$NVIDIA Corp(NVDA)$ Will report earnings on November 21, last quarter's earnings performance was bright, not only a record high revenue, the third quarter earnings guidance is also higher than analysts' expectations, Nvidia expects the third quarter revenue will reach $16 billion.

Bank of America analysts said enterprise-generated AI could play a key role in Nvidia's profitability ahead of its earnings report, suggesting investors may be underestimating "the potential growth in AI adoption by enterprise customers, which Nvidia can uniquely capitalize on through its best-in-class enterprise partnerships."

Special commend: How to achieve an 8%* annualized yield on your Tiger Vault Fund?

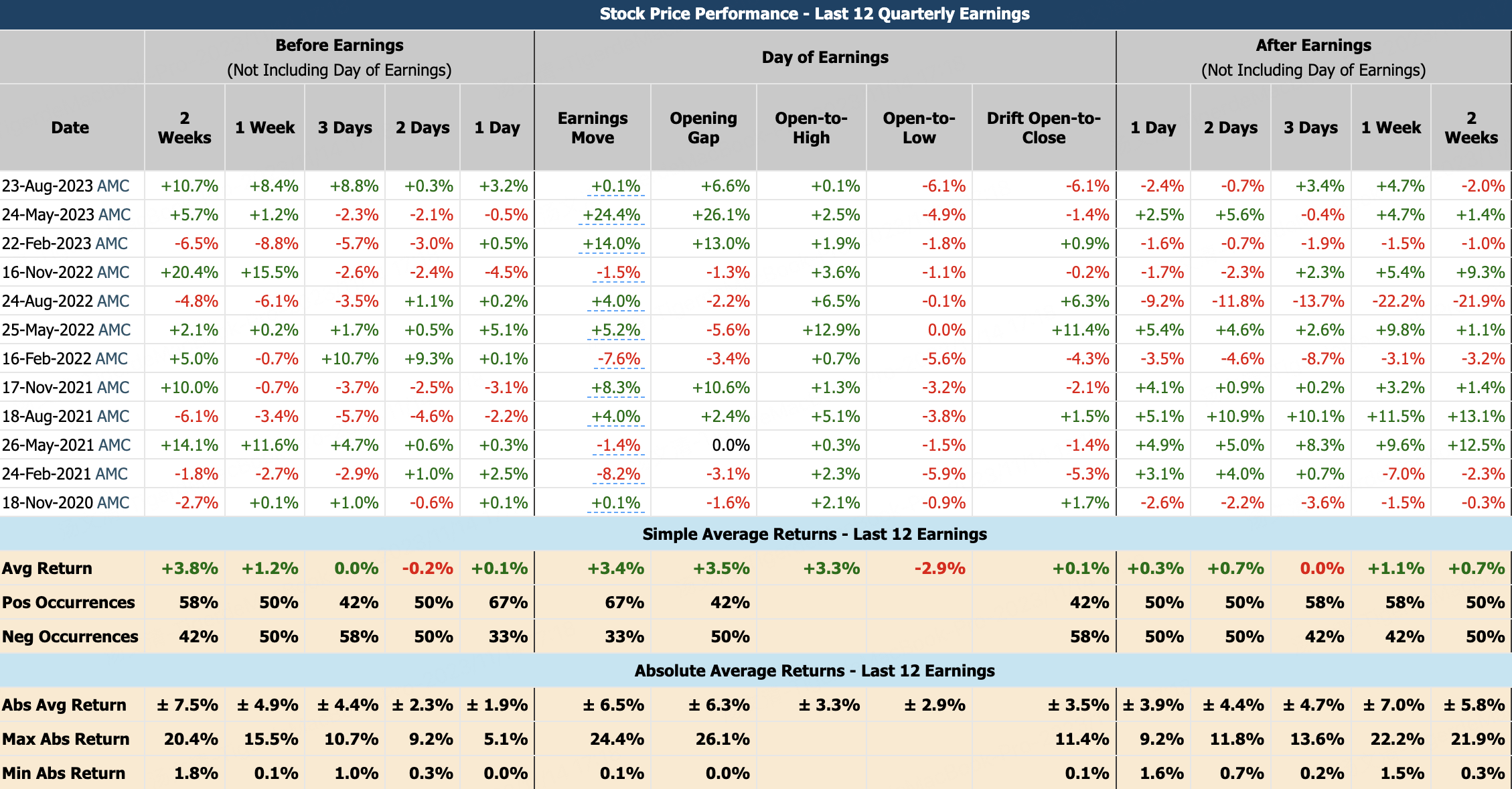

Historical earnings share performance

Prior to NVDA earnings releases, the average expected earnings move was ±7.2%. The actual move averaged ±7.2%, which is right in line with predictions. The opening gaps averaged ±6.0% while the stock drift after the open tended to move ±2.8%.

Based on historical data, average returns tend to rise before and after earnings reports.

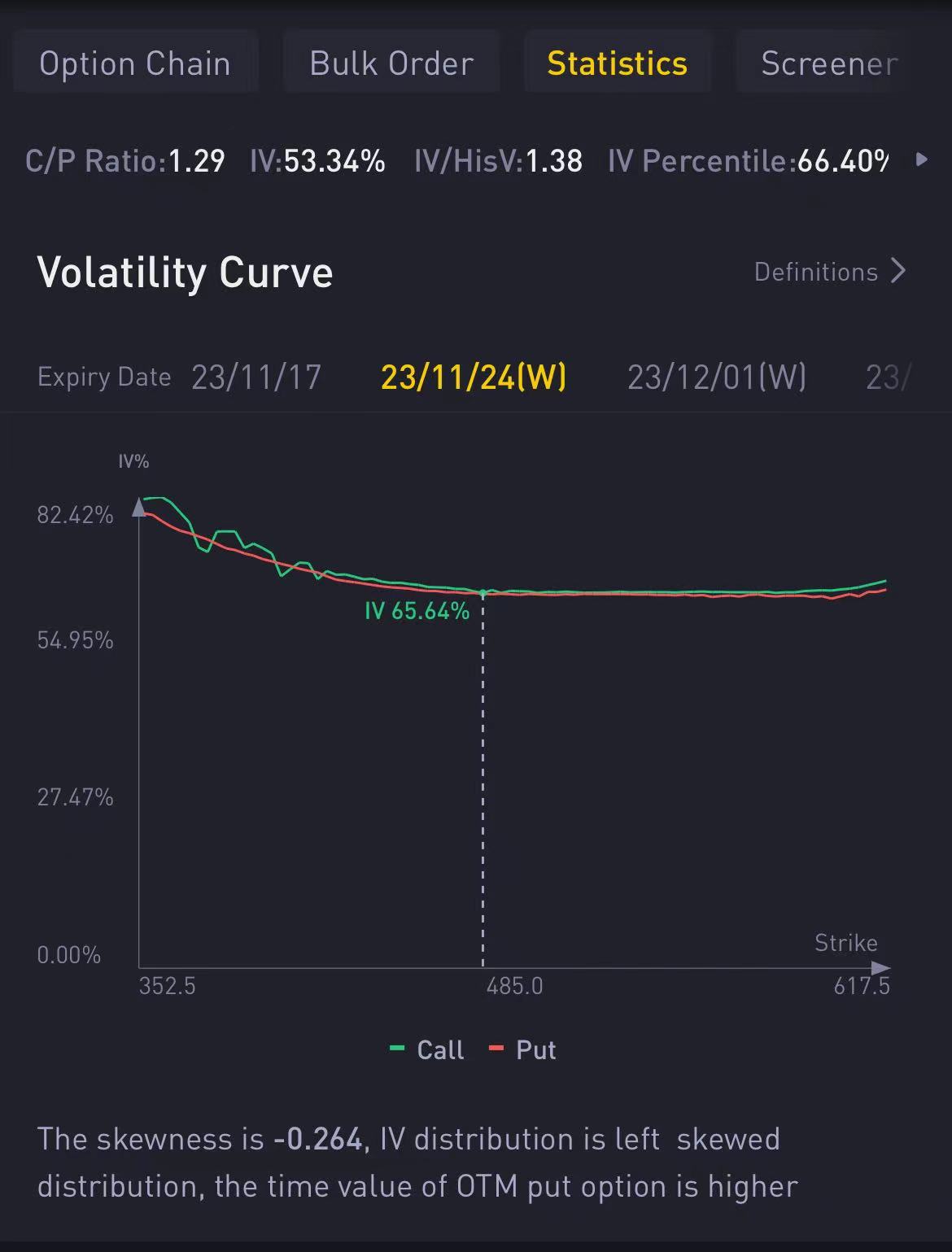

Option expectation

The implied volatility of options expiring in the reporting week is 65.6%, the company's expected stock price trend during the reporting period is ±44, the expected price range is 442~530, and the maximum expected rise or fall is ±9%.

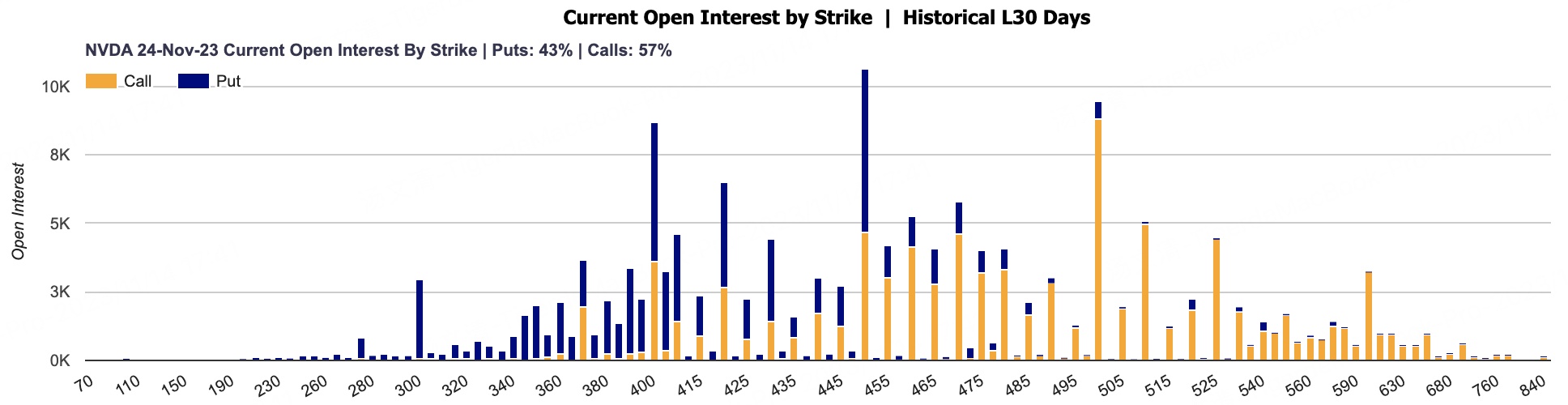

In the report week expiration (November 24) options, the open position of call options accounted for 57%, the highest open position of the exercise price is 450, of which the put option accounted for 56%. The next strike price is 500 and 400.

options active

As shown in the chart, institutions are currently optimistic about the rise of NVIDIA, and are generally bullish. The latest big opening is a call option $NVDA 20241220 580.0 CALL$

Option strategy

According to Figure 1 pre-earnings share price performance, the current strategy with the highest win rate is to sell the 0.25delat put strategy, with a Sharpe ratio of 0.85

sell $NVDA 20231124 460.0 PUT$

The annualized return reached 53%

Comments

Great ariticle, would you like to share it?

Great article

.