Khosrork

Lucid Group, Inc.'s (NASDAQ:LCID) ongoing struggles in ramping up volumes were further accentuated during the second quarter earnings release. Deliveries were flat on a sequential basis, cutting short the quarterly run-rate improvements seen exiting 2022. The latest results continue to cast a shadow on the company's ability to sell its premium-priced electric vehicles ("EVs") in a slowing global consumer backdrop - especially in its core U.S. market. Although Lucid's recent engagement with Aston Martin (OTCPK:AMGDF) on licensing its proprietary battery technology portends an emerging high-margin revenue stream, there is limited visibility into the extent of related demand ahead.

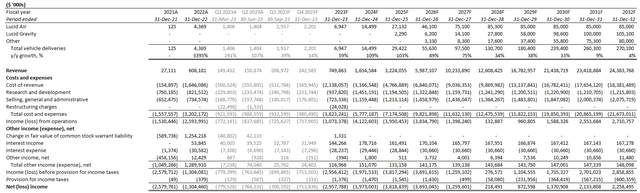

While management remains committed to driving brand awareness and demand through initiatives such as the "reinstatement of [Lucid's] original pricing program" (i.e., a better way to say price cuts), the move is likely to compromise margins further. The company's bottom line remains challenged by a slow ramp up of productions, which will likely be exacerbated by the Saudi Arabia facility coming online later in the quarter. This is already observed by a cost of revenue per vehicle delivered run-rate that remains in flux, underscoring the challenge of ramping up productions on multiple variants of the Lucid Air, and now at multiple locations, all at once. Meanwhile, operating expenses are also surging to reflect ongoing R&D of new products and technologies, as well as increasing selling costs spent on Lucid's expanding global network. And this comes even after a 20% reduction to the company's headcount announced earlier this year.

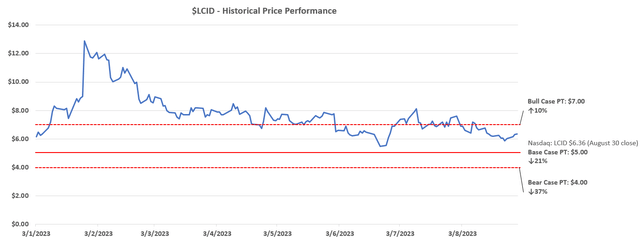

Taken together, the diminishing cost-returns spread on Lucid's ongoing growth investments is poised to weigh further on its valuation premium at current levels. There is limited respite in the near term to restore investors' confidence in the stock, as consistent evidence supportive of the company's upward volume trajectory remains to be seen.

Top-Line Struggles in Focus

We see two imminent challenges to Lucid's growth ambitions - 1) ASP declines; and 2) waning demand.

Vehicle ASP Reduction

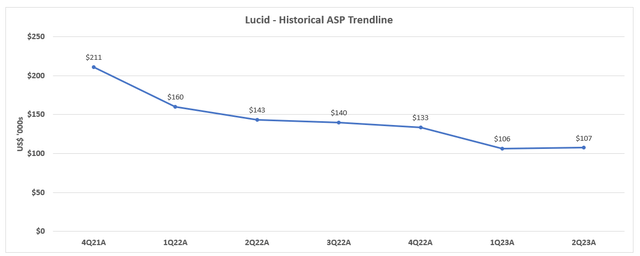

Lucid commenced deliveries on the Lucid Air Pure - the lowest priced variant of the flagship sedan - in late 2022. The company's ASP has been on a steady double-digit percentage y/y decline since, highlighting a shift in sales mix away from its higher-priced offerings such as the Air Grand Touring. The trend also underscores an increasingly price sensitive consumer backdrop amid an uncertain economy, even amongst the more affluent target audience that Lucid seeks to serve.

*Note: Actual vehicle ASP could be lower, given Lucid does not separately disclose revenues generated from its Atieva battery unit sales (Author)

Author

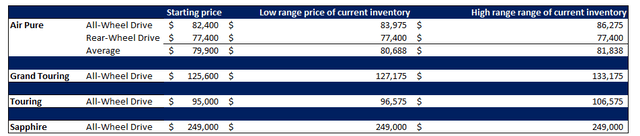

Lucid's recent implementation of price cuts across its line-up - or "reinstatement of its original pricing program" as management likes to call it - is likely to pressure its vehicle ASP further. The Air Pure now starts at $82,400 (down from the previous $87,400) according to Lucid's website, which is 2% to 4.5% cheaper than inventory currently available for delivery within two weeks. The upcoming rear-wheel drive Air Pure launching in September, which we estimate to be priced near $77,400 based on the July 2021 Investor Presentation, will likely drive incremental declines on Lucid's vehicle ASP. This is consistent with expectations that the Pure trim is currently the highest sales contributor for the company, as well as management observations for "a 3x increase in orders in the first full day of [price cuts] as compared to the end of July," highlighting consumers' price sensitivity.

Data from lucidmotors.com

While the Air Sapphire, which is fully equipped at $249,000, commences deliveries in October, it is unlikely for the higher-tier trim to substantially move the vehicle ASP upwards. Although Lucid's marketing for the Air Sapphire aims to mimic the appeal of the limited Dream Edition launched at Lucid's go-to-market in late 2021, the newest $249,000 variant likely faces diluted demand. The Sapphire trim in which Lucid aims to scale, unlike the limited Dream Edition, is also selling at a higher premium with less range, offering a limited exclusivity appeal relative to the car's hefty price tag.

lucidmotors.com

Lucid July 2021 Investor Presentation

Meanwhile, the Air Sapphire is also launching into a slowing consumer backdrop, adding to the vehicle's growing list of go-to-market challenges. Taken together, we expect the share of Air Sapphire sales will be limited at launch, with volumes likely ramping up to about 5% of the consolidated mix at its "steady-state" level of demand. This is similar with the premium S Class, and Model S/X's share of Mercedes' (OTCPK:MBGAF), (OTCPK:MBGYY) and Tesla's (TSLA) annual vehicle sales, respectively.

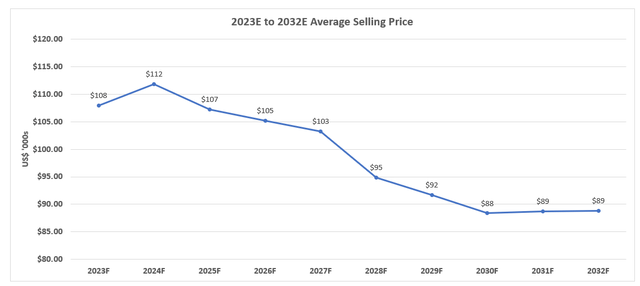

Considering Lucid's deliveries are becoming increasingly weighted towards the lower-priced variants, offset by an anticipated temporary uptick in demand for the higher priced Air Sapphire at launch, we expect ASP to exit 2023 in the $108,000 range. The figure is likely to decline further going forward, as Sapphire demand will eventually moderate, and give way to Pure's precedence. The upcoming introduction of the Gravity SUV and mid-sized model slated for "mid- to late decade," which caters to the most popular passenger vehicle segments in the U.S., will likely be priced in the sub-$100,000 to $100,000 range. This is in line with Lucid's strategy of first introducing higher priced, more profitable models to scale its capital-intensive operations before proceeding to lower priced, slimmer margin offerings in the long run, consistent with business models observed at rival EV pure-plays. The combination with increasing Air Pure sales is expected to drive Lucid's vehicle ASP down to the sub-$89,000 in the long run, highlighting the importance of capturing market share to ensure sufficient operating leverage needed for margin expansion.

Author

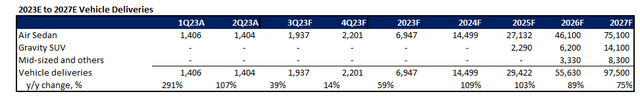

Increasing Demand Challenges

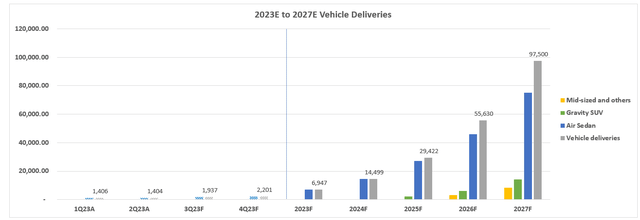

Lucid's downward trending ASP, coupled with stagnating delivery volumes in the first half of the year is concerning. Although management expects unit sales volumes to reaccelerate in the second half of the year, helped by the commencement of deliveries in Saudi Arabia later in the third quarter, the math still works out to be significantly weaker than rivals that have gone to market at a similar timeline.

Author

Author

While the Lucid Air boasts an incredible exterior and interior (seeing it in real life earlier this year was a different experience than pictures / videos online), the brand faces roadblocks still for consumers to buy into the premium product. Consistent with management's acknowledgement for the "need to add more vehicles to the visible fleet on the road," the limited number of Lucid Air deliveries to date is also limiting buyers' confidence in the brand. Coupled with the increasingly challenged consumer spending backdrop, Lucid risks entering a vicious downward spiral of buyers' aversion to the brand given its high price point yet limited on-road presence, which suppresses confidence in the brand's staying power.

Some prospective car buyers we have recently spoken to have also cited hesitance about Lucid given its limited number of service centers. While Lucid has been consistently expanding its global footprint, prospective buyers remain concerned about the viability of the company's nascent technology offering and reliability of its maintenance network relative to more established EV pure-plays and legacy automakers.

On a preliminary fact check with sales reps at some of Lucid's Canada locations earlier this year, the company's maintenance network in the region remains limited to its in-house servicing centers. This compares to more established rivals that benefit from an expansive network of both in-house and third-party servicing facilities that are knowledgeable in both the technologies and components of their EV offerings. Although the situation is better in the U.S., with Lucid disclosing "74 nationwide-approved body shops" in addition to its in-house servicing centers in the country, a similar strategy is likely needed overseas to buoy buyers' confidence in the brand. There is already a lot of consumer anxiety around EV adoption, as the electrification shift remains in early stages of an inflection. And the combination of Lucid's lacking on-road presence, alongside limitations to post-purchase customer experience support remain adverse factors for the brand's appeal.

Author

Valuation Considerations

Author

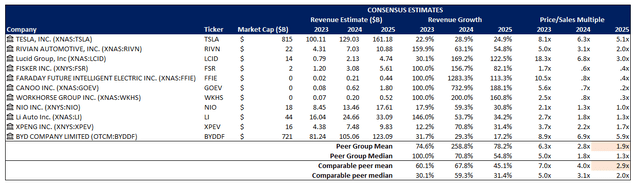

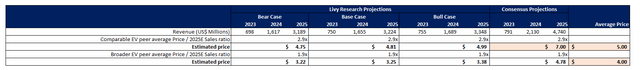

We have considered Lucid's peer group valuation multiples to gauge the company's valuation prospects on a relative basis in the next 12 months.

Data from Seeking Alpha

Our base case forecast expects 2025 revenue of $3.22 billion, driven primarily by deliveries of 29,400 vehicles. The 12-month price target for the stock of $5 is based on a price-sales ratio of 2.9x applied on both consensus ($4.74 billion) and our 2025 sales estimates. The 2.9x assumption applied reflects our belief that Lucid should trade at a steeper discount to Tesla's ~5x, and more in line with its comparable peers' average of 2.9x based on their growth and profitability outlook. The $5 base case PT is further corroborated by a 10x multiple applied on Lucid's 2028E EBITDA in our forecast, which is in line with multiples observed at stable-performing legacy automakers in the same capital-intensive business.

Author

In the upside scenario, we expect Lucid to achieve consensus 2025 revenue estimates of $4.74 billion, which we believe to be more optimistic than our bull case sales considerations (assumes 2025 revenue of $3.35 billion on deliveries of ~30,500 vehicles). The upside price target ("PT") of $7 applies the peer group average multiple of 2.9x on consensus 2025 revenue estimates.

In the downside scenario, we assume 2025 revenue of $3.19 billion on sales of ~29,100 vehicles. The bear case PT of $4 applies a 1.9x price-sales ratio to the downside forecast, which is the broader EV peer group's average to reflect expectations for Lucid's weaker market share gain prospects.

Final Thoughts

Rawlinson & Co. has a lot of credibility to restore before investors can regain confidence in Lucid's longer-term prospects as a competitive EV pureplay in the premium segment. Lucid's valuation premium combined with its consistent trend of underperformance portends downside potential from current levels. Uncertainties to the company's forward demand environment, coupled with ASP declines and elevated spending levels suggest significant execution risks on the horizon still to achieving the scale of volumes required to support Lucid's current market valuation at $6 apiece.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Comments