CACI International Inc (NYSE:CACI) will release earnings results for the fourth quarter, after the closing bell on Wednesday, Jan. 21.

Analysts expect the Reston, Virginia-based company to report quarterly earnings at $6.49 per share, up from $5.95 per share in the year-ago period. The consensus estimate for CACI International's quarterly revenue is $2.28 billion, up from $2.1 billion a year earlier, according to data from Benzinga Pro.

On Jan. 12, CACI was awarded a $416 million task order to sustain and modernize systems for the U.S. Navy.

CACI International shares fell 1% to close at $629.14 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

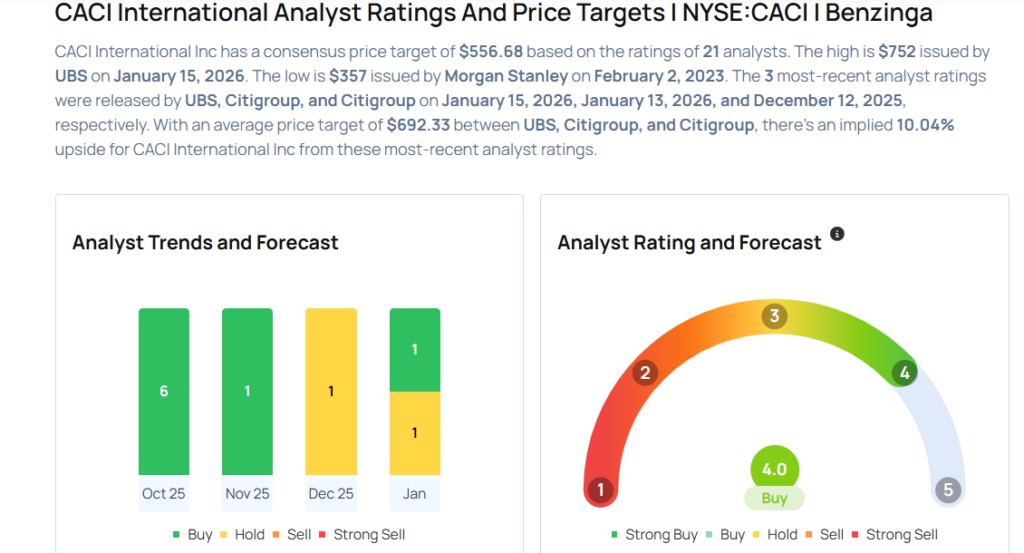

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- UBS analyst Gavin Parsons maintained a Buy rating and cut the price target from $759 to $752 on Jan. 15, 2026. This analyst has an accuracy rate of 72%.

- Citigroup analyst John Godyn maintained a Neutral rating and raised the price target from $642 to $683 on Jan. 13, 2026. This analyst has an accuracy rate of 62%.

- Truist Securities analyst Tobey Sommer maintained a Buy rating and raised the price target from $600 to $735 on Nov. 14, 2025. This analyst has an accuracy rate of 72%.

- Goldman Sachs analyst Noah Poponak maintained a Buy rating and increased the price target from $567 to $624 on Oct. 27, 2025. This analyst has an accuracy rate of 68%.

- JP Morgan analyst Seth Seifman maintained an Overweight rating and raised the price target from $575 to $645 on Oct. 27, 2025. This analyst has an accuracy rate of 86%.

Considering buying CACI stock? Here’s what analysts think:

Photo via Shutterstock

Comments