This Central Bank Is Repeating The Mistake Committed By Western CBs!

Central Banks across the West (Fed, BoC, ECB and BoE) committed a significant blunder in 2021 when they termed inflation “transitory” and let it run wild.

In fact, the Fed was buying Mortgage Backed Securities (MBS) and expanding its balance sheet under its colossal QE program last year when inflation was highest since the 70s. The post covid fiscal and monetary excesses were the principal reasons inflation became a monster. The inflationary fire was exacerbated by the rhetoric that CBs undertook early in the fight while ignoring the repercussions of their actions.

As a result, they were way behind the curve and lost their hard-earned credibility.

The “transitory” mistake is now repeated by the Bank Of Japan (BoJ). The Contrarian central bank, which has been buying unprecedented JGBs and has refused to abandon the YCC policy, is creating a monster of its own.

As I head home from Japan after 11 days, I am more confident that BoJ is on a path to creating a grotesque with wide-ranging consequences across asset classes.

Nevertheless, to profit from the trade, one needs to get the timing right which is the most challenging to predict.

Let us understand what’s happening in Japan, and we will look at some of the economic data from the US.

Japan- Labor Market And Inflation!

When you enter Japan, you first notice the presence of senior citizens/ boomers in the workforce. From airports to railway stations to cleaning streets, I was stunned to see the majority of the workforce be 50+.

Though it should not surprise you since we all are very well aware of the declining demographics, it sends shivers down your spine when you witness it with your own eyes.

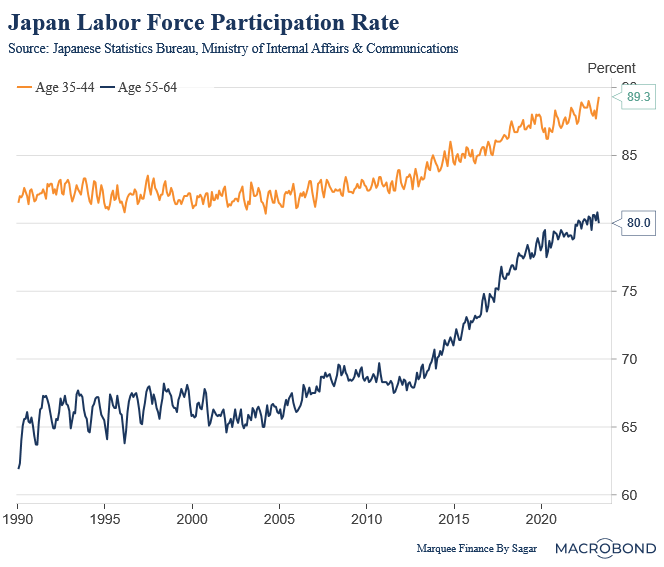

So, the first thing I looked for after coming back was the labour force participation rate of the population above 55.

Unsurprisingly, 80% of the population aged 55–64 is now actively working, and the figure is a whopping 90% for 35–55.

Secondly, many economists believe that “inflation” is solely a “wage” phenomenon. One of my friends from uni has been in Japan since 2014 and has been working in the IT sector.

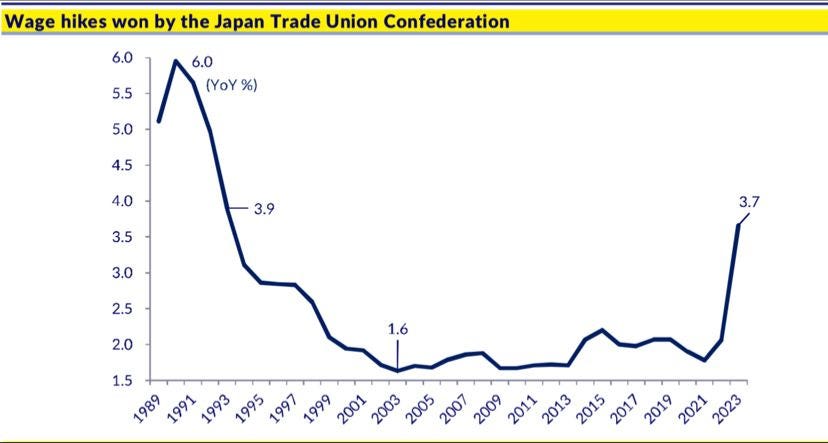

He got a raise of 15% this year when the overall wage increase across Japan Trade Unions was 3.7%, the highest since 1993.

While the manufacturing sector might have witnessed low single-digit wage growth, there are sectors where there is a shortage of skilled labour; and which are seeing hefty wage hikes.

The Shunto talks in March were proof that negotiating power of unions has risen considerably as inflation pinches the households.

All in all, the current inflationary episode is unique as it’s leading to what looks like a “sustained” increase in nominal wages. The fear remains that BoJ is fuelling the wage-price spiral by following an ultra-loose monetary policy.

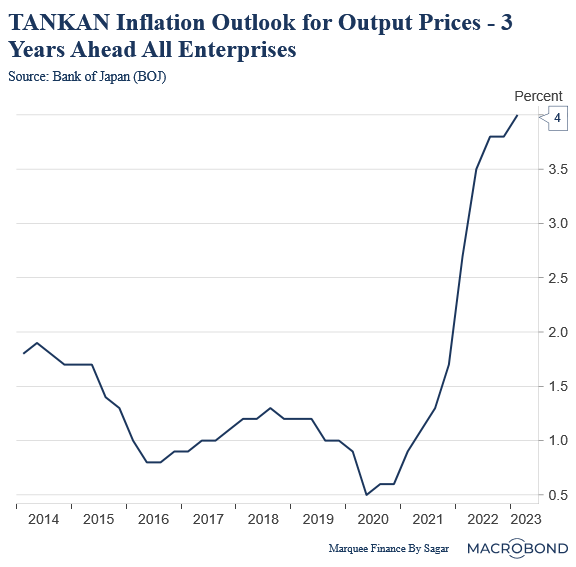

This was also visible in the just concluded Sintra talks where the new BoJ Governor Ueda, the highlight of the presser, who is a funny man, acknowledged that the inflation expectations are rising, thanks to the low unemployment rate.

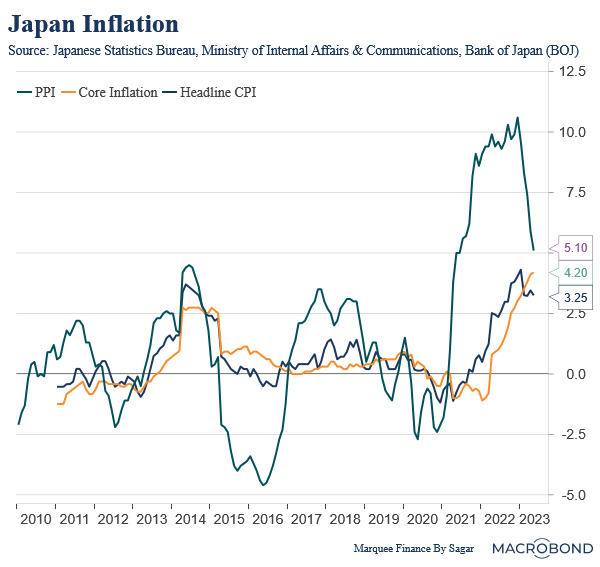

The continuous acceleration of core inflation, now at a 42-year high, confirms that the inflationary pressures are broad-based and unlikely to be “transitory”.

We must appreciate that the Japanese Government has been massively subsidizing fuel costs (post-war), so the headline CPI remains subdued.

Furthermore, the official figures for food inflation indicate an increase of 9% YoY, which is again lower than the actual retail inflation.

For example, My friend told me that the cost of milk has shot up by more than 20% from ¥170 /l to ¥220 / l in the last year.

Even the hotel tariffs are over the roof, and the prices for food across restaurants are up drastically in the last 12 months.

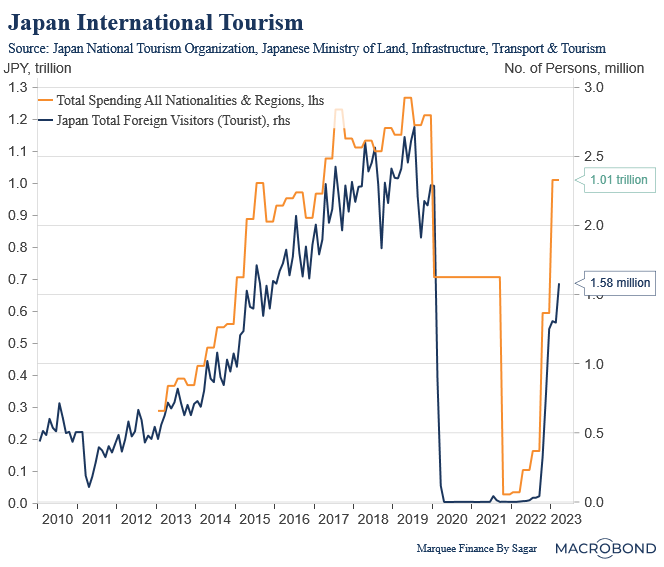

As international tourist arrivals pick pace, the prices might continue to rise unabated as pricing power remains firm.

These are the March figures, and I am pretty sure that the spending might have touched pre-pandemic levels in May/June.

As a result, BoJ can’t pursue the current monetary policy for long. The end of the YCC is inevitable; however, the timing remains uncertain.

The plunge in JPY to 145 levels is a warning sign as it may further fuel inflation.

Let us understand the repercussions of the policy normalization of BoJ.

The Normalization Consequences!

I have written multiple times about BoJ’s challenges in normalising the policy (owning more than 50% of the total JGB markets).

Nonetheless, with the resilient US data (especially from the labour market), the bond markets are pricing another two rate hikes this year and pushing back the rate cuts.

As a result, JPY has been in a free fall.

This has raised speculation that BoJ will abandon YCC in the July meeting. An orderly exit from the ultra-loose policy is necessary to avoid catastrophic consequences for various assets worldwide.

Japanese investors hold more than $3.3 trillion in net assets globally.

Furthermore, the market value of the US equity investments is greater than $160 billion.

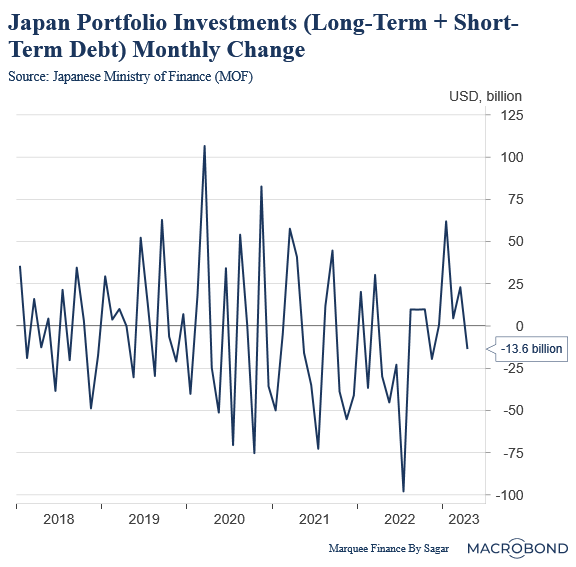

Source: Macrobond

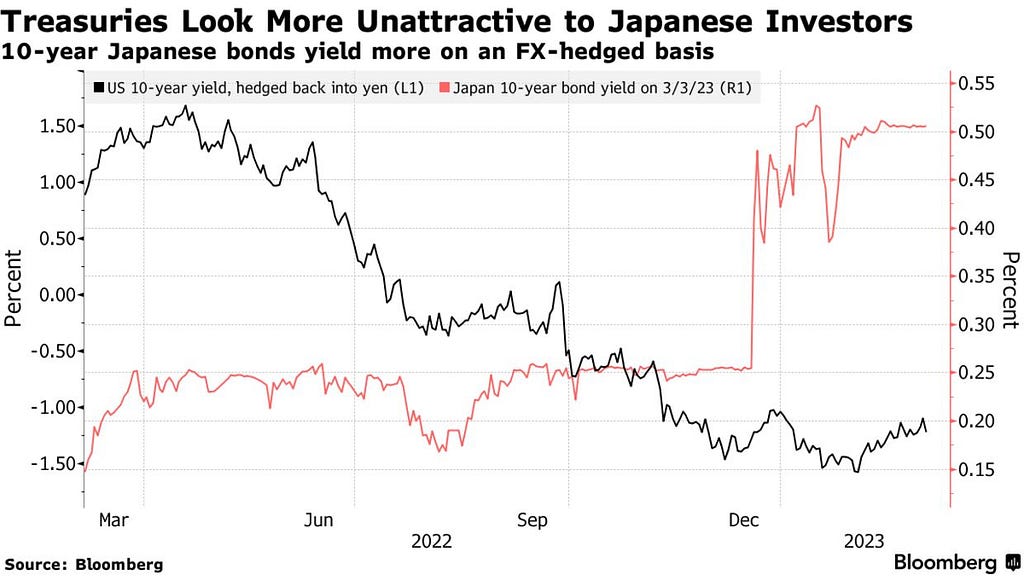

Though most of it will be sticky long-term capital, we must appreciate that JGB yielding 1% at home will be more lucrative than the hedged returns of the overseas portfolio, considering the elevated volatility in JPY.

Lately, the hedged returns for Japanese investors have dwindled since the Fed began raising rates. On the contrary, the JGB yields are 0.50% after the YCC tweak late last year.

NOTE: As per BBG, the calculation is based on a three-month currency hedge for Japanese investors on an annualized basis.

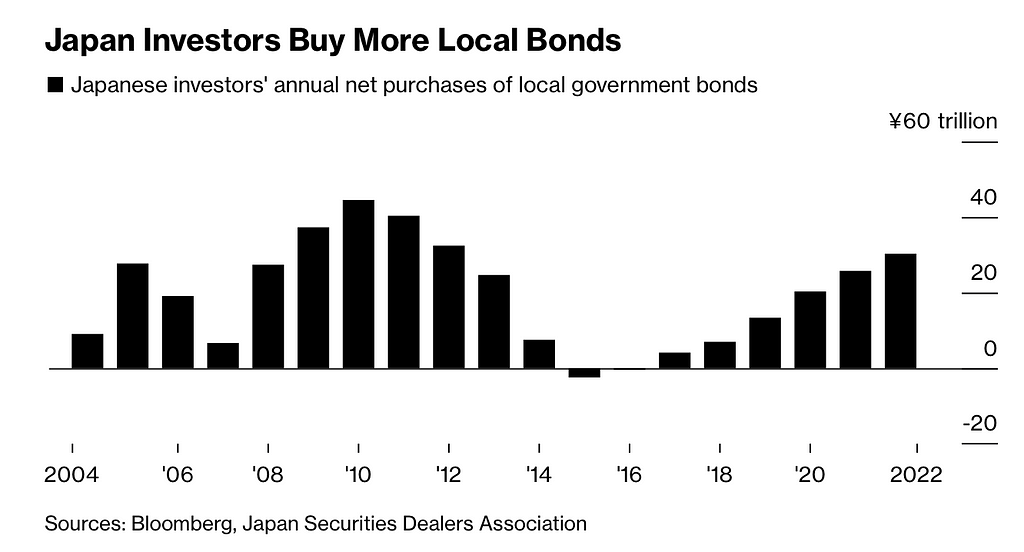

As a result, since the beginning of 2022, Japanese institutional investors (banks, life insurers and pension funds) have been shunning overseas bonds and buying local JGBs.

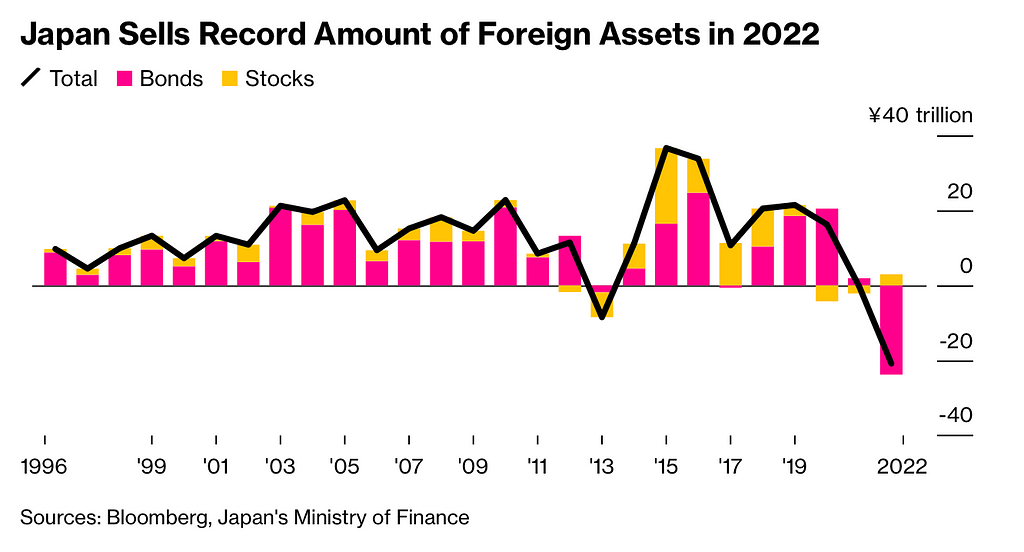

Source: Bloomberg

Last year’s purchases were the highest since the reversal of trillions of dollars of carry trades post the GFC.

The peak selling of the foreign debt happened when JPY touched a low of 150 in September last year. As the JPY appreciated in January post the YCC raise, some buying transpired, but it was short-lived.

Overall the debt+equities sales were the highest ever in 2022.

It’s a no-brainer that normalization of policy will lead to the dumping of large amounts of foreign bonds and equities by Japanese investors and buying of local bonds, as JPY volatility is here to stay.

US PCE!

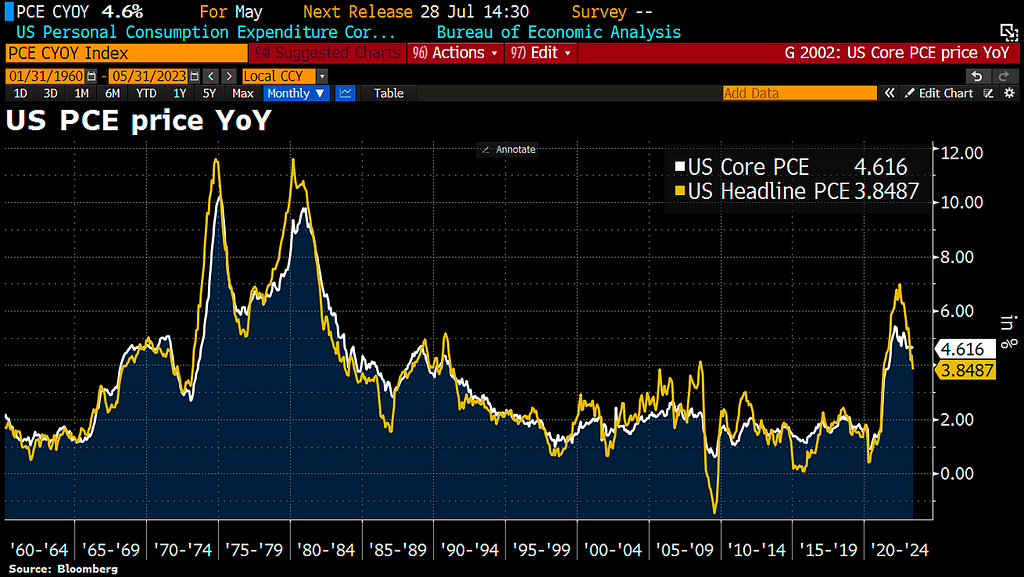

Fed’s preferred inflation measure: Core PCE, which even JayPo mentioned in the Sintra talks, came in at 4.6%, which was a tad lower than what Street was expecting.

As expected, June’s headline number will move to around 3.2%.

The real test will begin from July onwards as reducing the PCE from 3% to 2% will require “higher for longer”.

In fact, JayPo believes that core PCE will move to 2% only by 2025, shocking everyone.

I will discuss the US data and the all-important ISM numbers next week.

Conclusion!

JAPAN:

- After a fruitful trip to Japan, I am more convinced that the normalization of policy is the need of the hour as inflation and inflation expectations are in a one-way upward trend.

- Suppose the wage growth sustains 3–4%, which is highly likely considering the tight labour market. In that case, we might see persistent inflationary pressures and the current BoJ “transitory” stand will be a grave mistake as the Western CBs did.

- Furthermore, the end of YCC will support the local bond markets as institutions prefer JGBs over foreign assets.

- The timing remains vital, and if coordinated with rate cuts in the US, it might lower the risk of a spike in yields in the US. However, with the moves in JPY, markets expect a change in stance as soon as July.

US:

- The US economic data remains mixed as the labour market is resilient. However, some early signs of softening are there as continuing claims are higher by 10% over the pre-pandemic levels (more next week).

- The core PCE came in line with expectations, and the further move down will depend on how the growth pans out, and wages react in the near term.

- Follow me on Medium❤

- Follow me on Linkedin❤

- Follow me on Twitter❤

The “Transitory” Mistake! was originally published in DataDrivenInvestor on Medium, where people are continuing the conversation by highlighting and responding to this story.

Comments