Last night, the once 'mobile King' Nokia rose 9.5%, attracting the attention of many investors.

So far, Nokia's share price has risen by 50% in 2021!

With such a huge increase, what changes have taken place in Nokia's fundamentals? Is the surge a flash in the pan or a signal of the return of the king?

Missing the wave of smartphones, Nokia's plummeted by 90% from the top!

Nokia was once the 'mobile phone empire', with a market share of 50%, and 'arcade' once became synonymous with Nokia.

However, in the era of smart phones, Nokia insisted on building its own operating system outside Apple and Android, and its strategic positioning still focused on security, thus missing the era of smart phones.

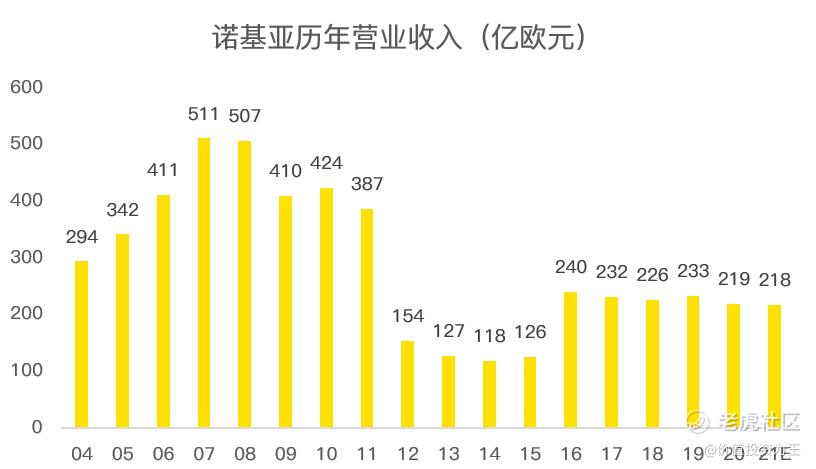

After Nokia sold its mobile phone business to Microsoft, consumers once thought Nokia was dead. From the financial data, Nokia's revenue plummeted, and it has not recovered yet.

Although it has fallen from the favored one to the target of public criticism, Nokia, founded in 1865, has experienced numerous crises in history. After missing the era of smart phones, Nokia did not wait for death, but strategically transformed into communication service provider.

In 2013, Nokia Holdings Siemens COM; In 2015, Nokia acquired Alcatel-Lucent for US $16.6 billion, becoming the second largest communication service provider in the world!

With its strong scientific research strength, Nokia has a firm foothold in 5G communication equipment, and its patent holdings are second only to Huawei. In recent years, with the suppression of Huawei's 5G by Western countries, Nokia has become the biggest beneficiary.

Performance stabilized and rebounded, and the king returned on the way!

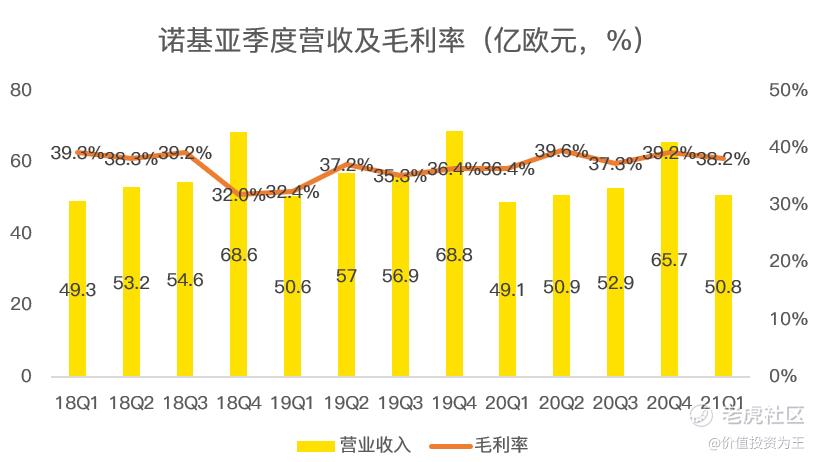

On April 29th, Nokia released its financial report for the first quarter of 2021, with quarterly revenue of 5.08 billion euros, up 3% year-on-year, and 9% year-on-year under fixed currency, which exceeded analysts' expectations.

In terms of quarterly revenue and gross profit margin, Nokia began to stabilize.

Before the release of the quarterly report, Nokia held an investor day on March 18th, and the CEO painted a bright future for investors.

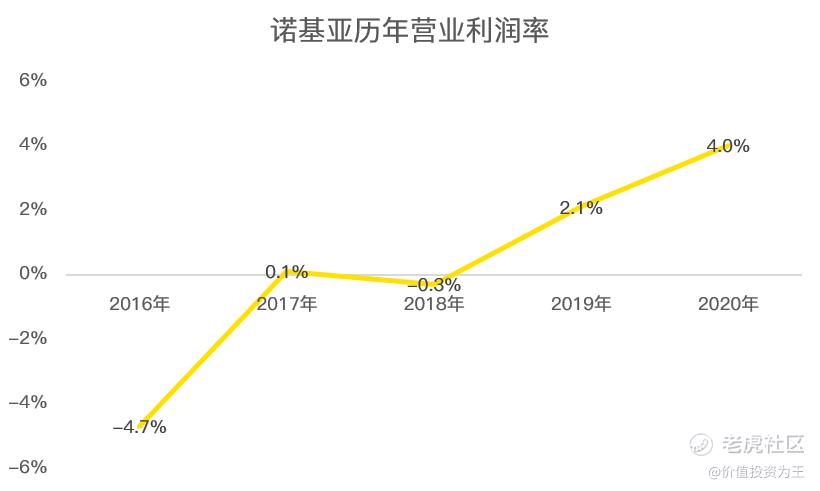

According to the company's outlook, Nokia's operating profit ratio is expected to be between 7-10% in 2021 and 10-13% in 2023, which is a qualitative improvement compared with the profit ratio of-4. 7% in 2016!

From the market trend, the company believes that 5G is still in its early stage, and it is estimated that the peak value of 5G market is twice that of 4G, and this trend will continue.

In order to meet the opportunity of the times, Nokia is repositioning itself and making a clear and detailed plan. In the future, it will no longer promote the end-to-end product portfolio as the company's characteristic in the capital market, but instead establish four fully self-financing and fully authorized business groups to fully respond to the needs of the market and customers. Every business group has a pragmatic strategy and goal to increase market share and profit by enhancing technological leadership.

On July 13, Nokia raised its performance guidelines for the whole year of 2021. The previously released revenue range was between 20.6 billion and 21.8 billion euros, and the operating profit ratio was 7-10%.

Although Nokia raised its guidance target, it did not give new guidance. Nokia will release its second-quarter financial report on July 29th, when it will revise its 2021 performance guidance.

If Nokia can achieve a magnificent double-digit operating profit margin in 2023, the current surge of Nokia is not a flash in the pan, but is expected to be a signal of the return of the king!$Nokia (NOK) $

Comments