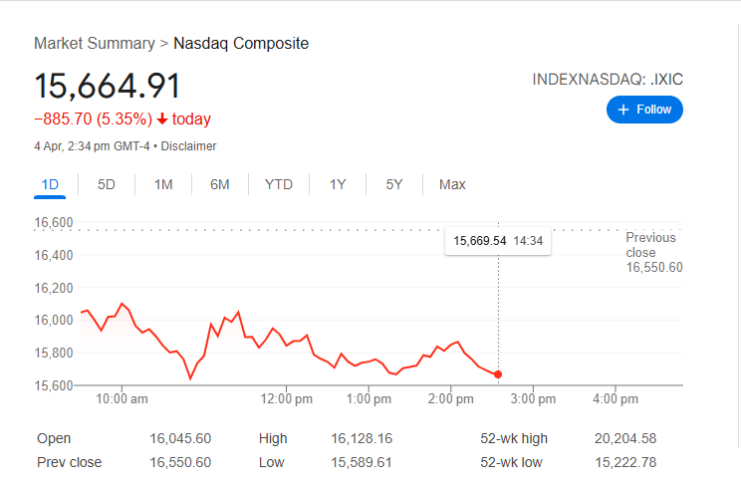

The American stock market is bleeding red on Friday after a tariff war started between the U.S. and China. Currently, the Nasdaq is down by 5.36% by approximately 888.48 points, the Dow Jones Industrial Average dropped by 4.64% by around 1,800 points, and the S&P 500 dropped by 5.20% by around 280.09 points.

However, while the American stock market is shaking up, the crypto market is holding strong. According to CMC data, at the time of writing the total crypto market cap is at $2.66 trillion with an intraday gain of 1.53%. The data suggest that the crypto is trying hard not to join NASDAQ and DOW.

But the big question here is why the crypto market is holding strong despite the global market crash and tariff uncertainties. Let’s find out.

Investors’ Sentiments Shift About Crypto

The main reason that crypto is holding strong during the challenging market conditions is a change in the perception of investors, governments, banks, and institutions. In the last two years, crypto has acquired more mainstream acceptance.

Whether it’s the launch of Bitcoin and Ethereum ETFs or cryptocurrency being included in the U.S. Strategic Reserve, these factors have contributed to changing investor sentiment. Moreover, institutional money is increasingly shifting to crypto, viewing it as a digital hedge tool.

However, there is one more outlook. Earlier this week, reports indicated Bitcoin dipped to $81,498 amid selling pressure tied to Trump’s tariff announcements, with altcoins losing over $50 billion in market cap in just two days. Today’s market rebound could be a buy-on-dip opportunity for investors as Bitcoin’s price bounced from the key support level of $81000.

Despite Positive Sentiments, Bear Market Looms?

Despite the recent rebound bear sentiment still exists. According to CryptoQuant data, 1,057 Bitcoin that hadn’t moved in 7–10 years just woke up. Long-term holders may be preparing to sell. Moreover, the various on-chain data suggest a decrease in active wallet addresses and new wallet creations. The data suggests that investors have reduced their accumulation, and the market is prepared to liquidate their holdings based on market conditions.

The fear and greed index is still at 25 points, indicating negative sentiments among investors. Therefore, it is important to exercise caution before taking any further moves, as this rebound could also turn out to be a bull trap.

Conclusion

Based on the contrasting market trends, crypto shows resilience amid stock market turmoil but faces potential bearish signals. Investors should approach with caution as changing sentiment and on-chain indicators suggest this recovery could be temporary despite crypto’s growing mainstream acceptance.

Comments