Dimitrios Kambouris/Getty Images Entertainment

Editor's Note: This article was amended on 08/22/2023 to reflect updated valuation analysis assumptions.

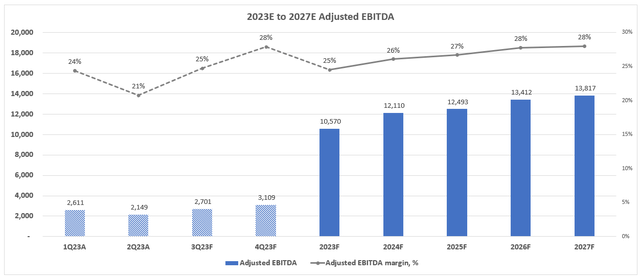

The Warner Bros. Discovery (NASDAQ:WBD) stock has been repeatedly contesting the $15 range this year but to no avail. Even after another round of upward adjustments to its synergy capture guidance to now $5+ billion through 2024 and beyond, alongside meaningful free cash flow generation and deleveraging progress, the stock has failed to sustain an uptrend. The stock has been trading consistently back towards the $12 level since its latest Q2 earnings report, which is in line with base case PT of $12 as previously discussed.

While management is now optimistic that WBD is nearing the end of its post-merger integration objectives, which opens up the dialogue for prioritizing longer-term growth opportunities, execution risks remain elevated. Whether management can orchestrate a balance between the secular wind-down of its networks segment - the bread and butter of the business - and expanding its strength in studios and direct-to-consumer ("DTC") amid rising competition is still an uncertainty, as plans to optimize returns through windowing and content licensing, for instance, has yet to yield significant improvements to growth in recent quarters.

In the following analysis, we will go over some of the updates to the company's operating environment - spanning the Barbie phenomenon to the writer's strike - alongside an analysis of several key fundamental metrics in an attempt to gauge why we think the stock will remain range-bound in the mid-teens despite expectations for forward improvements.

Net-Net, Things Are Looking Up

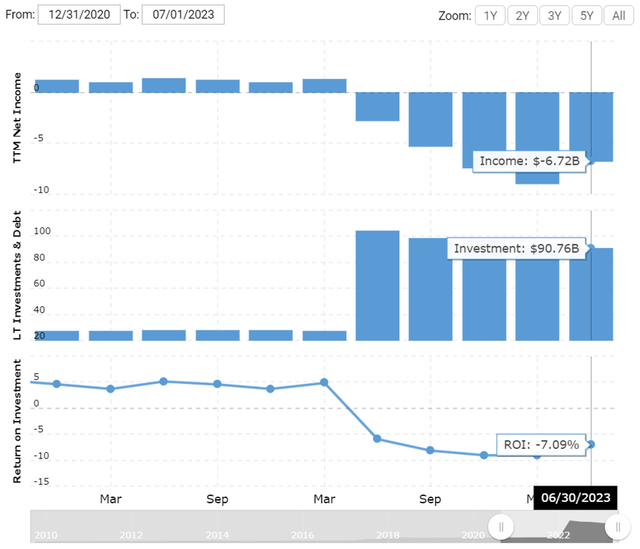

Improvements to adjusted EBITDA, free cash flow conversion, delivery and cost synergy capture together represent positive contributions to better value generation for the company. Yet, WBD's ROIC remains in the negative despite said improvements - and reasonably so, considering ongoing, though narrowing, losses post-merger, which have been exacerbated by persistent declines due to the combination of secular and macroeconomic headwinds in media.

Macrotrends

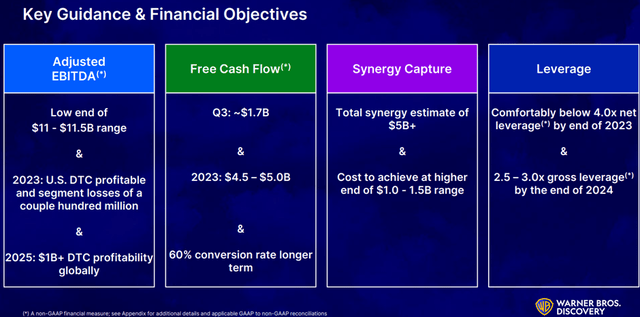

Specifically, annualized cost synergies post-merger are expected to top $5 billion following incremental upward adjustments to the guidance in recent quarters, underscoring management's commitment to optimize efficiencies. This is expected to free up spending for longer-term growth investments, which management plans to "lean into" once WBD's deleveraging and synergy capture goals are met next year.

Warner Bros. Discovery 2Q23 Earnings Presentation

However, results are yet to be seen, with the cloudy outlook still blighted by the early roll-out of Max expected to be offset by churn, intensifying competition, and broader cyclical weakness in advertising. But even in combination with the simultaneous decline in networks, which is the core cash generator to fund all of WBD's near- and longer-term goals, adjusted EBITDA is still improving, with cash conversion rates also likely to fall within the previously guided range of 33% to 50% based on the latest guidance, reinforcing management's confidence for the metric to reach 60% in the long-run.

Come On Barbie, Let's Go Party

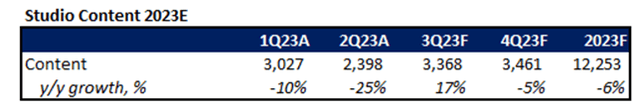

Admittedly, the second quarter was a dud for the studios segment, as The Flash performed nowhere close to what management had previously thought would be an "overwhelmingly positive" reception from the public audience. This had weighed further on the impact of a tough prior year compare, which included the theatrical release of The Batman and launch of LEGO Star Wars: The Skywalker Saga in games.

But after ChatGPT, the Barbie sensation has got to be the most influential topic this summer, underscoring a turnaround for studios in the current period. WBD's Barbie movie, which premiered in late July, has already exceeded $1.2 billion at the global box office. This marks WBD's fastest and eighth film to exceed $1 billion, with Barbie on track to outperforming Harry Potter and the Deathly Hallows: Part 2's $1.34 billion box office and become "the studio's highest-gross worldwide release of all time".

In addition to stellar reviews on the film's storytelling (true to WBD's roots), the studio's marketing advantage for Barbie is to thank - even as its actors refrained from promoting the movie during the Screen Actors Guild strike, which began a week before the movie premiered. As management has highlighted during WBD's second quarter earnings call, the Barbie blockbuster underscores the company's low-cost marketing advantage enabled by its expansive platform and marks another significant synergy capture opportunity.

Looking ahead, Barbie's success will be a huge plus for Q3 studios segment revenue and beyond, as it windows through different monetization platforms, from the theatrical big screen to PVOD / networks and streaming. Specifically, management's latest commentary hints at Barbie debuting on Max "in the fall", which will likely drive stronger subscription and engagement on the platform, and inadvertently bring incremental benefit to DTC's ramp up of advertising volumes. While management had alluded to the reliance of existing IPs and platforms to market the Barbie movie, we expect Barbie's arrival on Max later this year to drive adjacent views back to its relevant content slate across IPs such as HGTV and Food Network, reinforcing engagement on the newly rebranded streaming platform amid intensifying competition and broader macroeconomic challenges to the consumer.

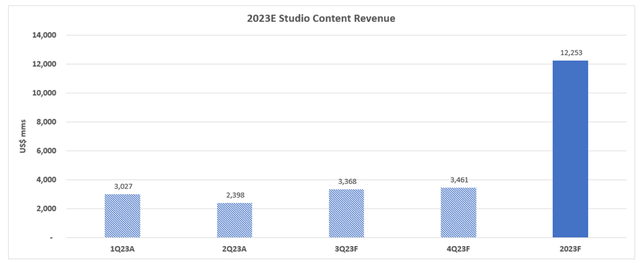

We expect Barbie to reaccelerate studio content sales in the third quarter, reversing prior quarters of declines back towards robust double-digit growth.

Author

Author

Combined with windowing opportunities for the film, alongside the introduction of Hogwarts Legacy for Nintendo Switch ahead of the holiday season, we forecast sequential growth through the second half of 2023, and expect WBD to pare studio content sales declines to -6% exiting the year.

Author

Streaming and Advertising Contributions

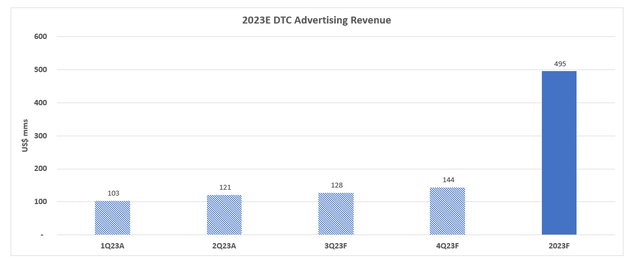

Now that we are on the topic of DTC, the segment's resilience in Q2 continues to highlight management's progress to the right direction when it comes to reprioritizing content licensing to third parties, even while its peers have been repurchasing distribution rights to wall-garden their platform content. Meanwhile, robust double-digit growth in DTC advertising sales also underscores a strong kick-off on ad placements in Max, which is still in early stages of ramping up. The results are also outperforming a slow growing industry that is still reeling from a cyclical downturn.

Drilling in further on ads, we think that WBD DTC's competitive cost per mile ("CPMs") and return on ad spend ("ROAS") for advertisers, which have been key to driving up the segment's ad placements by more than 50%, will continue to scale - especially in a cautious spending environment where advertisers are looking to optimize their ad dollars. This is further corroborated by a "very good result in a tough market" during WBD's latest upfront ad sales period in the U.S., which is near completion with an increase to volumes while maintaining consistent pricing levels relative to the prior year.

We expect the favorable trends to be further reinforced by Max's upcoming content slate, which will include Barbie coming fall. The combined streaming platform's continued ramp up of engagement in the U.S. and across the LatAm, EMEA and APAC regions over the next 12 months will be another plus to bolstering DTC's growth through ads. Taken together, we expect the DTC segment to capitalize on the ad opportunity in full throttle going forward, in line with management's commitment to further prioritizing this growth frontier:

I mean you see that we're growing advertising 25% in the quarter on the platform and that is in a challenging market environment. And in fairness, we haven't really started prioritizing this. And as I laid out, for the first time ever, advertisers are going to have access to some of the best shows in the entire landscape.

Author

Author

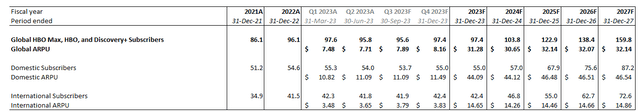

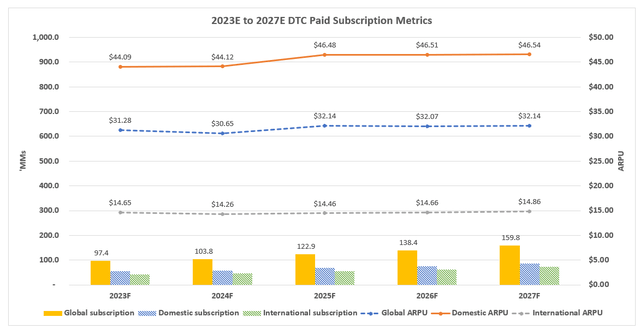

This will be key to driving up streaming ARPU, complementing price hikes implemented across WBD's streaming platforms worldwide this year. The critical role of advertising sales at DTC is further corroborated by higher ARPU in the ad-light subscription tier relative to the ad-free subscription tiers, in line with observations across rivals including Netflix (NFLX) which had recently entered the AVOD arena after years of aversion to the strategy.

However, the pace of ARPU expansion for DTC streaming at WBD is likely to start slowly at first. Any expectations for incremental acceleration likely will not come until later next year, as churn remains an immediate overhang coming off of a 4-million overlapping global subscription base between discovery+ and Max.

Author

Author

On the plus side, churn rates driven by the overlapping subscription base has been largely maintained at "materially better" levels than management had been expecting since the partial integration of Discovery and HBO content into HBO Max last year, and shortly afterwards, the full integration via the rebranded Max offering. This is expected to alleviate pressure on near-term ARPU growth as ad sales contributions continue to ramp up, while better-than-expected churn rates stemming from the overlapping subscriber base can be partially offset by recently implemented subscription price increases. The expectations are also supportive of management's expectations for segment breakeven by the end of 2024, and segment profitability of about $1 billion by mid-decade.

Author

The Network Bogey

Meanwhile, it is hard to ignore the rapid secular decline in network sales. The segment has been a key engine to all of WBD's ambitions to date - ranging from ongoing growth and content investments to its aggressive pace of post-merger deleveraging. Yet, every component of the business is getting sucked into an inevitable decline, as cord-cutters increase and linear engagement inadvertently slow, with contagion impacts into network advertising. This is in line with a persistent decline in broadcast and cable TV view times to record low levels, while streaming's share continues to surge. And things look like they will only get worse in networks, raising investors' concerns on whether management can orchestrate the great transition to streaming without breaking anything in the process.

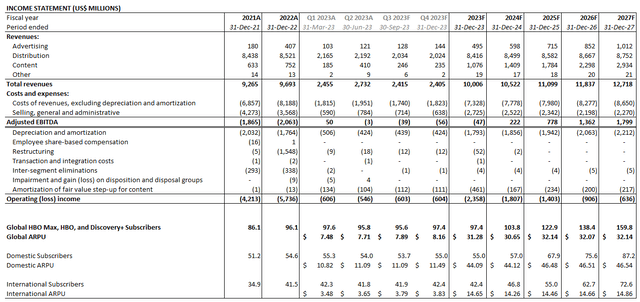

On the advertising front, while management is optimistic on the latest upfront volumes secured for its linear business, the combination of cyclical weakness in advertising alongside the secular decline in linear TV audience engagement remains an acute challenge. With management estimating a high single digit decline in network advertising sales in the current quarter, the sequential impact will be much worse in the mid-double-digits range. And even with the seasonal boost from returning sports broadcasting in the fourth quarter, management's expectations for sequential improvements then is likely to still yield weaker y/y performance.

Author

Author

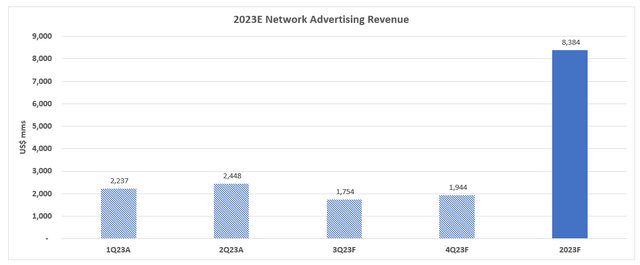

These challenges will be further exacerbated by anticipated weakness in network distribution sales through the remainder of the year, as WBD winds down its regional AT&T SportsNet business in the coming months. While the direct revenue impact will be nominal relative to total network distribution sales, given AT&T SportsNet's annualized revenue contribution of about $400 million, it is expected to drive an incremental impact on ad placements that had previously favoured the format, especially ahead of the upcoming return of sports broadcasting in the fall.

Author

Author

The completed exit will likely result in cost improvements next year, and it remains to be seen on whether it would make an impact towards tilting the scale on WBD's consolidated fundamental prospects back into balance, with DTC - a key opportunity that the company is prioritizing - still in its infancy while broader industry competition is already intensifying and network segment performance is sputtering.

Author

The Writer's Strike Impact Has Yet to be Felt

Contrary to some's optimism that the delayed timing of productions due to the ongoing WGA and SAG-AFTRA strikes will help with profit margins and cash flows this year, related improvements are unlikely to help the stock much as they will eventually flow through over the longer-term. Instead, our view is that the earlier the strikes end and productions of scripted content resumes, the better it is for WBD - especially as it looks to ramp up its DTC business amid a surging decline in linear TV.

The current strikes are effectively increasing uncertainties to the production of tentpole content, such as The Last of Us, which is critical to driving engagement for WBD. The delayed production and introduction of related content risks driving a misalignment to Max's go-to-market strategy in the U.S. and internationally. This could amplify churn headwinds in the near-term amid competition, macroeconomic uncertainties, as well as a company-specific come-down from an overlapping streaming subscription base, and potentially risk deferring DTC's timeline to segment profitability.

In the meantime, Max's industry-leading content slate, which includes the addition of Barbie in the fall, alongside discovery+'s non-scripted content heavy programming, which are not impacted by the ongoing strikes, will be partial compensating factors. The DTC segment's prudently planned integration of live sports ahead of the coming season - spanning MLB, NBA, NHL and NCAA - is likely another plus to overshadow potential disruptions to content launch due to implications of the ongoing strikes.

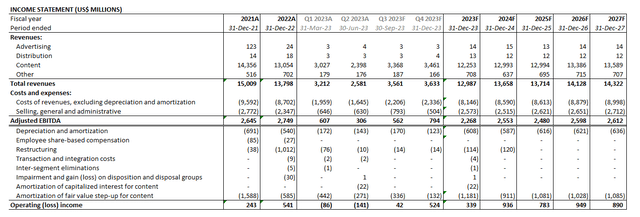

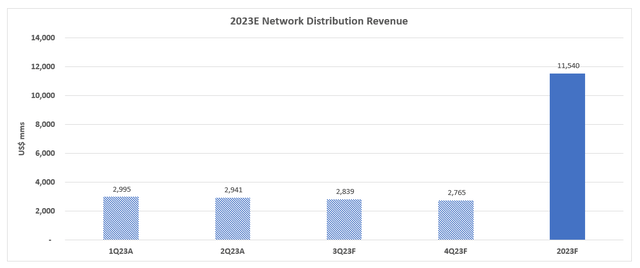

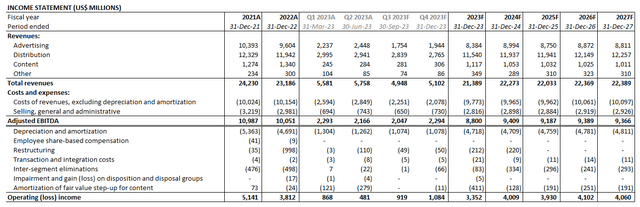

Fundamental Summary

Taken together, we expect revenue for the year to remain flat from 2022 following anticipated topline improvements - helped primarily by the Barbie sensation and resilient DTC ad sales. Meanwhile, persistent net losses since the merger last year are expected to narrow further, with WBD likely to exit the year with nominal GAAP profitability driven by the flowthrough impact of increasing cost synergy capture.

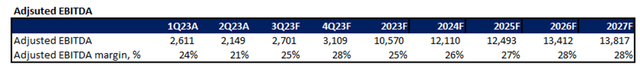

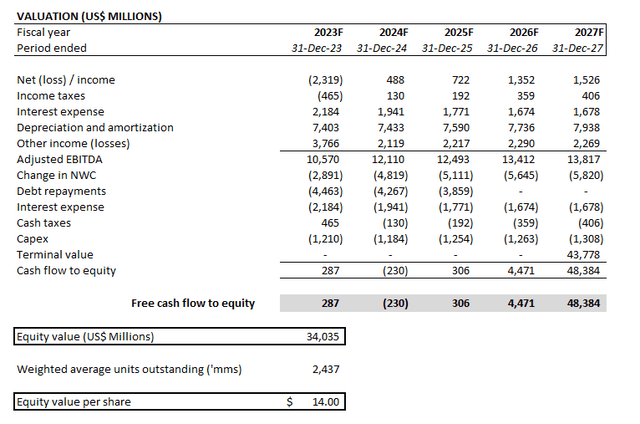

Taken together, we expect full year 2023 adjusted EBITDA to total about $11 billion, which is largely in line with management's guidance for the metric to fall on the lower end of its previously guided $11 billion to $11.5 billion range.

Author

Author

Warner_Bros._Discovery_-_Forecasted_Financial_Information.pdf

Valuation Analysis

Author

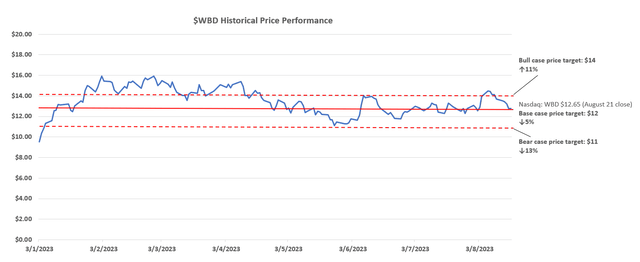

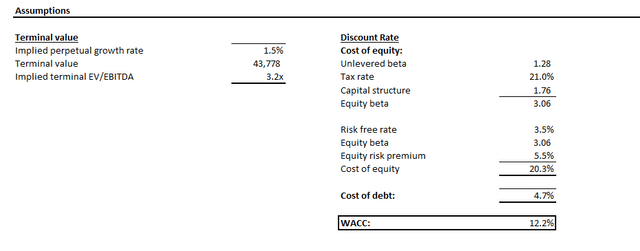

Applying a modest 1.5% perpetual growth rate to projected cash flows, or 3x terminal EV/EBITDA, in line with the offsetting impact of both secular declines and growth in WBD's existing media business model, alongside a discount rate of 12% based on the company's risk profile and capital structure (2.5x long-term gross leverage), a discounted cash flow analysis would yield an equity value of $14 per share on the stock.

Author

Author

Author

Author

While the estimated intrinsic value per share based on the DCF analysis implies upside potential of more than 40% for the stock at current levels, we think it is unlikely for WBD to grow into this valuation in the near-term as markets continue to look for tangible evidence that its ROIC can return to positive levels. Recall from our previous analysis where we discussed the two key components of valuation - 1) steady-state value, and 2) future creation value premium. The valuation theory estimates a component of stock pricing attributable to a business' worth when "NOPAT (net operating profit after tax) is sustainable indefinitely and incremental investments will neither add, nor subtract, value" - hence, a steady-state of growth - and another attributable to the business' premium generated by ongoing investments. Specifically, the future value creation component represents the incremental value that investments earn (i.e. return on invested capital / "ROIC") relative to cost of capital, and takes into consideration the time period in which this value-creating opportunity will last.

In WBD's case, its ROIC has been deep in the negatives since the blockbuster merger last year, meaning returns are coming in at a level lower than capital invested. The spread between returns and cost of capital is the key driver to the future value creation premium. This makes WBD's negative spread a key multiple compression risk for the stock, hence its valuation discount to peers.

And even taking into consideration expectations for an improving spread between returns and cost, supported by WBD's expanding earnings, cash flows, and cost synergy capture, alongside reducing leverage, the company's near-term ROIC is likely to stay in the negatives until there is greater evidence for a sustainable reacceleration in growth. This will continue to drive its discounted valuation to peers over the near-term, considering limited visibility on how WBD plans to navigate through accelerating irreversible declines in networks, and challenges to growth in DTC streaming amid intensifying competition and significant capital outlay requirements.

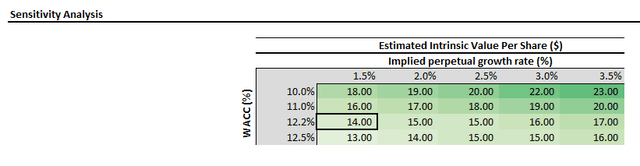

Taking into consideration WBD's near-term ROIC prospects and valuation multiple on a relative basis to its peers, we expect recent market anticipation for fundamental improvements in its underlying business to have already been priced into the stock at current levels. Considering WBD's media and entertainment peers, such as Paramount Global (PARA) and Comcast (CMCSA), which are reeling from secular declines in linear TV and growth challenges to their respective DTC streaming businesses, and are also struggling from negative ROIC, their higher price/earnings multiple at current levels are in line on a relative basis to WBD's lower anticipated returns in the near-term. Paramount and Comcast's ROIC metric is almost a one-fold improvement to WBD's, hence their doubling valuation multiple improvement.

Data from Seeking Alpha

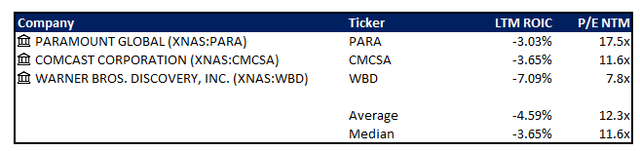

A similar relative trend is observed between WBD's earnings multiple relative to streaming industry leader Netflix.

Data from Seeking Alpha

The latter boasts a ROIC in the low-teens, which represents a close to three times improvement to WBD's -7% ROIC. This is in line with Netflix's earnings multiple that is more than three times of WBD's.

Considering WBD's ROIC - a key metric to the future value creation premium component of valuations - will likely remain negative in the near-term, we expect the stock to stay in the $12 range in line with our steady-state PT of $12 as previously discussed. Incremental upside potential towards and beyond the mid-teens range, in line with its cash flow prospects, will largely depend on the restoration of sustainable long-term growth, net of secular declines in networks, which would be key to maintaining expansion of its investment cost-returns spread. Since management remains focused on navigating through near-term macroeconomic and secular challenges, while achieving WBD's post-merger integration financial targets, with a focus on growth unlikely to ramp up until next year, potential for incremental upside realization in the stock's value will likely take on a similar timeline.

Final Thoughts

Admittedly, WBD is consistently delivering on its post-merger integration financial targets after a shaky start filled with hard-to-digest project cancellations and hefty restructuring costs. This is accordingly driving improvements to its ROIC, though related optimism has likely already been priced in. Looking ahead, persistent declines in recent quarters, coupled with uncertainties to how lingering secular, macroeconomic, and competitive headwinds will be resolved will remain a near-term limiting factor on the stock's multiple expansion prospects in our opinion. Until there is greater clarity on how management plans to "lean into top line growth opportunities across the company", along with tangible support (e.g. DTC ARPU and subscription growth, segment profitability, adjusted EBITDA and free cash flow expansion, etc.), we remain hold-rated on the stock

Comments