Artificial intelligence (AI) chip leader Nvidia $NVIDIA Corp(NVDA)$ will report second-quarter earnings after the U.S. stock market on Wednesday (23), and investors expect Nvidia's revenue in the quarter to beat expectations, and shares rose 5% on Monday.

Wall Street expects Nvidia's revenue to grow about 110 percent to $12.5 billion in the current quarter, according to Refinitiv data. Nvidia has missed earnings estimates only once in the past two years. Citigroup analysts last week estimated Nvidia's revenue for the current quarter at only about $12 billion, but brokerages expect that to rise to $14 billion.

After Nvidia estimated second-quarter revenue growth of more than 50 percent in May this year, its 12-month forward PE surged to more than 80 times, but since then, analysts have raised their earnings expectations and PE has been falling. Nvidia's current 12-month forward PE is close to 40x, well above AMD's 29x.

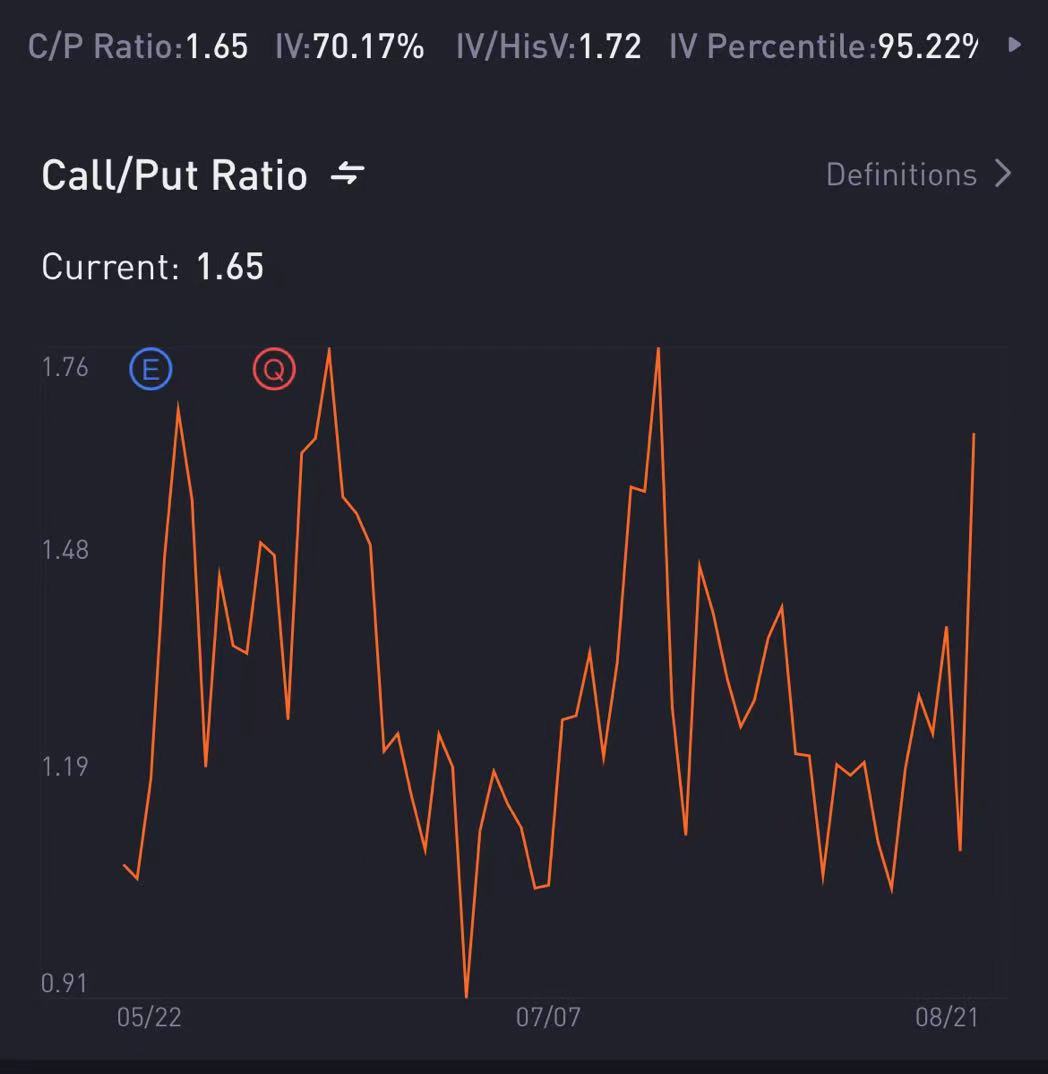

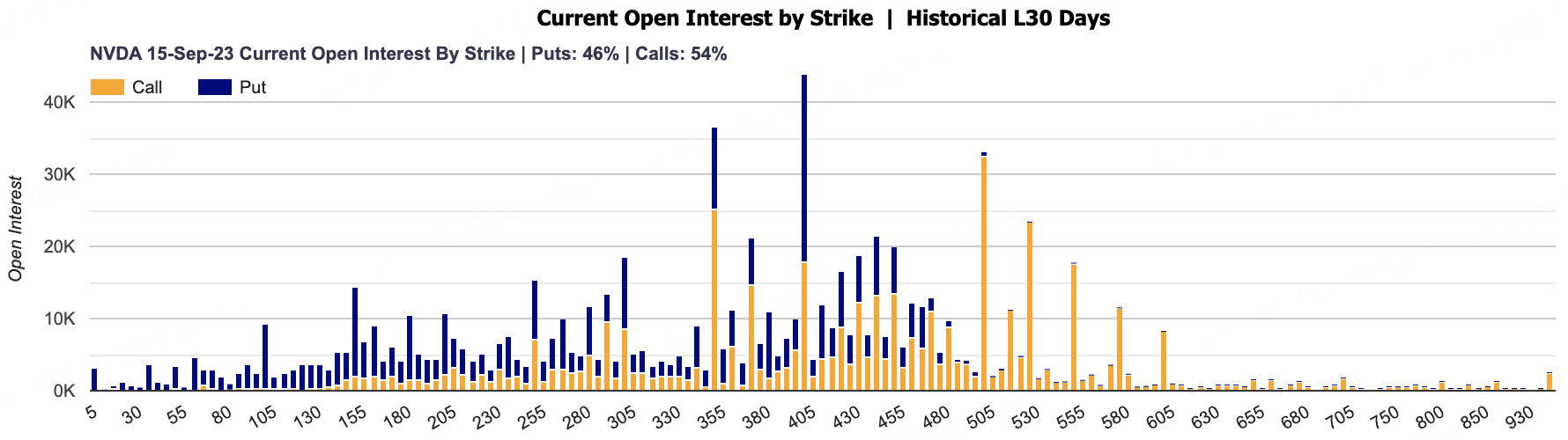

With strong bullish impact, Nvidia's call/put ratio reached 1.65 on the eve of earnings:

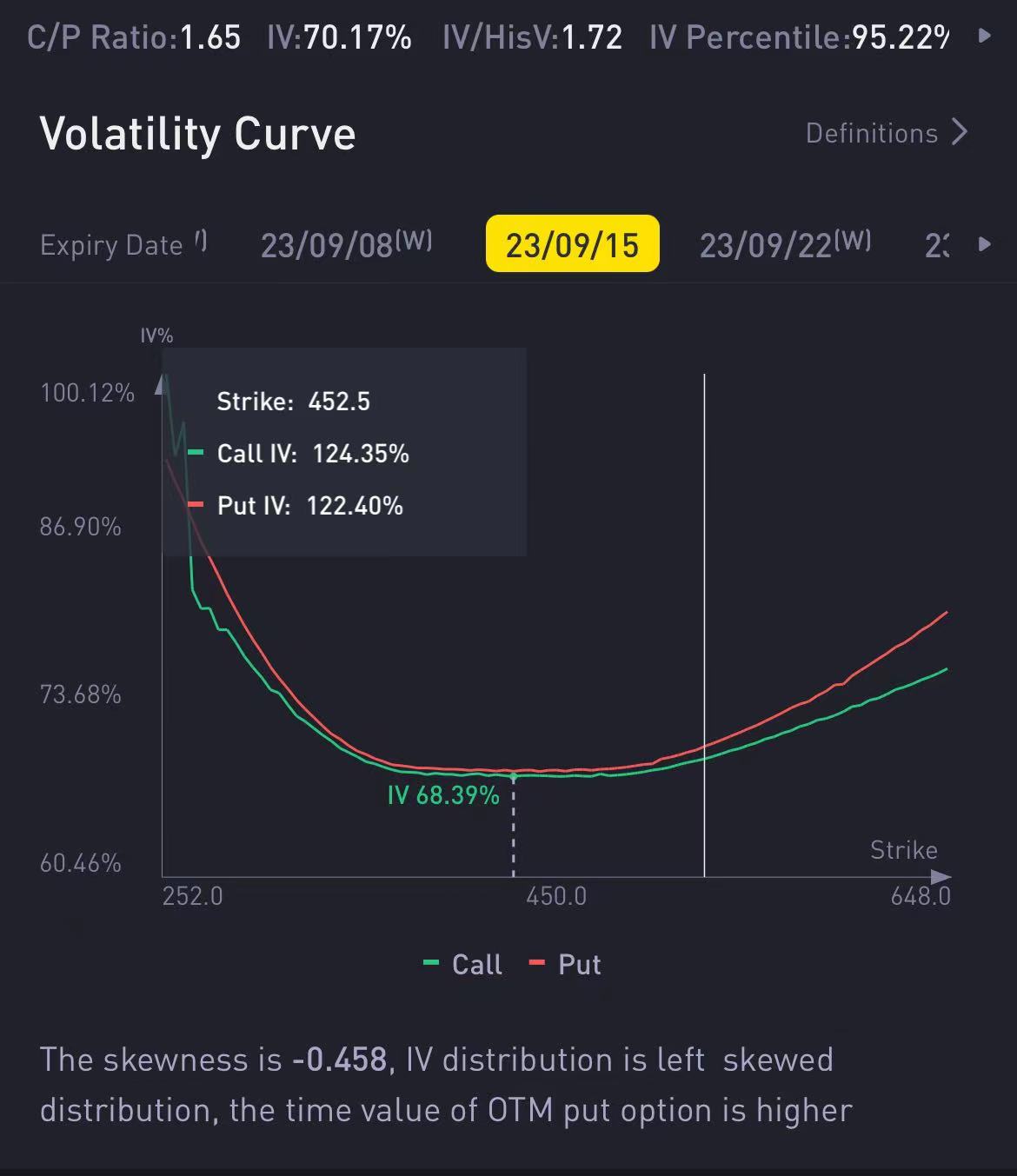

The implied volatility of call options expiring this week is as high as 124.35%, and the implied volatility of put options is as high as 122.4%

Volatility declined for options expiring next week, with calls at 88.5% and puts at 87.42%.

Implied volatility for September 15 monthly options is similar to this week:

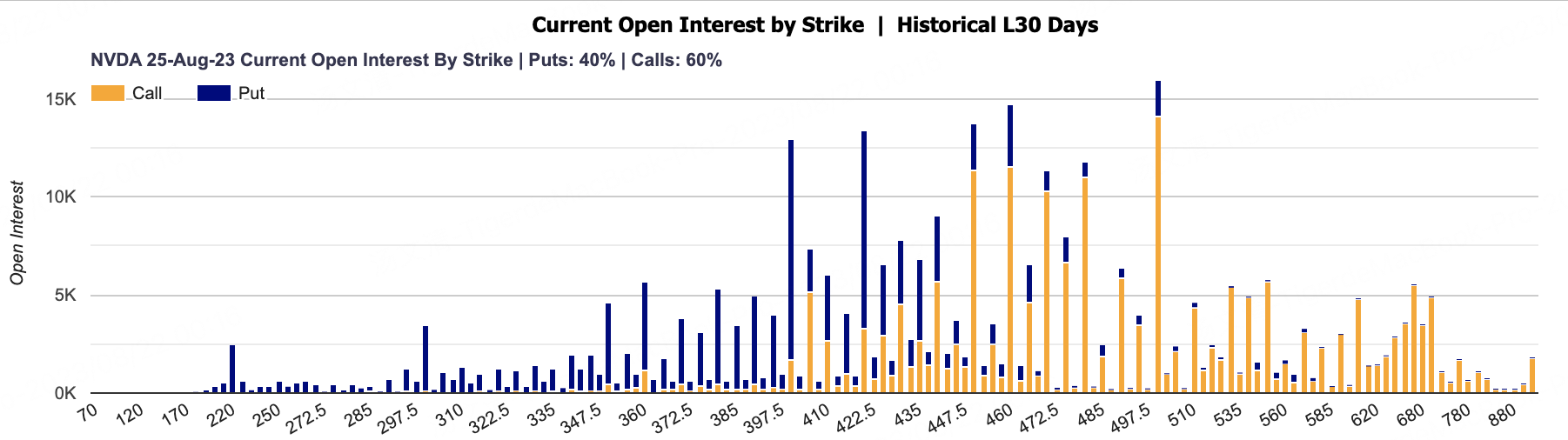

For the week, $NVDA 20230825 500.0 CALL$ 500 strike had the highest open interest, followed by 460,450,480,470. Open put options for the week, $NVDA 20230825 400.0 PUT$ 400 strike price for the highest open interest, followed by 420.

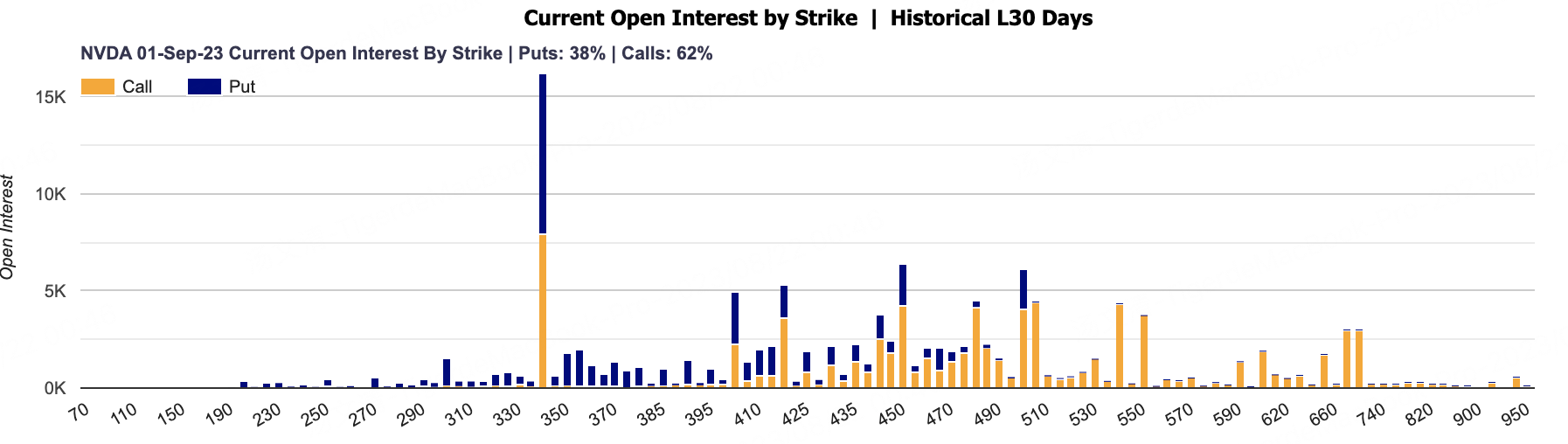

For options expiring next week, the highest open interest has a strike price of 340. Overall trading volume was much lower than this week.

Open interest for September 15 monthly options is similar to this week. The 500 strike price of the call option has the highest open interest, and the 400 strike price of the put option has the highest open interest.

Comments

this will positively affect forward guidance. But if NVIDIA can also get a contract with another party like Samsung for say 5,000 units, that would mean virtually doubling capacity for NVIDIA. That's a $2T valuation right there, without pulling much of a sweat.

In my experience, the run-up should be concerning. Expectations are massively high and anything less than another absolutely, out-of-the-park, into-the-stratosphere earnings report is going to cause a correction. Hoping otherwise, but that's my experience.

Nvidia's new algorithms built in on chip allow increasingly complex computational lithography workflows to execute on GPUs in parallel, exhibiting a 40X speedup using Hopper GPUs. The new algorithms are integrated into a new cuLitho acceleration library that can be integrated into mask makers’ software (typically a foundry or a chip designer).

I think people are superestimating demand for AI chips lol. If NVDA dont crush on these reports its gonna drop hard

Great ariticle, would you like to share it?