$Meta Platforms, Inc.(META)$ shares surged 20.3% to a record high on Friday after issuing its first dividend days ahead of the 20th anniversary of its Facebook unit.

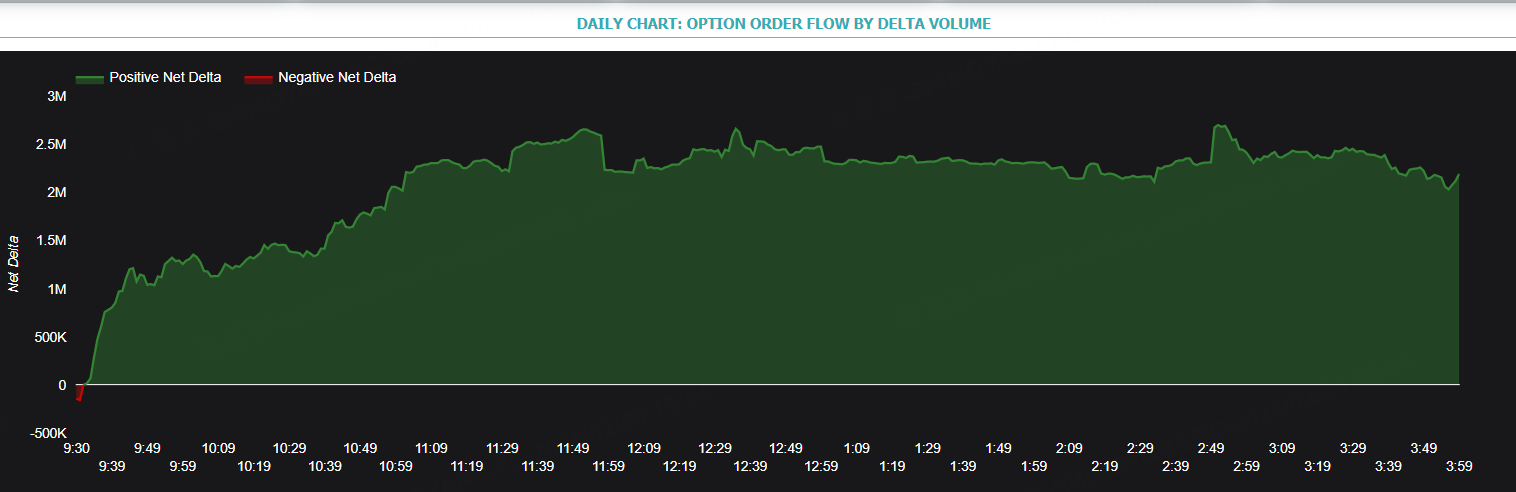

There are 2.38 million Meta option contracts traded on Friday, 6.6 times higher than the equity's 90-day average volume. Option order flow sentiment implies that traders are wagering strong bullish bets in META stock on-balance. After converting the options volume into an equivalent number of META shares bought or sold, we can find that traders bought a net equivalent of 2,195,902 shares of META stock on Friday.

Shorting OTM Puts for META Stock

In any case, short-put income plays are now very popular for shareholders. This is based on a contrarian reaction to how far the stock has moved up.

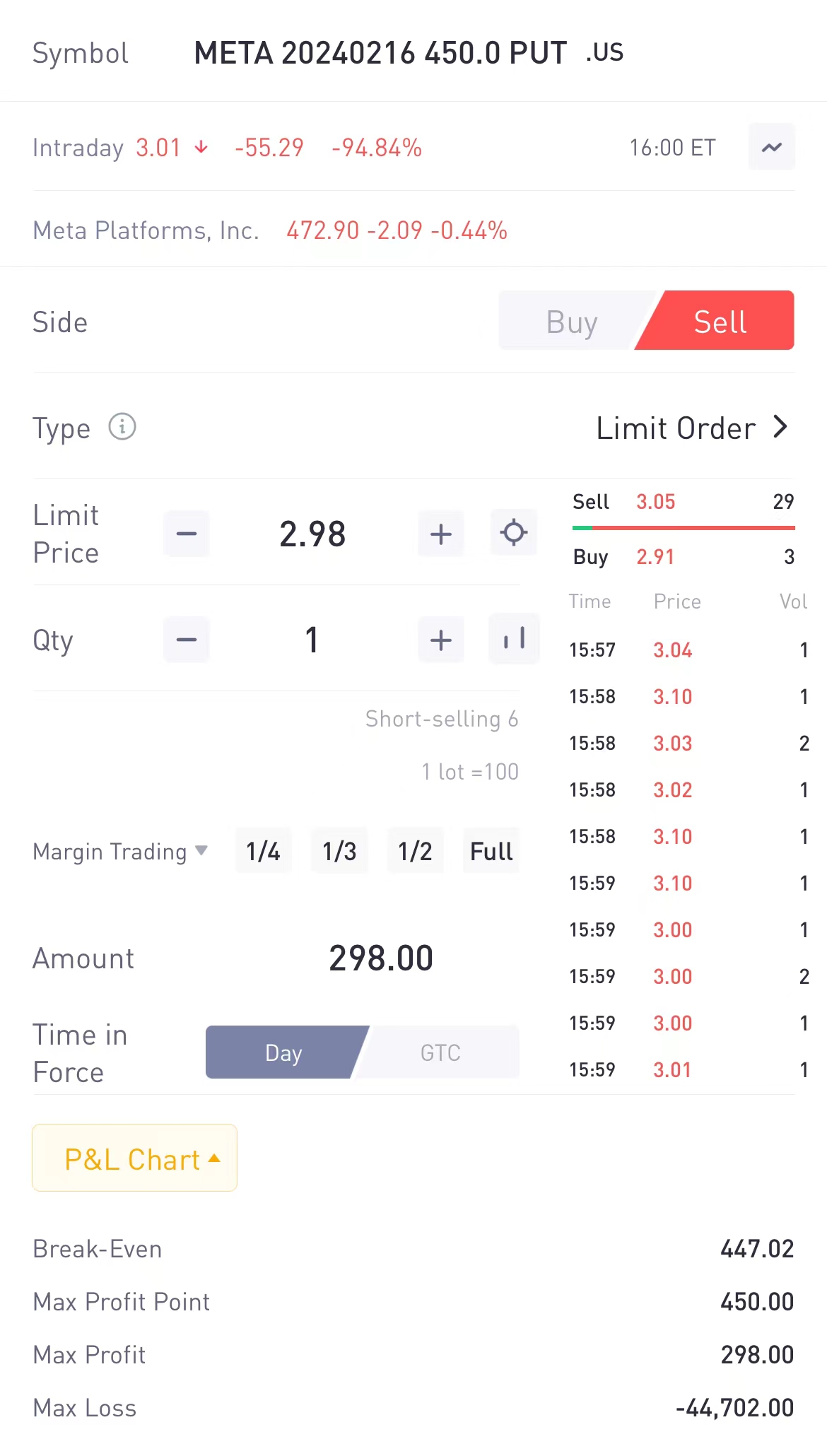

META stock closed at $474.99 on Friday. Traders can sell short out-of-the-money (OTM) puts in nearby expiry periods.

For example, shareholders can enhance this yield by shorting the $450 strike price put expiring on Feb. 16 for $2.98 per contract.

It can be a good strategy for mature investors to roll over when holding some targets for a long time. There are only 10 days until expiration. So if repeated every 2 weeks for a quarter the investor can potentially generate about 6x this amount for the next 90 days.

That is a good potential income for existing shareholders. For those who don't already own META stock it could bring potentially risks, should the stock fall below $450 in the next two weeks. So this strategy is more suitable for investors who are willing to buy Meta stock at some lower prices.

Analysts See Further Upside in META Despite Its Rise

Several analysts updated their ratings for META on February 2, 2024 following solid earnings:

Citigroup's Ronald Josey raised their price target on Facebook by 19.3% from $440 to $525 on 2024/02/02. The analyst maintained their Strong Buy rating on the stock.

Roth MKM's Rohit Kulkarni raised their price target by 37% from $365 to $500 and maintained their Strong Buy rating on the stock.

JP Morgan's Doug Anmuth raised their price target by 27.4% from $420 to $535 and maintained their Strong Buy rating on the stock.

Goldman Sachs's Eric Sheridan raised their price target by 20.8% from $414 to $500 and maintained their Strong Buy rating on the stock.

Susquehanna's Shyam Patil raised their price target on Facebook (NASDAQ: META) by 37.5% from $400 to $550 on 2024/02/02. The analyst maintained their Strong Buy rating on the stock.

Comments