As of Aug. 27, 2025, two stocks in the utilities sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Talen Energy Corp (NASDAQ:TLN)

- On Aug. 7, Talen Energy posted better-than-expected quarterly earnings. “The Talen team continued to execute in the second quarter. We expanded our relationship with Amazon to 1.9 gigawatts (“GWs”) and announced the strategic acquisition of Freedom and Guernsey. This further enables Talen’s ability to offer reliable, grid-supported and regionally diverse capacity to hyperscale data centers and other large commercial off-takers. The Freedom and Guernsey acquisitions expand Talen’s fleet and are expected to unlock material value on day one,” said Talen President and Chief Executive Officer Mac McFarland. The company's stock jumped around 6% over the past month and has a 52-week high of $394.07.

- RSI Value: 72.2

- TLN Price Action: Shares of Talen Energy rose 6.5% to close at $378.79 on Tuesday.

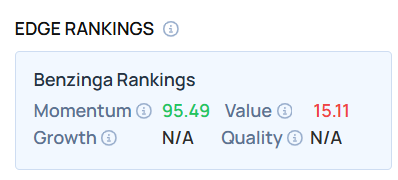

- Edge Stock Ratings: 95.49 Momentum score with Value at 15.11.

Hawaiian Electric Industries Inc (NYSE:HE)

- On Aug. 7, Hawaiian Electric posted downbeat quarterly earnings. “Our core operations performed as expected in the second quarter, with the utility progressing measures to protect our communities against the risks posed by extreme weather events. We’ve also continued to make the changes necessary to move forward as a simpler, more focused company best positioned to serve our communities for the long term. This includes our sale of Pacific Current’s solar and battery storage assets and the expected divestiture of our remaining stake in American Savings Bank over the next year,” said Scott Seu, HEI president and CEO. The company's stock gained around 14% over the past month and has a 52-week high of $13.18.

- RSI Value: 74.3

- HE Price Action: Shares of Hawaiian Electric gained 0.6% to close at $12.20 on Tuesday.

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Read This Next:

- Jim Cramer: Kodiak Sciences Is A ‘Pure Spec’ Stock, Recommends Buying This Utilities Stock

Photo via Shutterstock

Comments