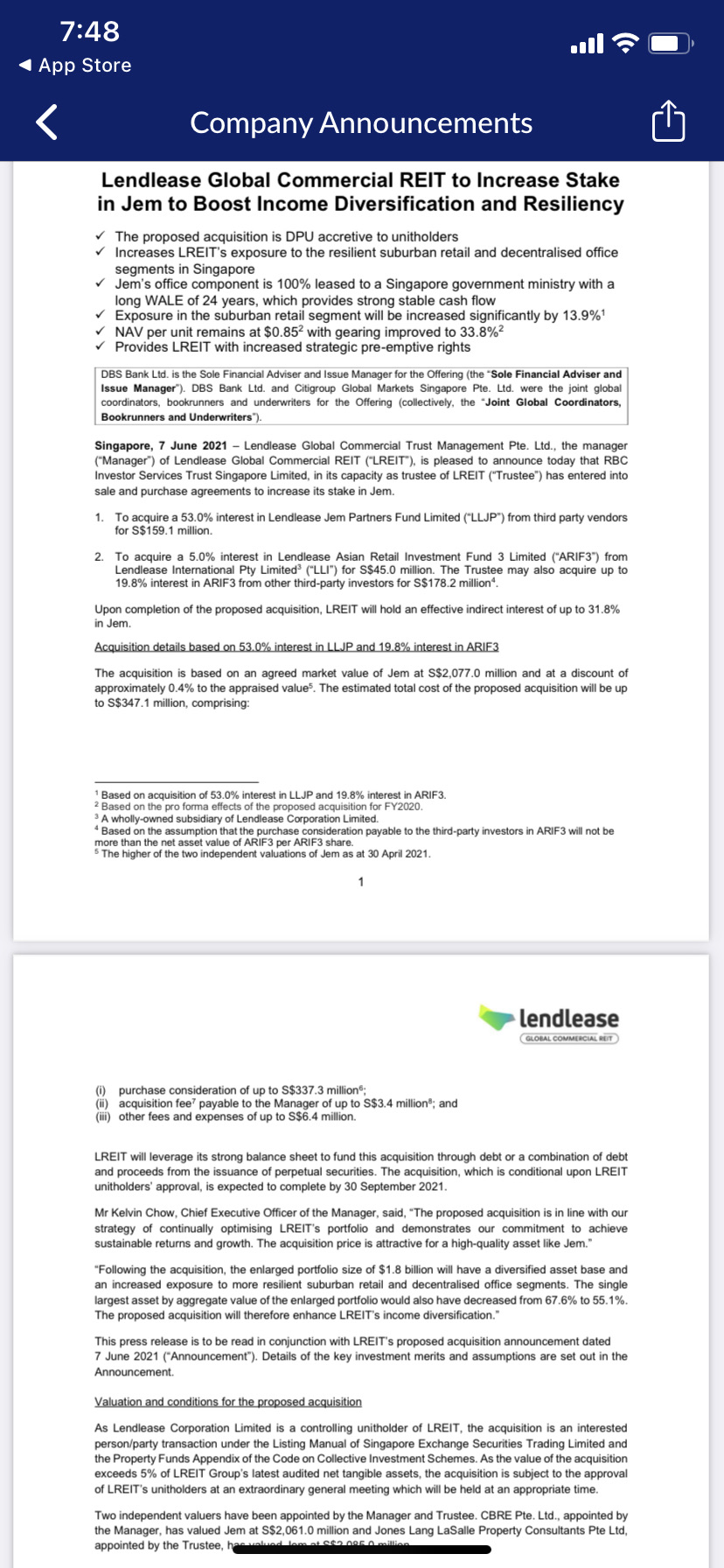

$Lendlease Global Commercial REIT(JYEU.SI)$Extract from sgx annoucmement 7 June 21. LREIT will leverage its strong balance sheet to fund this acquisition through debt or a combination of debt and proceeds from the issuance of perpetual securities. The acquisition, which is conditional upon LREIT unitholders’ approval, is expected to complete by 30 September 2021.

Mr Kelvin Chow, Chief Executive Officer of the Manager, said, “The proposed acquisition is in line with our strategy of continually optimising LREIT’s portfolio and demonstrates our commitment to achieve sustainable returns and growth. The acquisition price is attractive for a high-quality asset like Jem.”

“Following the acquisition, the enlarged portfolio size of $1.8 billion will have a diversified asset base and an increased exposure to more resilient suburban retail and decentralised office segments. The single largest asset by aggregate value of the enlarged portfolio would also have decreased from 67.6% to 55.1%. The proposed acquisition will therefore enhance LREIT’s income diversification.”

This press release is to be read in conjunction with LREIT’s proposed acquisition announcement dated

7 June 2021 (“Announcement”). Details of the key investment merits and assumptions are set out in the announcement

Comments