The Stage Is Set For Higher Volatility Across Asset Classes!

In what many market participants call “Operation Say Nothing”, the busiest week in the Central Banks Universe was marked by CBs Ex-Japan “NOT” committing anything and dumping the forward guidance.

The data-dependent approach (also meeting by meeting approach), first popularized by Christian Lagarde, has now landed in the USA as JayPo refused to divulge the future rate hike details. The ECB did something intriguing apart from the expected 25 bps hike, which we will discuss later and is of paramount importance if followed by other “loss-making” CBs.

In the East, the BoJ did the long-awaited YCC tweak as political pressure builds on the “Contrarian Central Bank” to act. Furthermore, Chinese stimulus measures reaffirm the CCP’s “commitment” to induce growth and inflation in a languishing deflating Chinese economy.

Let’s understand the likely “Inflection” point in the global macro!

US!

We had the super-important FOMC meet.

As expected JayPo raised rates by 25 bps. The equity and bond markets were calm and didn’t react to the policy as the hike as the exuberant markets already priced in the “dovish” Fed.

The markets got the cheer from JayPo as he uttered the magical words of the “soft landing”.

“Not Using Term ‘Optimism,’ But There Is A Path to Soft Landing”: JayPo.

Furthermore, he also indicated that the Fed staff is no longer anticipating a recession. Well, it seems that the “Fairytale Landing” has seeped into the minds of Fed staff as well.

Moving forward, one of the statements that hit me hard was JayPo’s words:

“Could be cutting rates while continuing QT.”

This is a powerful statement that can profoundly impact the stocks and bond markets. In fact, the continuous drain of liquidity can also lead to lower bank reserves in the future, leading to a blow-up of more regional banks (though some time away).

For the bond markets, it becomes crucial to consider the supply of bonds by the Treasury Department as we head into an election year with a large fiscal deficit (which might get exacerbated by the upcoming slowdown as taxes plunge).

The bond markets predict that the Fed is done with tightening monetary policy, and we are at the peak rates. Furthermore, markets are predicting rate cuts from the middle of the next year.

Powell’s statements failed to push back the rate cuts. It becomes really intriguing because, on the one hand, JayPo states that inflation will come down to Fed’s 2% target by 2025. On the other hand, markets are anticipating rate cuts before elections.

So, markets believe either JayPo is wrong, and inflation will reach 2% in 2024, or a recession will force the Fed to bring down the rates next year.

This also brings into question how “restrictive” the policy actually is and where the “neutral rate’“ stands!

Many market participants also worry that a resurgence of inflation is inevitable as financial conditions have eased significantly and the commodities have had a mega rally in the past few weeks (discussed later) . (also the positive wealth effect)

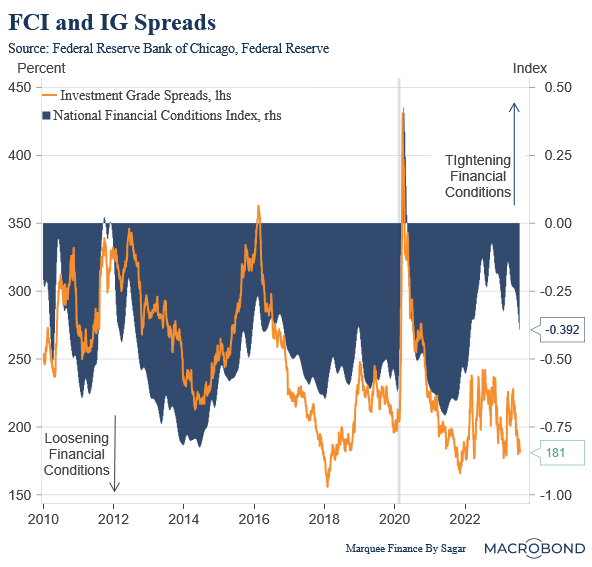

The IG (Investment Grade) and the HY (High Yield) spreads are now the tightest since the Fed began to raise rates. Moreso, the NFCI is considerably loose.

Regarding financial conditions, JayPo gave us some clues regarding the next week’s SLOOS survey on bank lending. Powell stated:

“In addition, the economy is facing headwinds from tighter credit conditions for households and businesses, which are likely to weigh on economic activity, hiring, and inflation.”

“SLOOS will come out next week and confirm what you’d expect; you have got pretty tight conditions in the economy.”

Europe!

As the monthly flash PMIs began to kick in, Europe’s struggle with higher rates became visible. Though I have long believed that inflation has been stickier in Europe than the US due to the energy shock, the growth collapse has even surprised me.

There are early signs that transmission of tighter monetary policy has been swift in Europe compared to the US. Furthermore, the collapse can partly be explained by the continent’s deindustrialisation post-war last year.

The slump in the cyclical sectors of the economy led by the manufacturing sector is now spreading to the services sector. Some of the Services PMI (France) have entered into profound contraction with reading as low as 45.

One of the reasons for the effective transmission of monetary policy is the lower fiscal stimulus post covid that Europe had compared to the massive fiscal stimulus in the US. Furthermore, the miserable Chinese reopening is also leading to weaker manufacturing data as Europe remains a big beneficiary of burgeoning Chinese consumer demand.

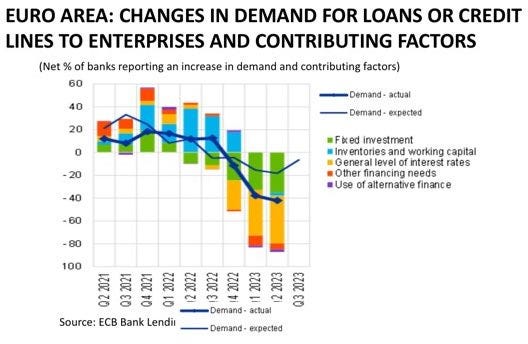

Credit is also contracting in Europe more than the ECB expected as higher rates, weak consumer sentiment and lower Chinese demand dents borrowers (both corporate and the HHs) appetite. The weak housing market further exacerbates the credit contraction as mortgage demands collapse.

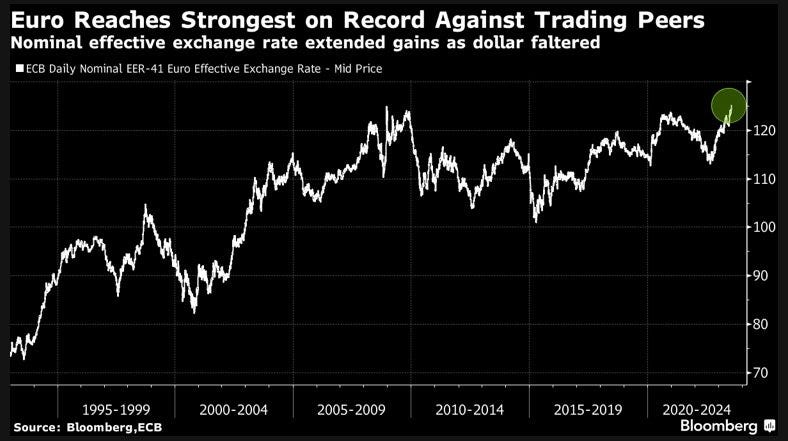

Markets were highly bullish EUR as there were enormous long positions (due to increasing interest rate differential and hopes of a soft landing in the US). As a result, the nominal exchange rate has reached the strongest on record.

Huge dollar short positions and long EUR positions mean that DXY can head higher in the very short term as and when unwinding transpires (ceiling of 103).

Nevertheless, the markets have priced in a perfect soft landing, and as the data start worsening in the US, DXY will eventually head lower to 95 levels, most probably in Q4/Q1 next year.

As expected, the ECB raised rates by 25 bps, and Madame Lagarde sounded dovish.

In fact, considering the weak data in recent days, many ECB hawks are now on the verge of turning dove as further rate hikes can really dampen economic activity.

IMHO, the ECB is done hiking, and the focus now shifts to how long can the labour market remain buoyant. A weak labour market will mean inflation returns to 3% sooner than expected. Still, if the labour market remains resilient (due to structural reasons), we are in for a sure-shot stagflationary outcome for Europe.

Nevertheless, the highlight of the ECB policy was a “surprise” decision to halt the interest payments on minimum reserves that banks need to hold. This is significant as it would hurt banks’ earnings and reduce liquidity as Central Bank’s losses reduce.

CONTEXT: Central Banks operating losses due to the differential that they receive on their trillions of dollars of accumulated securities post-GFC and pay on bank reserves (at current rates) have been growing gigantically. It was also adding liquidity to the global financial system.

The East!

This week in the equity markets was about the rally in Chinese equities due to speculation of massive stimulus measures. We have seen this picture play multiple times this year, and on every occasion, the markets (Chinese stocks) cooled off after an initial spike.

Nevertheless, this puts a floor on the commodities, and if the fiscal measures do surpass expectations this time and the Chinese economy goes back on full throttle, we might see a rally in the commodities until the US data deteriorates.

The commodities action, including the recent spike in agricultural commodities, will be inflationary and lead to some price pressures in Q3/Q4 as there is a 1–2 Q lag.

Check out the weekly and monthly changes in the commodity indices (as of 26th July).

The BoJ’s buckled under political pressure and tweaked the YCC ceiling in what could be termed “baby steps” towards normalization. I call it baby steps because the reference point remains 0.5% while it’s flexible, and the ceiling remains at 1%.

“The Bank will continue to allow 10Y JGB yields to fluctuate in the range of around + and — 0.5% from the target level, while it will conduct YCC with greater flexibility, regarding the upper and lower bounds of the range.”- BoJ.

So, it’s a step in a direction which helps the bond markets find the suitable yield for the JGBs, a move towards an orderly exit out of the YCC.

Regarding assets, the BoJ move might, in the very short-term (a month or so max), lead to some printing of JPY, but in the medium term (6 months to a year) will lead to heavy selling of USTs and European bonds by Japanese investors as the yields at home become attractive compared to hedged yields in the US and European bonds.

Conclusion!

US:

- While the markets believe it’s the end of the tightening story, the Fed might hike in September for the last time if the data remains resilient.

- While JayPo declined to give any forward guidance, he reignited the “hopes” of a soft landing.

- Next week, The SPOOS Survey might highlight tighter financial conditions as the credit conditions remain tight (auto loan rejections have already been high).

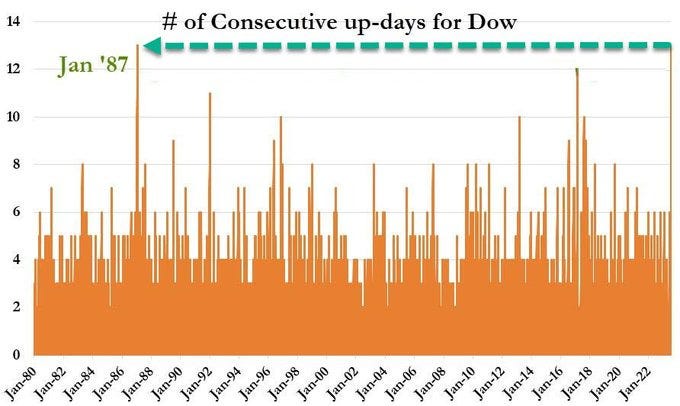

- The market rally is broadening as Dow Jones outperforms the tech-heavy index massively on the back of value outperforming growth stocks.

- IG and HY Spreads remain extraordinarily tight on the “false” hopes of the “Goldilocks” scenario.

- Europe:

- The cyclical weakness in Europe is deepening as the data deteriorates rapidly. Manufacturing PMIs were ugly, and the slowdown is also broadening to Services.

- The transmission of policy rates is swifter in Europe as demand for credit contracts is at a record pace thanks to higher borrowing costs, lower exports to China and deindustrialization post the energy crisis.

- A highly likely unwinding of long EUR positions in the next few weeks, which has already begun.

China:

- More than $700 billion of stimulus will likely be unleashed by the Chinese authorities to drive growth higher.

- Commodities hoping for a US soft landing and Chinese demand revival have seen a stealth rally.

- I remain cautious about China and need more concrete evidence before adding positions. Though, Chinese tech (CQQQ) remains attractive compared to US Tech (QQQ).

Japan:

- As Political pressure builds on the BoJ to act on inflation and abandon their ultra-loose monetary policy, the BoJ tweaked the YCC ceiling to 1% but with a greater “flexibility” so that the bond markets find the right price for JGBs.

- BoJ is targeting an orderly exit from the YCC so that an abrupt normalization of the policy doesn’t cause chaos in the global financial system.

- The BoJ’s policy is a “significant” headwind for the global bond markets, and the reversal of carry trades can also lead to the selling in equity markets.

Inflection Point! was originally published in DataDrivenInvestor on Medium, where people are continuing the conversation by highlighting and responding to this story.

Comments