Enterprises investment need to jump out of the national and regional level, taking the whole industry as the research Object in the whole global ecosystem. You need to compare the historical path of competition in this industry, and the current dynamic of competition,and try to predict **re competitive relationships. All industry have a process of growth, change, extinction, and transformation that can take decades or even hundreds of years.

So you need to look at the production, management, culture, team members, product, innovation, profitability, etc. of similar companies around the world. Be clear about companies which are more competitive and gain more market share and profits in the **re, while the opposite which companies are going to go down.

Focusing on the changes in corporate profitability and gross profit margins.

The monopoly companies obtain the long-term profits and make Compound Profit Growth possible. Once the monopoly change and the profits of enterprises will lost greatly.

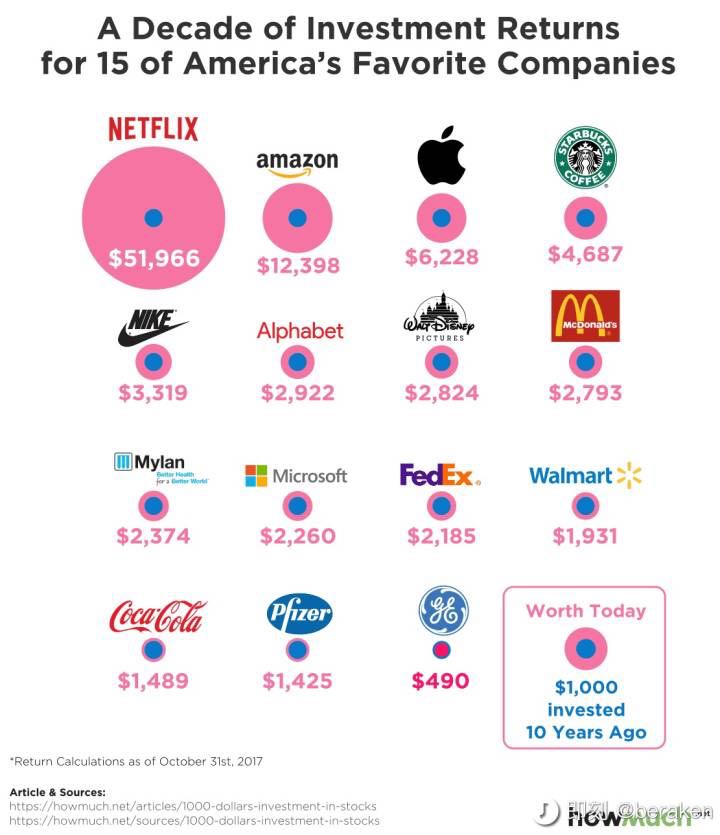

The compounding power of capital is staggering. Professional experience in using leverage can accelerate growth, while improper leverage can distort the investment mindset.

Why investment fails, except for uncontrollable natural disaster and the impact of state policies, in most cases, it's because of the mispricing or wrong valuation of asset, lacking of reference standards and valuation benchmark system. High opportunity and time cost in high prices purchase without long-term growth.

So, professional evaluation system, key trigger points monitoring, ongoing comparison among global industry, and more common sense, then better investment return.

Comments