$Palo Alto Networks(PANW)$ stock continued to surge over 5% in early trading on Tuesday after Congresswoman Nancy Pelosi disclosed that she bought positions in the cybersecurity company. Palo Alto stock had risen about 15% in the past three trading days.

Pelosi purchased between $500,000 and $1M worth of call options in the Nikesh Arora-led company, according to a congressional trading form filed by Pelosi. The purchase was made on Feb. 12.

The 83-year-old Pelosi also disclosed a call option purchase worth between $100,000 and $250,000. The purchase was made on Feb. 21, the same day shares plummeted after the company lowered its full-year revenue and billings guidance.

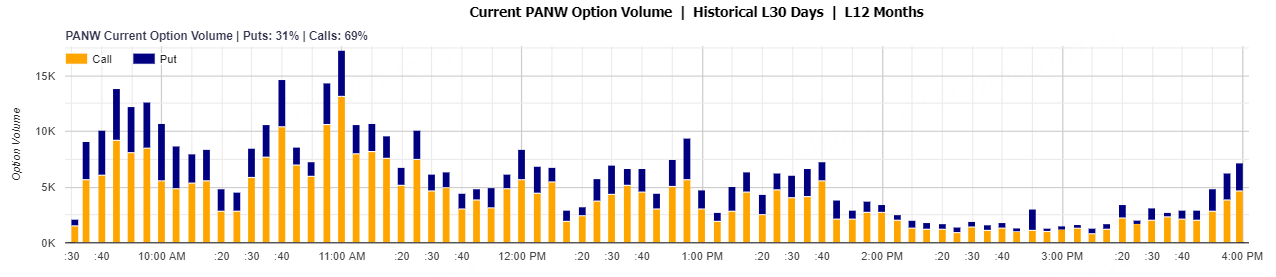

A total number of 468,609 options related to $Palo Alto Networks(PANW)$ was traded on Monday, 9.2 times higher than the 90-day average volume. Call options accounted for 69% of total options trading volume.

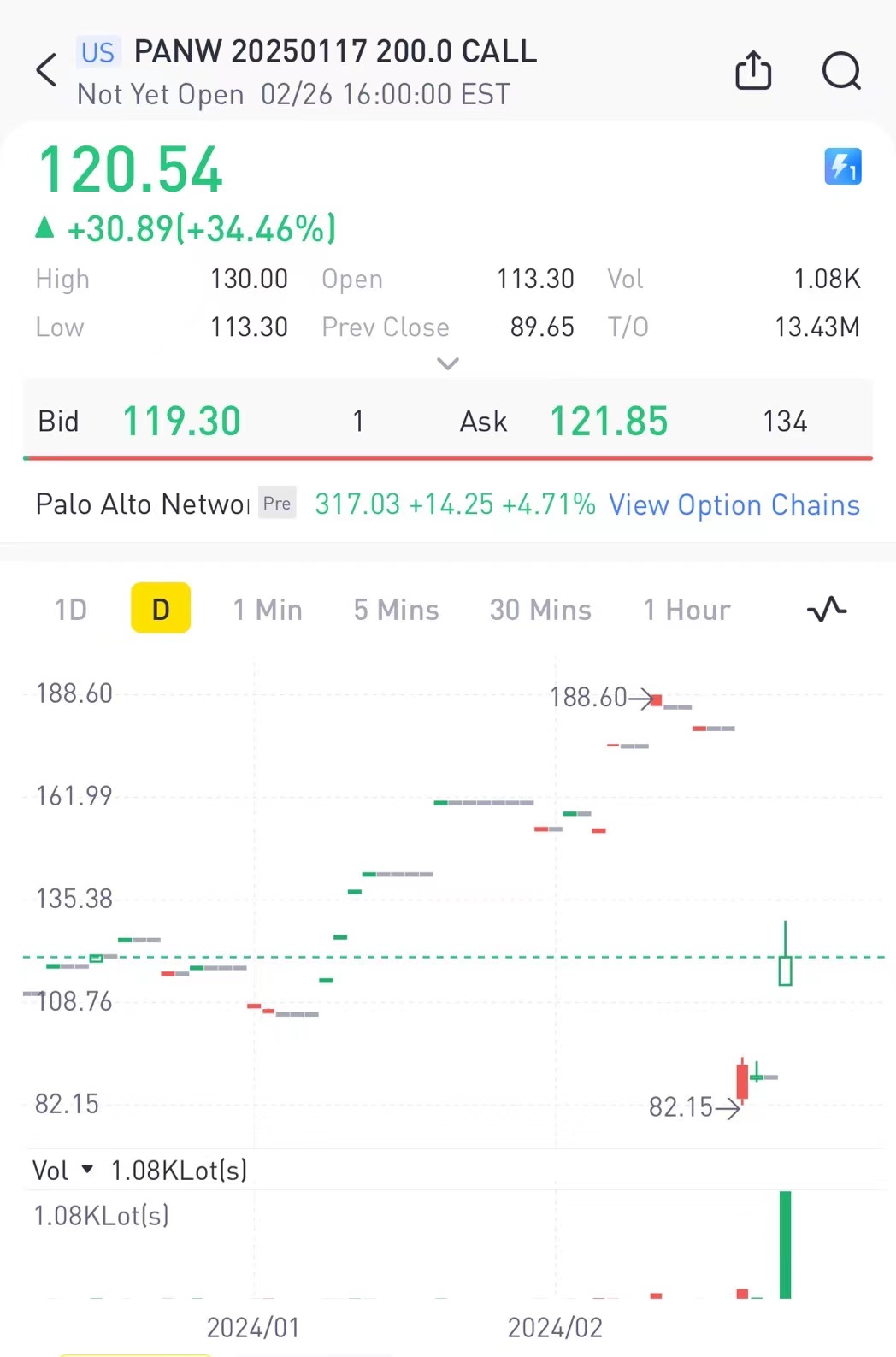

The option contract Nancy Pelosi bet was the $200 strike call option expiring Jan 17th, 2025. It had risen over 43% in the past three trading days.

Palo Alto’s Call Premiums Skyrocket 600%

After Palo Alto lowered its guidance, several Wall Street firms downgraded the company on concerns that the new change in strategy is likely to seriously hurt its business over the next year or more.

Separately on Monday, investment firm Susquehanna reiterated its Positive rating on Palo Alto Networks though it cut its price target following the company's strategy shift.

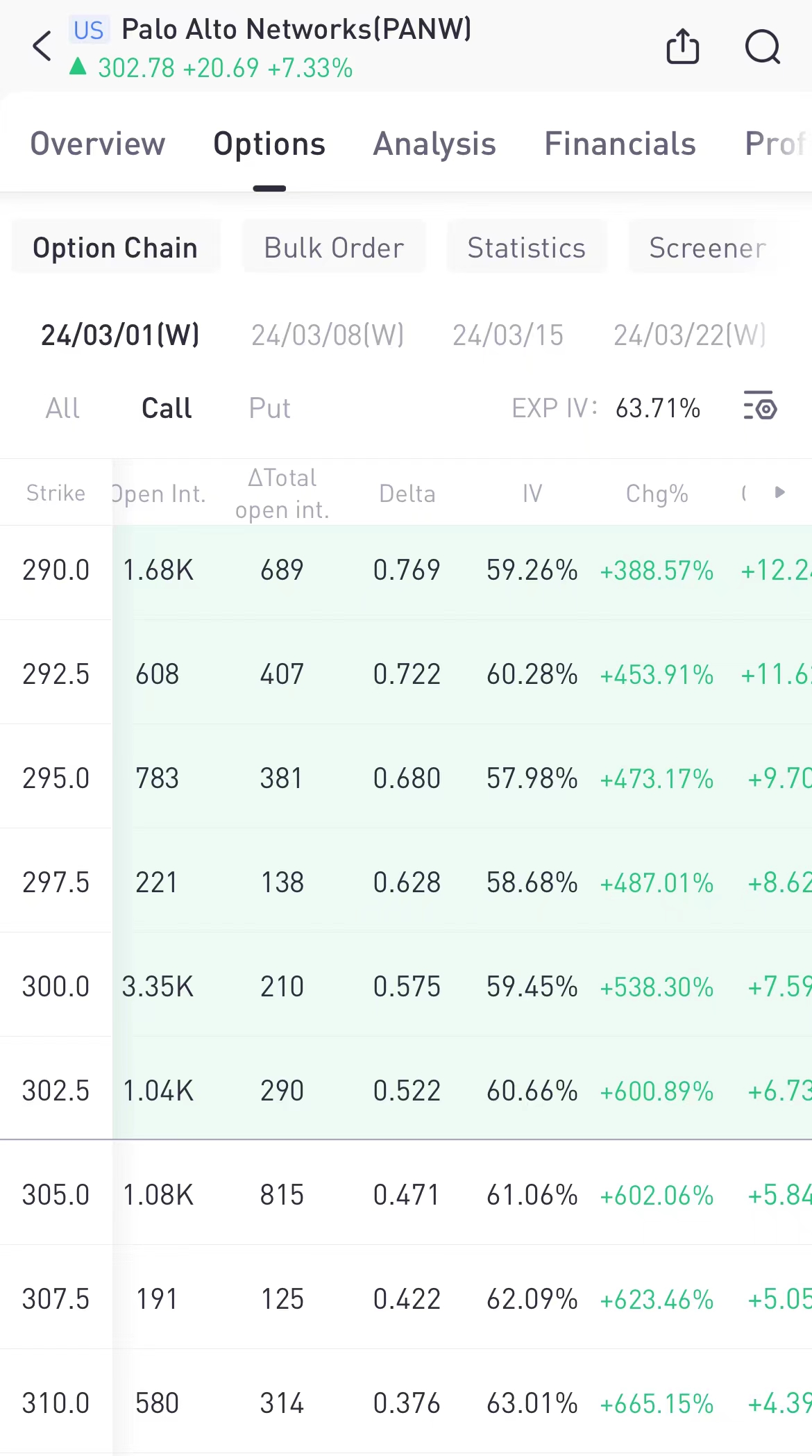

Palo Alto’s option chain shows that several call options such as $302.5, $305, $307.5 strikes expiring this Friday skyrocket over 600% on Monday.

The Congressional Trading Spree

Over the past six months, members of Congress have engaged in 10 trades involving Palo Alto Networks, comprising 7 purchases and 3 sales. This flurry of activity, including transactions by Representatives William R. Keating, Michael C. Burgess, John R. Curtis, Jonathan Jackson, Josh Gottheimer, and Senator Markwayne Mullin, as well as a sale by Representative HON. GREG STANTON, indicates a growing interest in the cybersecurity sector among lawmakers.

Palo Alto Networks, a heavyweight in the cybersecurity industry, has been at the forefront of defending against digital threats. The company's significance has been magnified by the increasing importance of cybersecurity in national security and corporate governance, making it a potentially lucrative investment for those with foresight into security trends.

Palo Alto's Sell-Offs May Overdone, Analysts Say

Palo Alto Networks stock got crushed last week after the company issued disappointing forward guidance, but some on Wall Street believe that investors have become too bearish on the stock.

While Susquehanna's Patil lowered the stocks' one-year price target from $400 per share to $325 per share, the analyst remained bullish on the stock. Even after this morning's surge, the price target suggests additional upside of roughly 5%.

In another note released this morning, JPMorgan analyst Brian Essex said he thinks there is some misunderstanding about Palo Alto's outlook commentary and deal structure. During the earnings call last week, Palo Alto CEO Nikesh Arora indicated that he was seeing some "spending fatigue" in the cybersecurity industry. But Essex seems to think that this comment hasn't been put in the proper context and that the investor reaction may have been overly negative.

Comments