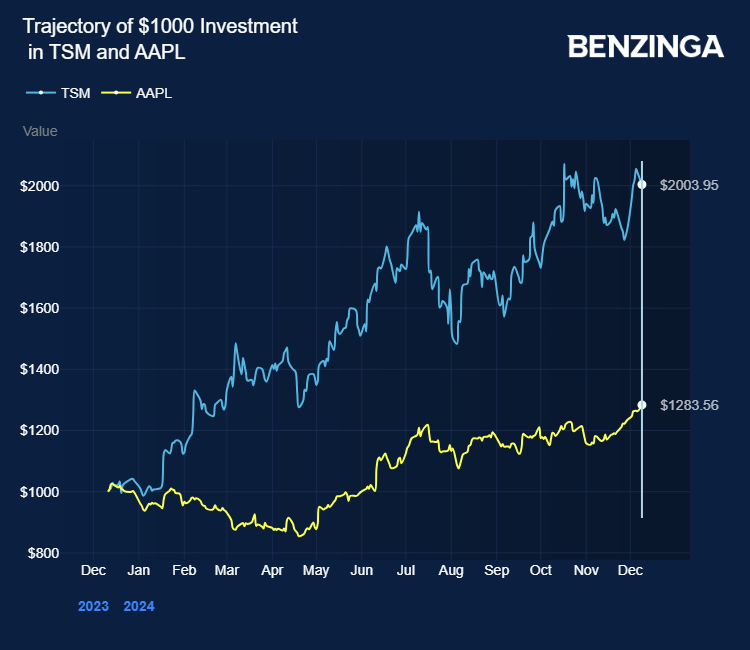

Taiwan Semiconductor stock is up over 96% year-to-date. The chipmaker is extending its footprint beyond Taiwan to help countries develop their semiconductor moat instead of depending solely on China.

Recent reports indicated Nvidia is exploring the production of the Blackwell AI chips at Taiwan Semiconductor’s Arizona plant. Apple and Advanced Micro Devices Inc (NASDAQ:AMD) are already customers of Arizona’s Taiwan Semiconductor chip plant.

The chipmaker has manufactured Nvidia’s Blackwell chips in its Taiwan facilities, where its chip-on-wafer-on-substrate (CoWoS) capacity exists.

Taiwan Semiconductor has maintained its key advanced technology production facilities in Taiwan, which renders it vulnerable to geopolitical risks.

Investors can gain exposure to Taiwan Semiconductor through iShares Semiconductor ETF (NASDAQ:SOXX) and First Trust NASDAQ Technology Dividend Index Fund (NASDAQ:TDIV).

Price Action: TSM stock closed lower by 0.36% at $198.45 premarket at the last check on Tuesday.

Also Read:

- Broadcom Likely For Upside Backed By AI Pipeline, Market Recovery, VMWare Synergy: Analyst

Image via Shutterstock

Comments