Jeremy Allaire, CEO of Circle Internet Group (NYSE:CRCL), said Wednesday that “regulatory” clarity provided by the GENIUS Act was one of the major reasons behind the company’s strong performance in the third quarter.

GENIUS Act Impact?

During Circle's third-quarter earnings call, Allaire was asked about the USDC’s (CRYPTO: USDC) market share increasing to 29% from 28% in the prior quarter, and whether the passage of the GENIUS Act helped boost the stablecoin’s demand.

“We saw very strong growth in Q3. I think that growth has come from, yes, the regulatory clarity,” he responded.

Allaire added that technological advancements also played a big role, and together, these factors led to more market activity, leading to the adoption of stablecoin by major financial institutions, payment firms, neo banks, and large enterprises.

See Also: Forget DOGE, SHIB Volatility: Popcat Rallied 40%, Then Plunged 50% In 1 Day

The Significance Of A New Stablecoin Bill

The GENIUS Act, which was signed into law by President Donald Trump earlier this year, has been a game-changer for the global monetary system, according to economist Lynette Zang. She added that the stablecoins would usher in “hyperinflation,” and issued a stark warning about the future of the dollar.

Sen. Elizabeth Warren (D-Mass.) warned that the Act could put consumers and the entire financial system at risk if left unchecked. She urged stricter enforcement measures to prevent corruption, financial instability and conflicts of interest tied to Trump-linked ventures.

Trump has long been a proponent of the legislation, saying it "is going to make America the Undisputed Leader in Digital Assets.”

The GENIUS Act requires stablecoins to be fully backed by dollars or equivalent liquid assets, mandates annual audits for large issuers, and introduces new standards for foreign stablecoin issuance.

Circle Records Strong Q3

Meanwhile, Circle posted third-quarter net income of $214 million, up a whopping 202% year over year.

USDC in circulation reached $73.7 billion, a 108% annual increase, marking a record quarter for the world’s second-largest stablecoin issuer.

Price Action: Despite the impressive performance, Circle’s stock slid 1.19% in after-hours trading after closing 12.21% lower at $86.30 during Wednesday’s regular trading session, according to data from Benzinga Pro.

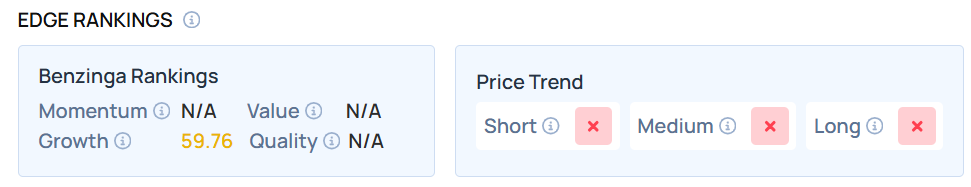

Benzinga’s Edge Stock Rankings showed that the stock had a weaker price trend in the short, medium, and long terms. Click here to see how other stocks associated with cryptocurrencies perform on this metric.

Read Next:

- Cisco, Firefly Aerospace, Pan American Silver, Serve Robotics And Circle: Why These 5 Stocks Are On Investors’ Radars Today

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo Courtesy: Shutterstock AI on Shutterstock.com

Comments