Stephen Lam

Salesforce (NYSE:CRM) has been consistently delivering this year on its "four key areas of transformation". Following our previous quarterly update on the stock, the company has delivered another round of beat and raise exiting fiscal Q2. The following analysis will discuss our updated fundamental analysis on the company considering its actual fiscal Q2 outperformance and fiscal second half ambitions. We will also be analyzing a few key takeaways from Salesforce's recently announced mandates for its AI CRM roadmap (e.g. AI Cloud architecture; Data Cloud cross-sell; Einstein GPT-integration, etc.), with discussion on relevant risks.

The strong double beat and raise exiting fiscal Q2 underscores progress in 1) driving productivity and profitability, 2) maintaining resilience through innovation, 3) strengthening relationships with investors, and 4) repositioning the company for sustained growth. And after talks about AI integration for several quarters now, the CRM software leader has officially admitted the nascent technology as the fifth focus area on its transformation roadmap.

Specifically, Salesforce has set out an ambition to become the leading AI CRM software provider in the "new innovation cycle". The strategy would couple AI, data, CRM and its proprietary Trust platform into one architecture integrated directly within Salesforce.

At the heart of this transformation will be Data Cloud - the "fastest-growing organic product" innovated by Salesforce. Data Cloud was initially introduced as "Customer 360 Audiences" in 2020, and underwent several name changes - including "Salesforce CDP" - which is exactly what it is: a customer data platform, or "CDP". And the product's continued success has appropriately latched on to the current momentum in AI. The company has basically deemed Data Cloud as a prerequisite to accessing its generative AI capabilities, making the product an immediate beneficiary of the AI frenzy.

However, we remain cautious over Salesforce's uncertain deployment and monetization timeline for its generative AI-enabled CRM applications. Despite management's allocation of substantial airtime to AI benefits through Einstein and Data Cloud, for example, the bulk of its AI applications (e.g. ChatGPT/Claude app for Slack, Marketing GPT, Tableau GPT, Flow GPT, etc.) are not yet generally available.

In the meantime, we see much of the stock's uptrend this year to have priced in Salesforce's progress in restoring margin expansion while also maintaining organic double-digit (although not hyper) growth despite a persistently "measured buying environment". Looking ahead, incremental multiple expansion to push the stock higher would likely depend on whether Salesforce's AI strategy can drive accretive growth for the company in the long-run. This would be critical for reversing the impending reality that Salesforce is approaching "maximum customer wallet share" in CRM software, which puts its double-digit organic growth streak - a key investment thesis - at risk.

We see Salesforce as having no choice but to win in the AI mania by leveraging its sprawling reach in CRM software. Yet, monetization uncertainties over its AI CRM ambitions as well as intensifying competition - especially its lack of organic developments in generative AI technologies as previously discussed - remain potential overhanging risks in our opinion.

What is Salesforce's AI CRM Roadmap?

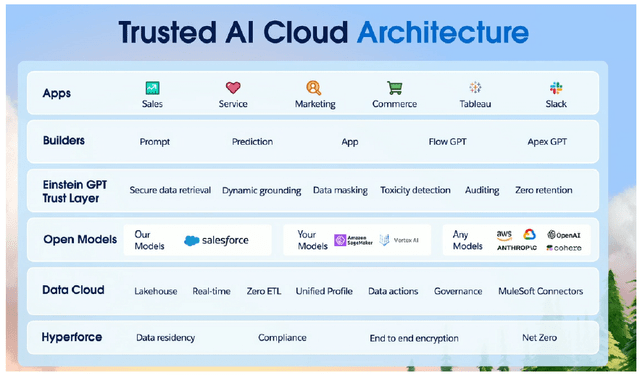

Salesforce introduced "AI Cloud" in mid-June, which we see as its official transition to AI CRM. The new offering is essentially an AI-enabled CRM "starter pack" that combines AI, CRM, data and trust into one architecture that seamlessly integrates within the Salesforce ecosystem.

Salesforce presentation

Specifically, AI Cloud covers both breadth and depth into Salesforce's prospective AI opportunities.

On the breadth aspect, the AI, data, CRM and trust components can essentially be linked to Einstein, Data Cloud, Salesforce's CRM platform and cloud offerings, and Einstein GPT Trust Layer, respectively.

AI: The AI component refers largely to Einstein, which Salesforce refers to as "the world's first generative AI for CRM". Einstein leverages OpenAI's GPT technology as well as its own open-source large language models, such as CodeGen | Salesforce AI Research, CodeT5 and Salesforce AI Research Introduces CodeTF: A One-Stop Transformer Library For Code Large Language Models (CodeLLM). It is essentially the foundation to all things generative AI offered by Salesforce, enabling AI-generated content across all aspects of the CRM process.

Data: Data Cloud is at the heart of AI Cloud, with the CDP solution being the enabler of Salesforce's AI CRM ambitions in our opinion. Data is essential in the age of AI transformation, and Salesforce has made it clear that Data Cloud will be a prerequisite for customers looking to benefit from the company's generative AI CRM offerings.

We view Data Cloud as the primary immediate beneficiary of AI tailwinds at Salesforce. Despite its consumption-based pricing model, which is inherently more macro-sensitive relative to the subscription model, Data Cloud's take-rates has largely defied the measured spending environment with revenue growth of 16% y/y during fiscal Q2. This continues to highlight effectiveness in Salesforce's strategy to use Data Cloud as a hook for increasing its wallet share of prospective AI opportunities, while also leveraging current AI tailwinds to cross-sell its fastest-growing organic product.

CRM: AI Cloud will integrate CRM technologies from the broader Salesforce ecosystem, including relevant data analytics and productivity apps (e.g. Slack, Tableau), as well as PaaS offerings (e.g. Flow, Apex) - but with added Einstein GPT functionality.

Trust: The trust component refers to Salesforce's commitment to security, starting with its Einstein GPT Trust Layer. Through the Einstein GPT Trust Layer, customers can use LLMs critical in building their respective generative AI-enabled CRM solutions without the need to move or store their data in the model, enabling a "secure and trusted" experience critical to the enterprise environment.

Meanwhile, on the depth aspect, AI Cloud will also provide customers with access to Einstein GPT functions within its key analytics, productivity, and PaaS offerings. This includes Slack GPT, Tableau GPT, Flow GPT, Apex GPT, Commerce GPT, Marketing GPT, and Service GPT.

AI Cloud will be offered at $360,000 per year under a consumption-based pricing model and requires an annual commitment contract. The hefty price means initial general availability will first cater to the likes of large, multi-cloud customers.

What are the Risks to Salesforce's AI Ambitions?

1. Uncertainties to monetization - Close to half of AI Cloud's features are not yet in general availability. This means AI Cloud deployment will not start to impact P&L meaningfully until later in the fiscal year, with limited visibility into its monetization ability until fiscal 2025. This potentially limits Salesforce's near-term capture of AI tailwinds (with the exception of Data Cloud's exposure), offering little respite to the ongoing pace of decelerating growth due to both macroeconomic headwinds and scale.

2. Limited share capture at launch- AI Cloud's hefty pricing highlights Salesforce's aims to expand wallet share amongst its largest, multi-cloud customers. We think this will limit the product's initial go-to-market to existing customers only, which risks limited capture of accretive growth.

Specifically, we see existing enterprise IT budgets to gradually shift legacy CRM spend to AI CRM, so catering to existing customers will likely just be a reallocation of existing revenue from one bucket to another at Salesforce. However, the initial go-to-market pricing for AI Cloud could also be a customer retention strategy aimed at securing existing market share before expanding to new end-markets.

While smaller customers could partake in Salesforce's AI CRM offerings outside of the AI Cloud bundle and through the individual Einstein GPT-enabled applications (e.g. Slack GPT, Tableau GPT), related pricing strategies remain uncertain as many of the features are not yet in general availability. As such, we see potential roadblocks to Salesforce's capture of AI's TAM-expanding tailwinds, especially given uncertainties in the near-term.

3. Competition - The advent of generative AI risks levelling out the playing field for Salesforce in our opinion. The nascent technology gives software providers a chance at re-establishing their market positioning and partaking in related growth opportunities, which risks chipping away at Salesforce's current CRM moat. This is already observed through competitive offerings at both Salesforce's software peers and even its key go-to-market partners - most notably, Microsoft's (MSFT) recent deployment of AI-enabled "Copilot" features, such as Dynamics 365 Copilot and Power BI Copilot, which rivals closely with Salesforce's Einstein GPT-enabled applications. Even Salesforce itself is heavily reliant on technology partners such as OpenAI, which are also its competitors for AI CRM market share. The company's lack of organic technology developments in the nascent subfield of AI risks potentially dull the lustre of its CRM moat over the longer-term.

To compensate, we view Salesforce's focus on enhancing stickiness of its ecosystem is prudent. This is corroborated through management's focus on integrating AI Cloud with Data Cloud. Not only is Data Cloud currently the immediate beneficiary of AI tailwinds at Salesforce, the CDP offering also helps secure future demand for the company's' AI CRM applications and AI Cloud architecture.

Salesforce's early introduction of the Einstein GPT Trust Layer was also a differentiating value proposition. Despite the offering's reliance on third-party technology (i.e. OpenAI's GPT model), the Einstein GPT Trust Layer adequately addressed where it matters most for enterprise customers in the adoption of generative AI technology - data security. However, we see competitors rapidly picking up on this aspect, which is quickly wearing off Salesforce's edge before AI Cloud's go-to-market. This includes data software providers such as Snowflake (SNOW) and Palantir (PLTR) which now offers similar enterprise data security features in their products to facilitate customers' AI strategies. This risks subjecting Salesforce's value proposition to obsolescence, which further clouds visibility into its AI CRM prospects as the nascent technology becomes increasingly democratized across the broader software industry.

Fundamental and Valuation Considerations

Fundamentally, we believe Salesforce's solid beat and raise in fiscal Q2 was a step in the right direction, buoying the stock's pace of recovery this year. Margins have also turned a page from the worst of 2022, which is partially compensating for its stabilizing growth.

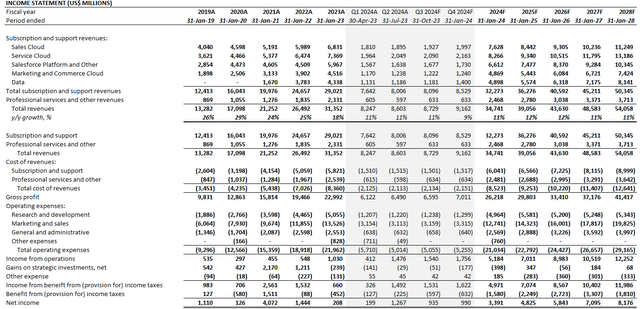

Author

We think the stock's performance has continued to reward Salesforce's efforts in becoming a more efficient company, while also driving stable growth through integration and innovation.

Author

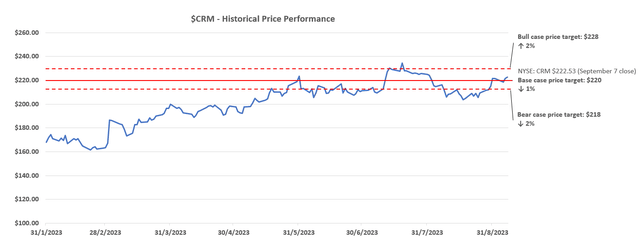

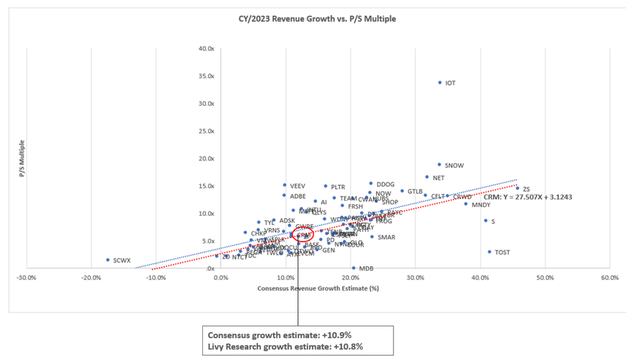

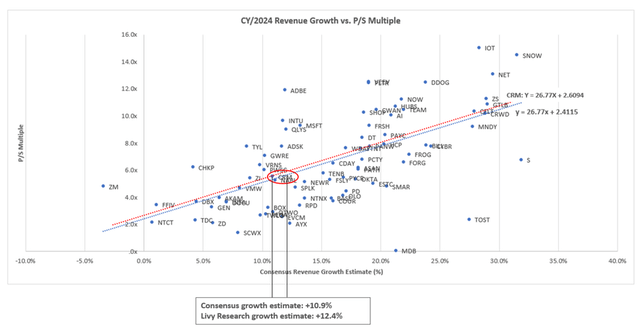

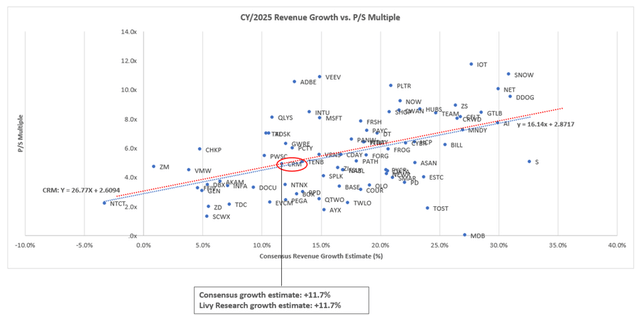

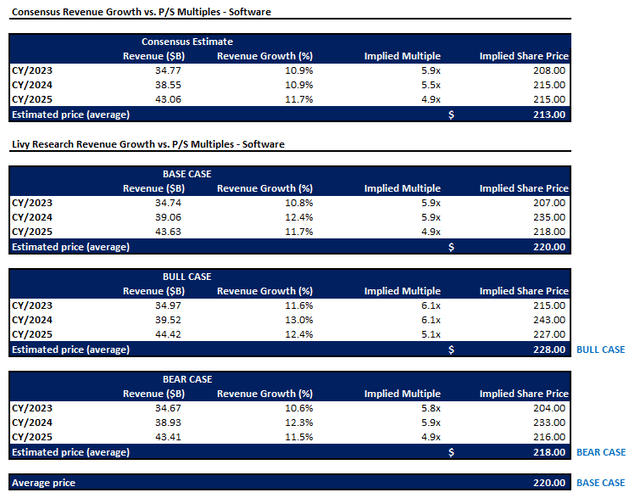

Considering its peer group valuation multiples and our updated fundamental forecast for Salesforce, we believe the stock is fairly priced at current levels.

Data from Seeking Alpha

Data from Seeking Alpha

Data from Seeking Alpha

Our price target of $220 is calculated by averaging the outcome of 4.9x to 6.1x forward sales across base, upside and downside estimates through FY 2026. The multiples applied take into consideration Salesforce's valuation curve (dotted red line) relative to the broader software sector performance (dotted blue line).

Author

We think materializing on its AI CRM strategy will be key to unlocking an incremental valuation premium to push the stock higher. Salesforce needs to deliver structural evidence that its AI CRM strategy can become a sustainable growth accretive factor in order to shift its valuation curve (i.e. the dotted red line in the peer comp diagrams) higher. Further clarity on Salesforce's monetization roadmap for its generative AI CRM roadmap would be beneficial, which makes the upcoming Dreamforce conference a key watch item on our list. Since a lot of Salesforce's AI CRM offerings are not yet generally available until late 2023 / early 2024, we do not expect them to be a "needle-mover" for Salesforce in the near-term. But we do think the strategy will be critical to maintaining its current pace of growth, or better yet, become accretive to subscription and support segment revenue.

Final Thoughts

Salesforce has been building up a lot of excitement over its AI CRM ambitions in recent quarters. And the latest admission of AI CRM into its list of "key areas of transformation", paired with an impressive improvement on profit margins and cash flow, effectively restores confidence in Salesforces' ability to weather the lingering macroeconomic uncertainties and their impact on the enterprise spending environment.

However, we fear that Salesforce might be on the edge of losing grip on its CRM moat. The majority of offerings within the AI Cloud architecture seem to lack differentiation, especially with Salesforce being heavily reliant on third-party AI technology partners to drive its strategy. While Salesforce seeks to democratize AI for its customers, we think the advent of AI has actually levelled out the playing field for rivals to take from its sprawling market share. For instance, Microsoft Copilot could potentially risk consolidating the CRM industry and take share from Salesforce, given the stickiness of its enterprise software ecosystem (worst case, think Teams' absorption of Zoom opportunities).

The company's lack of a detailed monetization roadmap for its AI CRM ambitions, other than disclosing a $360,000 annual starting price for AI Cloud and trying to capitalize on near-term cross-sell tailwinds for Data Cloud, also sheds uncertainty over relevant revenue contribution prospects. Taken together, we think AI remains a risk to dulling the lustre of Salesforce's CRM moat, instead of a compelling value accretive factor to the stock.

Comments