Update on recent trading strategies for $iShares 20+ Year Treasury Bond ETF(TLT)$ and $Direxion Daily 20 Year Plus Treasury Bull 3x Shares(TMF)$

For the background on my trading opinions on TLT and TMF, please refer to the three previous articles:

I began selling puts on TLT in early November. In December, I added selling calls on TMF. At that time, the trading logic was that TMF has inherent leverage costs, making it unsuitable to directly short TLT, which is viewed favorably in the long term. Therefore, I chose TMF, which would potentially drop further in case of a decline.

After experiencing TMF skyrocketing to around 68, the actual stock is finally making money now. However, I have sold covered puts at 60&62, which will be passively exercised at maturity.

Now that TLT prices have dropped back to around $96, I will continue to increase TLT's sell put positions, choosing strike prices at 95-93. If these prices are passively picked up, I will switch to sell puts with strike prices of 90-88.

If 90-88 is also passively exercised, I will go as low as selling puts at 85 and hold the stock for a while.

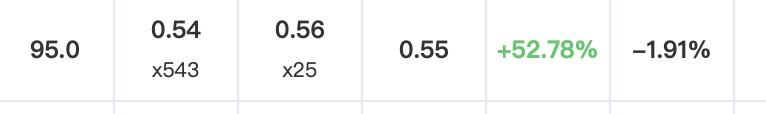

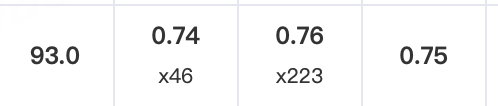

Currently, the options premiums for TLT with January expiration and a strike price of 95, and with February expiration and a strike price of 93, are 0.55 and 0.75, respectively.

While these premiums may not too attractive. Considering the long term, they are relatively safe. With treasuries prices expected to rise in the second half of the year as the interest rate cuts, the safety margin for selling puts is very high, and I recommend it. (Disclosure: I personally hold the following two contracts.)

Comments

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?