In the world of options trading a credit spread is a strategy in which the trader buys and sells options on the same stock (both calls or both puts) with the same expiration date but at different strike prices. The strike prices chosen are such that the premium received for selling a call or a put is greater than the premium paid for buying the other call or put. Thus the trade begins with a credit. Common credit spreads are the bull put spread and bear call spread.

Video Shows Why Diversifying Isn’t as Important as You Thought

Credit Spread for a Rising Stock Price

If a trader expects a moderate price increase for a stock, an appropriate credit spread is the bull put spread. This approach uses put options, one at a higher strike price and another at a lower strike price. The trader purchases the put at the lower strike price and pays a premium. They sell the higher priced put and receive a premium greater than the one that they paid. This is where the credit comes in. If the stock performs as expected and rises slightly or simply stays above the level of the higher strike price, both puts expire worthless. The trader keeps the initial credit as their profit.

If the stock price falls below the level of the upper strike price the trader’s profit starts to diminish and can result in a loss. The loss is limited by the put that was purchased at the lower strike price.

Credit Spread for a Falling Stock Price

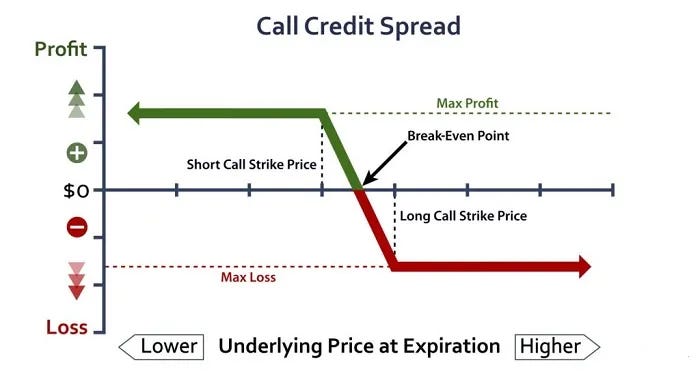

If a trader expects a moderate decrease in a stock price a useful credit spread is the bear call spread. This options strategy uses call options. The trader purchases a call at a higher strike price and sells one at a lower strike price. The premium for the purchased call is lower than that one that was sold. Thus the trade starts with a credit. If the stock performs as expected and falls in price or at least does not rise to the level of the lower strike price in this trade, the options contracts expire worthless. The trader retains the initial credit as their profit.

Should the stock price rise above the lower strike price this cuts into the initial credit with this trade, diminishes profit, and can result in a loss. The loss is limited when the stock price rises to the level of the call that was purchased.

Why Use a Credit Spread?

The point of using a credit spread is to limit risk in options trading. While a trader may have good reason to expect a stock to either rise or fall in price, life and options trading are never certain. This is not an approach to use when one expects a huge move either up or down in the price of a stock. That is because the same setup that limits risk also limits profit. A credit spread is for when stock prices are moving incrementally up and down.

What Is the Risk of a Credit Spread?

The primary risk in a credit spread is the same as for any strategy when the trader does not read the market correctly. Two things drive stock prices. Fundamentals drive prices over the long term. Market sentiment drives prices over the short term. As we so often note at Top Gun Options, the market only cares (pays attention to evolving fundamentals) when it cares. Thus, a trader needs to trade the market that they have and not the one that they would like to have. At times when the market gets confusing this can become difficult. That is when it is useful to be trading with a dedicated trading squadron such as at Top Gun Options where we potentially print money in up, down, and sideways-trading markets.

[Video] How to Make Profits in a Hostile Stock Market

Originally published at https://topgunoptions.com on August 22, 2023.

Comments