Summary

- In October, I recommended Toyota as a Strong Buy and strong year-end sales results have bolstered this thesis as the auto giant executes on its bid to gain EV market share.

- Toyota EV sales volumes surged 30% YOY in the U.S. in 2023, accounting for ⅓ of units sold.

- Toyota is #1 among Seeking Alpha’s Quant-rated automaker stocks, securing high grades in every key category, including growth, valuation, and profitability.

HJFBooysen/iStock Editorial via Getty Images

One of the most attractive investments in the industry, Toyota (NYSE:TM) has secured the #1 slot among Seeking Alpha's Top Quant-Rated Auto Manufacturers. Toyota's underlying metrics highlight the company's robust, profitable growth, with revenue up 23% year-over-year, operating margins at a staggering 70%, and bottom-line profits up more than 50%.

I recommended Toyota Motor Corporation as a strong buy in October for its potential upside in the EV segment, and year-end sales volume results have bolstered this thesis. Toyota's U.S. annual sales volumes rose 6.6% in 2023, bolstered by a 30% surge in EV sales. Toyota's growth is likely to persist as its share of the global EV market continues to rise. Toyota has reassured customers that the company is focused on enhancing its EV market position in 2024 by introducing 22 new vehicle editions.

"Toyota's multi-pathway approach to electrification accelerated in 2023 with even more vehicle choices to meet our customer's lifestyle and budget…our teams are busy preparing for an outstanding 2024 to bring 22 new, refreshed or special edition vehicles to showrooms, including sedans and more electrified options to satisfy strong customer demand. By the end of 2025, we plan to have an electrified option available for every Toyota and Lexus vehicle in the U.S.," said North American Executive VP Jack Hollis.

Toyota Motor Corporation Stock

Market Capitalization: $252.87B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 1/10/2024): 3 out of 528

Quant Industry Ranking (as of 1/10/2024): 1 out of 32

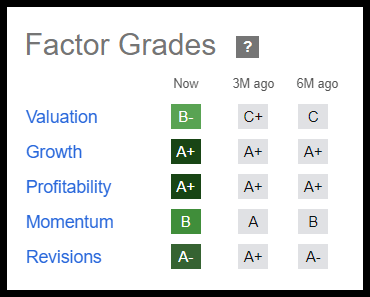

Seeking Alpha Factor Grades rate investment characteristics on a sector-relative basis. Toyota Factor Grades include A's in growth and profitability and B's in valuation and momentum, with an overall Quant Rating of 4.98.

Toyota Stock Factor Grades

Toyota Stock Factor Grades (SA Premium)

Although criticized for lagging competitors in the EV game, Toyota has significantly enhanced its commitment to electrification after a change in leadership earlier this year. The Japanese auto giant has vowed to have an electrified option available for every Toyota and Lexus model globally by 2025. In October, Toyota announced plans to collaborate with energy giant Idemitsu Kosan to mass produce all-solid-state batteries for Battery Electric Vehicles (BEVs). Seeking Alpha Analyst Harrison Schwartz cogently captures the positive upside of Toyota's EV battery development pivot and what the inroads could mean for the stock price:

The stock has risen by around 30% since it announced a new battery technology that pushes the EV range to 620 to 930 miles. These new "solid-state" batteries are also expected to result in ~10 to 30-minute charging, cost significantly less, and have lower fire and maintenance risks. Further, the company expects this technology to be implemented from 2026 to 2028, making it a horizon that potentially warrants a stock price premium.

Toyota's latest sales data for U.S. year-end results revealed strong growth overall while demonstrating progress on its EV vision. Toyota sold 2.248 million vehicles in the United States in calendar year 2023, a 6.6% increase over 2022, while the Daily Selling Rate (DSR) rose 7%. Electrified vehicle sales surged 30%, making up almost one-third of total cars sold in 2023. Q4 sales volumes increased 15% and DSR 18.5%, while December sales rose 25.5% and DSR +30.3% adding to Toyota's outstanding growth and profitability

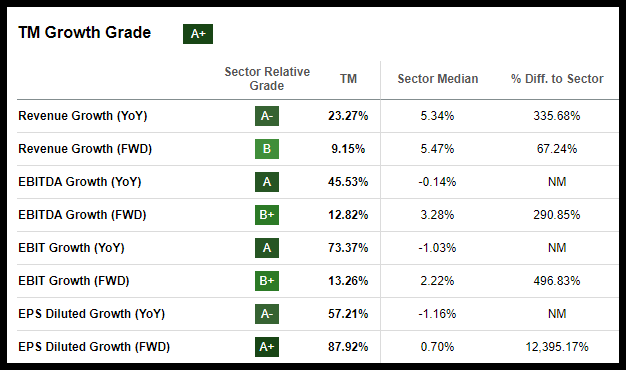

Growth & Profitability

Toyota has delivered strong, profitable growth over the past year. The company's net income margin of 9.3% is more than 100% above the sector median. Toyota's crucial underlying metrics have resulted in high Seeking Alpha Sector Relative Growth Grades. Revenue, EBITDA, and EBIT have seen impressive growth year-over-year, and forward numbers are strong.

TM Stock Growth Grade (SA Premium)

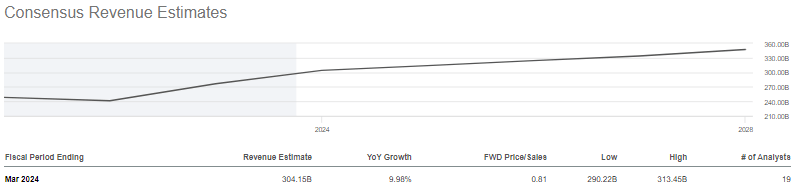

Consensus estimates have revenue projected to grow by almost 10% for Toyota's fiscal year ending March 2024 to $304.15 billion.

TM Stock Consensus Revenue Estimates (SA Premium)

Despite strong profitability and increases in projected revenue, Toyota has inconsistently paid a dividend, resulting in a warning banner that highlights the stock's poor dividend safety grade. Despite an inconsistent dividend, Toyota showcases tremendous fundamentals, and bullish momentum. Its stock price is up 34% over the last year, but it trades at a significant discount.

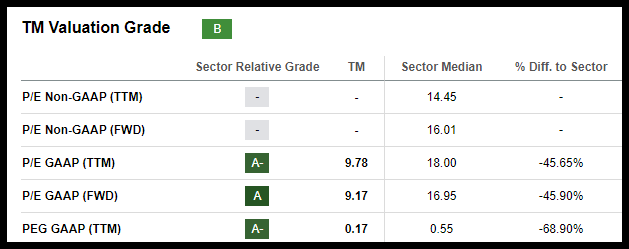

Momentum & Valuation

According to key underlying drivers relative to the consumer discretionary sector, the stock remains undervalued despite sound historical and forecasted profitable growth. In addition, the stock price is up more than 30% over the past year, outperforming the market by double digits.

Toyota 1Y Stock Performance Vs. S&P 500

Toyota 1Y Stock Performance Vs. S&P 500 (SA Premium)

Toyota still appears inexpensive despite the price performance versus the sector. Both historical and forward price-to-earnings ratios are each almost 50% below the sector median, and the price/cash flow forward ratio of 5.93 is 40% below the sector median, according to Seeking Alpha's TM Valuation Grade data. The PEG metric, which measures value and growth, is a mere 0.17, almost 70% below the sector median.

TM Stock Valuation (SA Premium)

Risks

Investors should monitor Toyota's success in implementing its EV market penetration and solid-state battery strategies. Failure to meet market expectations and negative news could affect Toyota's stock price. Toyota has a high level of debt when compared to common equity, but its operating income is more than sufficient to mitigate risk with a covered ratio of nearly 90.

Although the global car market has been forecast to grow in 2024, the industry faces risks related to customer affordability issues, tight credit conditions, potential decline in sales prices and demand as inventories escalate. A macro factor that bears heavily on both Toyota's immediate and long-term prospects is whether governments worldwide maintain policy pledges to streamline EV adoption to meet green transition goals.

Concluding Summary

Strong year-end sales results have bolstered our case made in October that Toyota, one of the world's largest carmakers, is not only at the top of automaker picks - but one of the best EV stocks to buy. Toyota sales of electric vehicles in the U.S. surged 30% in 2023, and overall volumes rose over 6%. The results continue to support Toyota's vows to boost EV market share and long-term commitment to electrification of its fleet. The stock price is up over 30% in the past year and forward growth looks robust. Yet Toyota's key valuation metrics such as P/E, PEG, and price/cash flow remain significantly below the sector medians.

Seeking Alpha's quant ratings and investment research tools help to ensure you are furnished with the best resources to make informed investment decisions. We have many stocks with strong buy recommendations, and you can filter them using Stock Screens to suit your specific investment objectives. Alternatively, Alpha Picks might be ideal if you're interested in two monthly stock picks of the top 'strong buy' quant stocks.

Comments