Analyze NVIDIA from the perspective of company revenue and debt ratio

$英伟达(NVDA)$ 2023 is a year of rapid recovery for Nvidia, and it can also be considered a year of good luck.

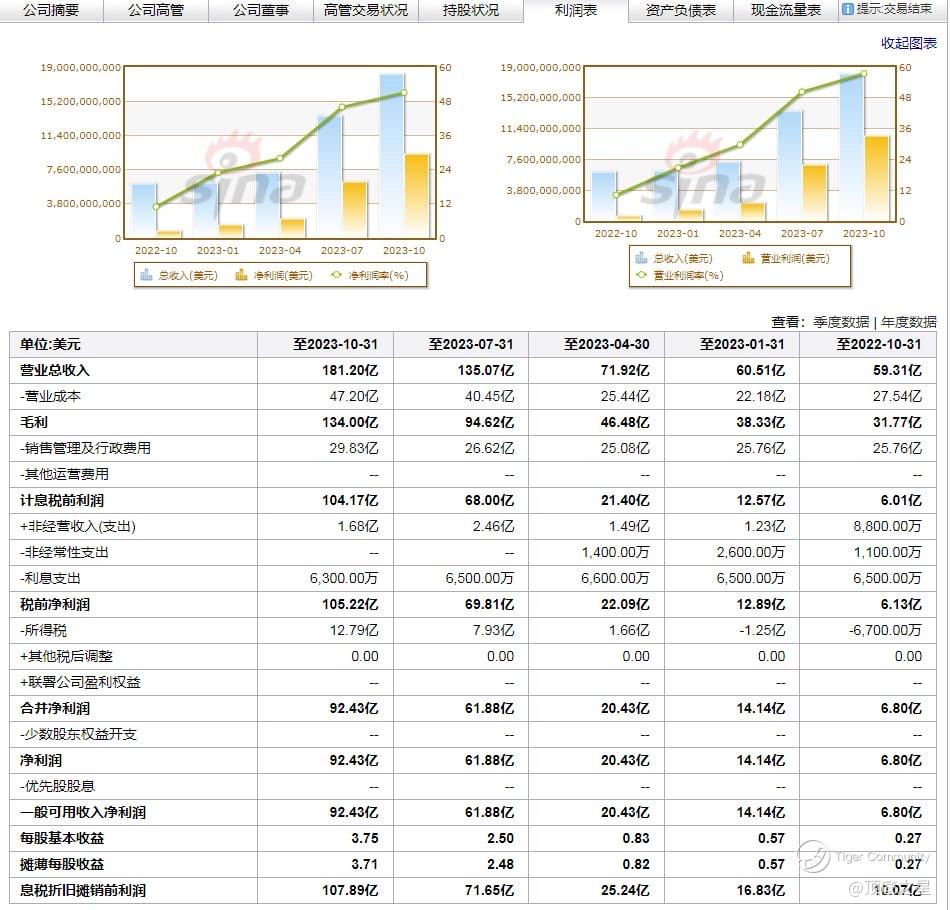

It can be seen from its quarterly income statement last year that profits have increased gradually over the four quarters of the year, and the span is very large, so the impact on this year will be great. Even if inertia prevails, the stock's upward momentum will not be It will be plenty.

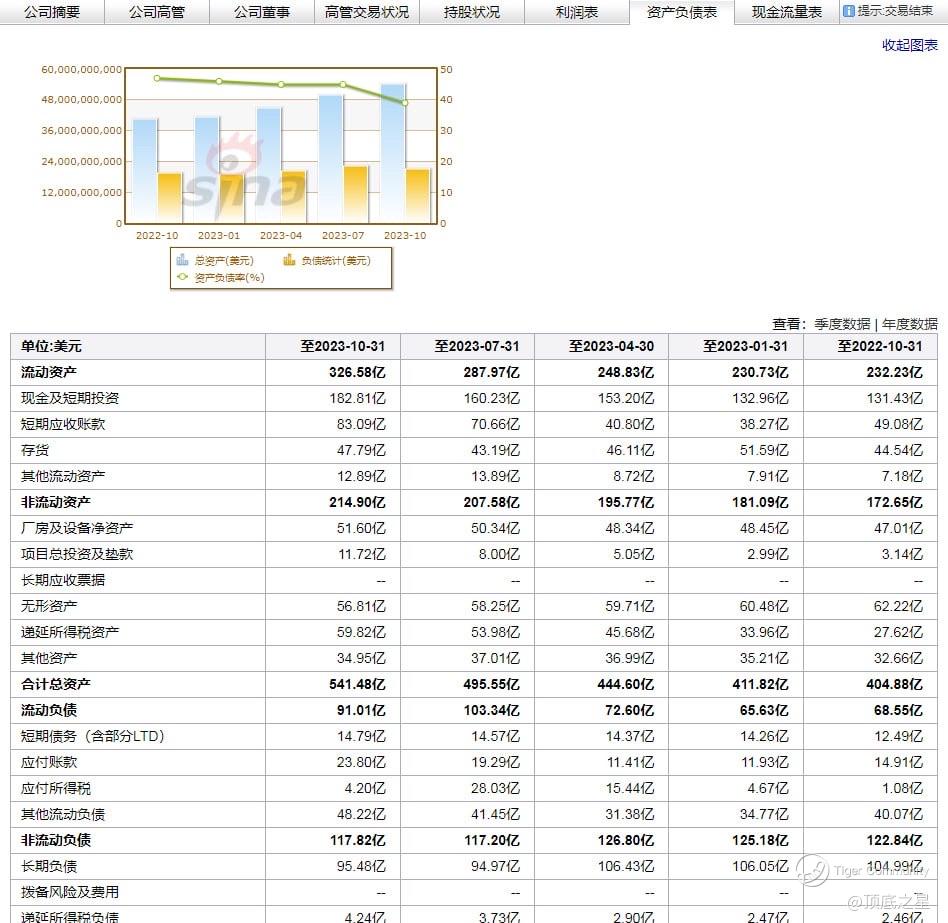

Another quarterly balance sheet can also reflect that the company's operations are currently good, which has improved its ability to resist risks. The increase in current assets has played a catalytic role in expanding investment areas and projects.

Because of this, I believe that Nvidia this year will also give investors a satisfactory answer.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Comments