on Tuesday, the second-largest discount retail department store group in the United States, $Target(TGT)$ announced that its total revenue for the Q4 2023 was $31.92 billion, a year-on-year increase of 1.7%, better than analysts' expectations of $31.83 billion.

Among them, sales were $31.47 billion, up 1.6% year-on-year.

Net profit was $1.382 billion, up 57.8% yoy; adjusted earnings per share were $2.98, better than analysts' expectations of $2.42, compared to $1.89 in the same period last year.

Gross margin was 25.6%, also better than the 22.7% in the same period last year. Same-store sales fell by 4.4%, slightly better than analysts' expectations of a 4.5% decline, but it was the third consecutive quarter of decline.

Better-than-expected profitability after the performance announcement immediately boosted the stock price by nearly 20%. Target's stock price also soared after the previous quarter's financial report.

Q4 benefited from Black Friday and the Christmas season, and purchasing power was unleashed. $Target(TGT)$ 's latest performance shows that revenue and net profit exceeded expectations. On February 20, $Wal-Mart(WMT)$ , the world's largest retailer, also announced better performance and raised its dividend, pushing Walmart's stock price to a new high.

$Wal-Mart(WMT)$ 's Q4 fiscal 2024 revenue was $173.39 billion, exceeding market expectations of $170.35 billion, an increase of 5.7% over the same period last year's $164.05 billion. Walmart also raised its annual dividend by 9%, the largest increase in over a decade. After the performance announcement, $Wal-Mart(WMT)$ 's stock price hit a historic high, reaching $60.45 at its peak.

In contrast, the performances of relatively high-end chain department stores such as $Macy's(M)$ and $Nordstrom(JWN)$ were mixed. Macy's encountered operational difficulties and is awaiting acquisition, but fortunately, the acquisition price has been raised. Nordstrom's Christmas season revenue and earnings per share exceeded expectations, but it released a pessimistic outlook, causing the stock price to plummet by 10% after hours.

$Macy's(M)$, a struggling American department store, announced on the 27th that it will close nearly one-third of its stores by 2026 while increasing the number of stores for its upscale department stores, Bloomingdale's and Blue Mercury. After the company's financial report, Macy's stock price plummeted for two days, but its earnings were boosted by the raised acquisition price, causing a 13% surge in the stock price on Monday.

$Ulta Salon Cosmetics & Fragrance(ULTA)$ ,the largest beauty retail chain in the United States, announced on March 5 that its holiday quarter sales exceeded Wall Street's expectations. The company's Q4 revenue was $4.42 billion, higher than the expected $4.39 billion, with adjusted earnings per share of $0.96, higher than the expected $0.88. However, the retailer holds a cautious attitude towards the future year, causing the stock price to fall by about 10% in after-hours trading.

Next, $Costco(COST)$ , $Dollar Tree(DLTR)$ , and $Ulta Salon Cosmetics & Fragrance(ULTA)$ will also announce their financial reports. Which one are you looking forward to the most?

Costco, the third-largest retailer in the world and the largest chain warehouse club, will announce its fiscal 2024 second-quarter earnings after the market closes on March 7. Market expectations for Q2 revenue are $57.88 billion, up 6.7% year-on-year; expected earnings per share are $3.62, compared to $3.30 in the same period last year.

Previously, on December 15th, Costco announced its fiscal first-quarter 2024 revenue of $57 billion, up 6.2% year-on-year; earnings per share were $3.58, with net profit of $1.589 billion, compared to $1.364 billion in the same period last year, all slightly higher than market expectations.

$Dollar Tree(DLTR)$ , a listed company of a US discount grocery chain, will announce its financial report on March 13th. The discount retailer is expected to announce quarterly earnings per share of $2.66, up +30.4% year-on-year. Revenue is expected to be $8.67 billion, a 12.3% increase from the same period last year.

$Ulta Salon Cosmetics & Fragrance(ULTA)$ , the largest beauty retail chain in the United States, will announce quarterly financial reports on March 14th. The company's stock surged nearly 30% after the last quarterly report.

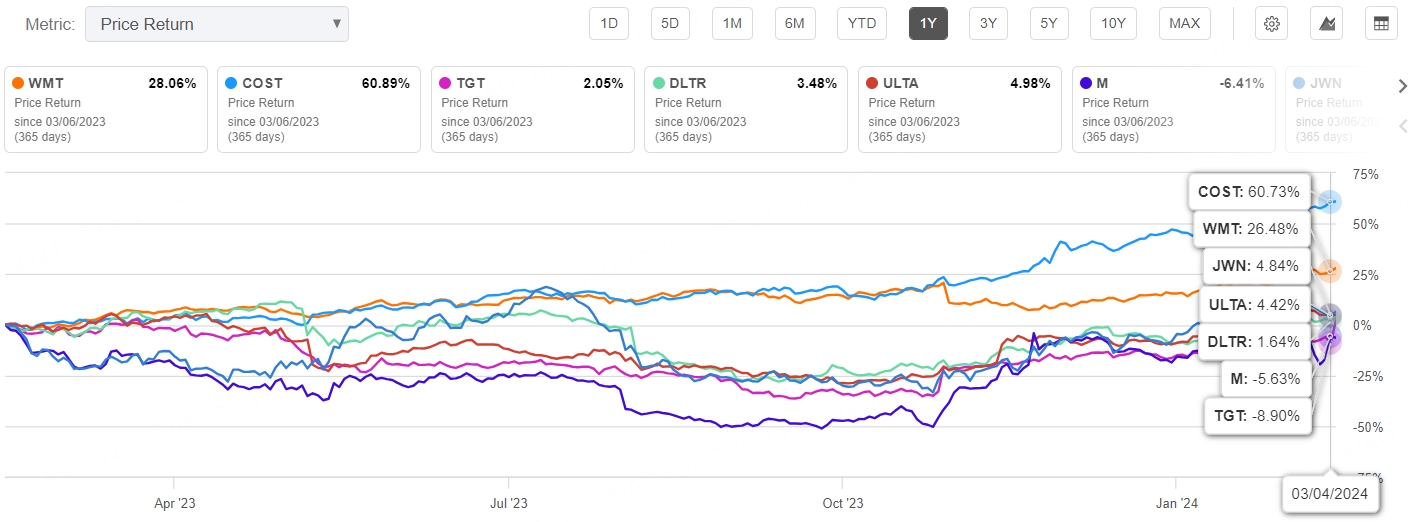

In the past year, $Costco(COST)$ has had the highest increase, reaching 60.89%, followed by $Wal-Mart(WMT)$ , with an increase of 28.06%. The increases for other companies are in single digits. It is uncertain whether other companies can catch up with the increase in the coming year.

Here is a comparison of the fundamental information, ratings, profitability, dividends, operating cash flow, and other basic financial data of the seven large retail and supermarket stocks:

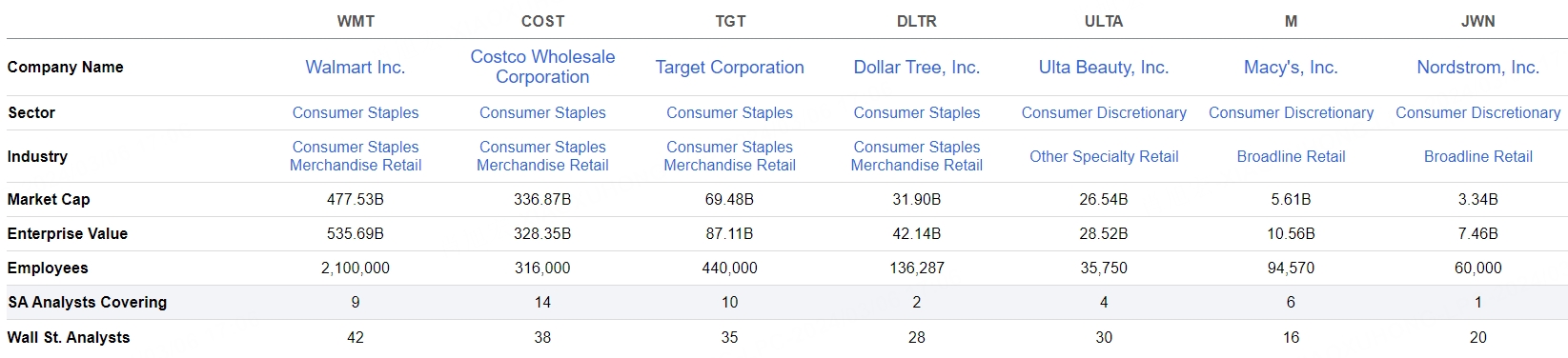

Market value ranking of the seven companies: Walmart> Costco > Target > Dollar Tree > Ulta Salon > Macy's > Nordstrom.

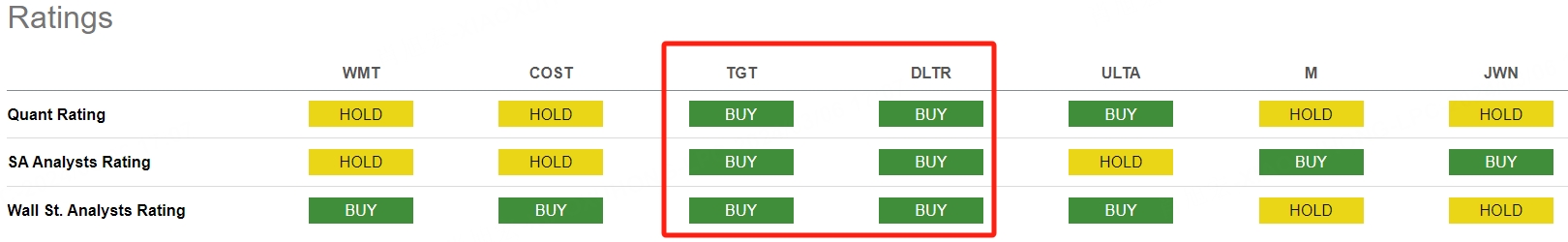

According to ratings from Wall Street, Target and Dollar Tree maintain a relatively high number of "buy" ratings.

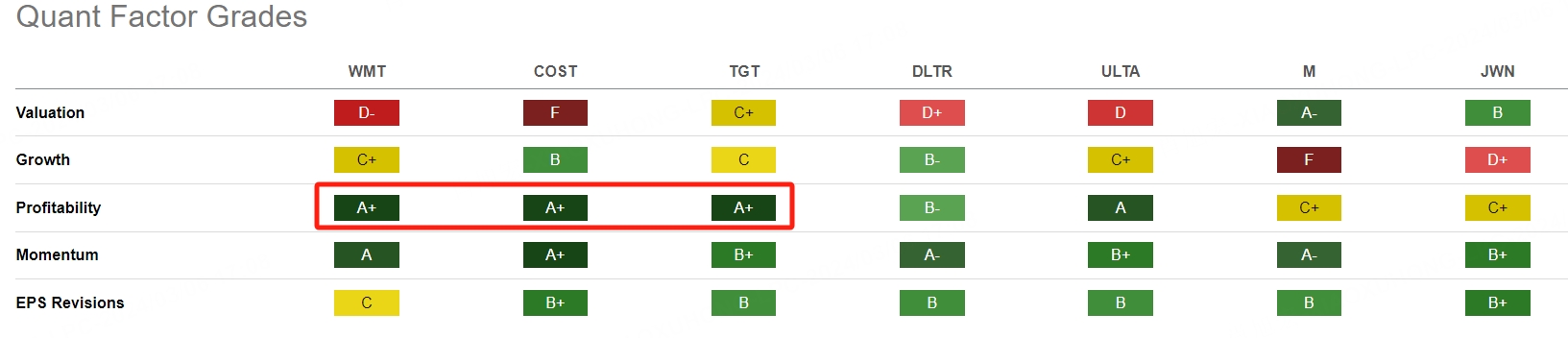

In terms of profitability ratings, Walmart, Costco, and Target are rated as A+ the highest, followed by Ulta Salon rated as A.

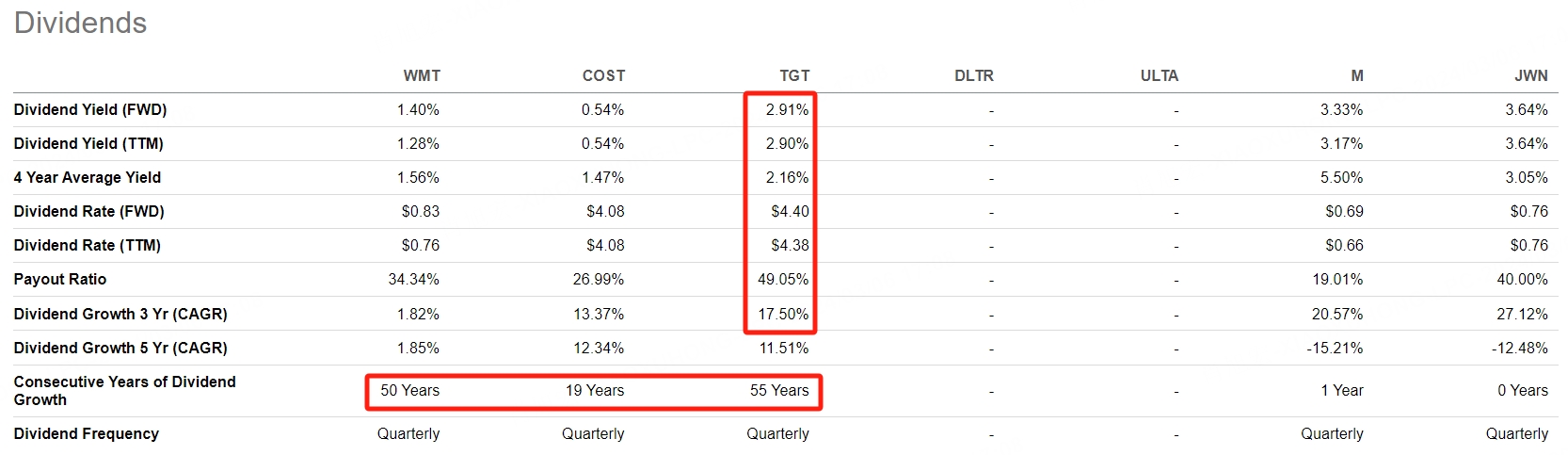

In terms of dividend data, Target and Walmart have maintained dividend records for over 50 years, followed by Costco, which has been paying dividends for 19 years. In terms of comprehensive dividend data, Target has a higher dividend ratio.

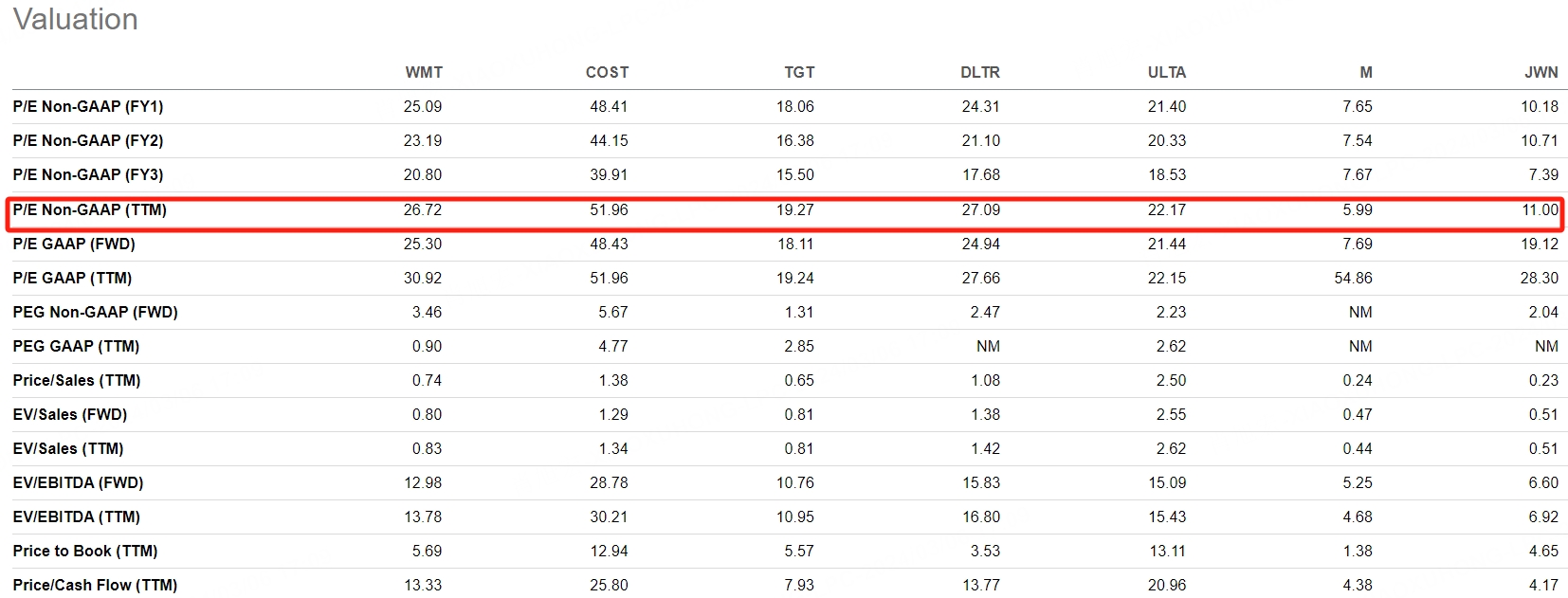

In terms of future 12-month valuation, Costco > Dollar Tree > Walmart > Ulta Salon > Target.

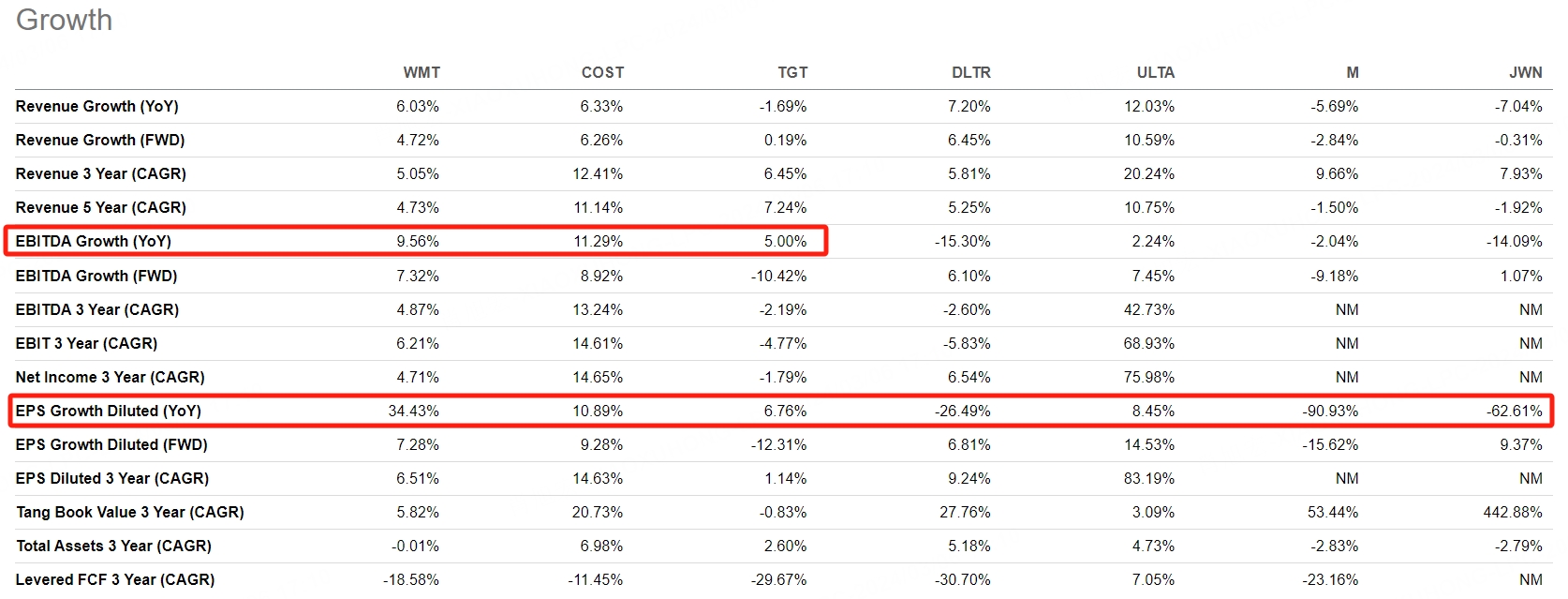

In terms of year-on-year revenue growth, Costco > Walmart > Target > Ulta Salon, and earnings per share follow the same order.

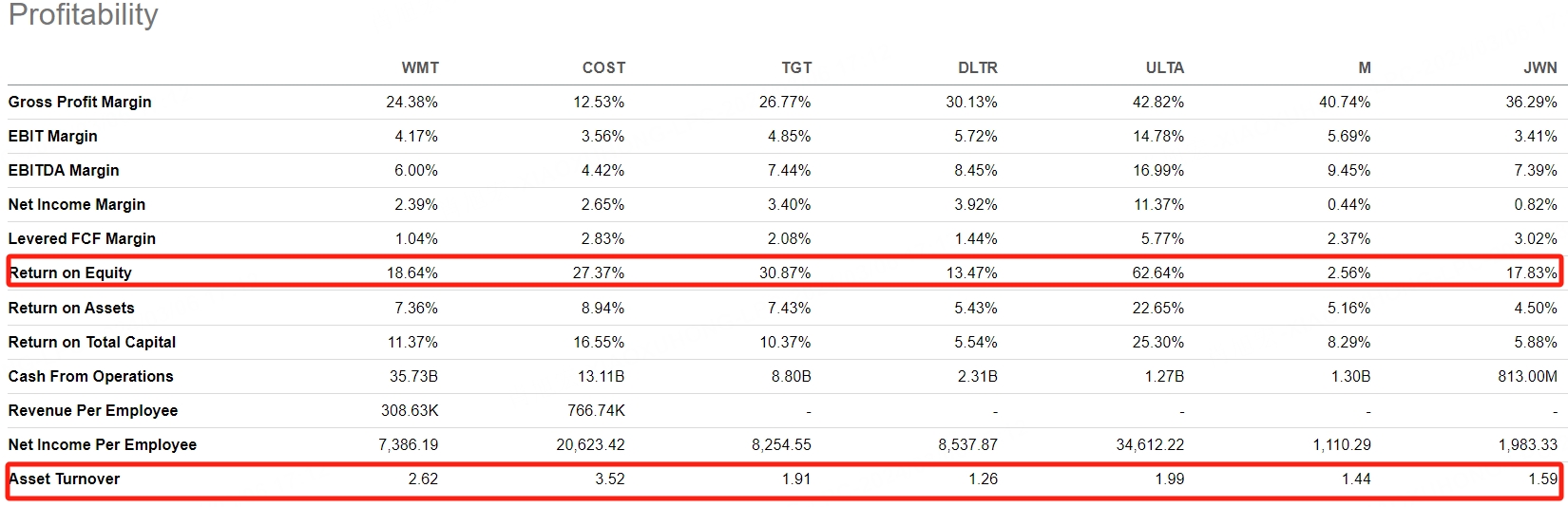

In terms of earnings per share return, Ulta Salon > Target > Costco > Walmart.

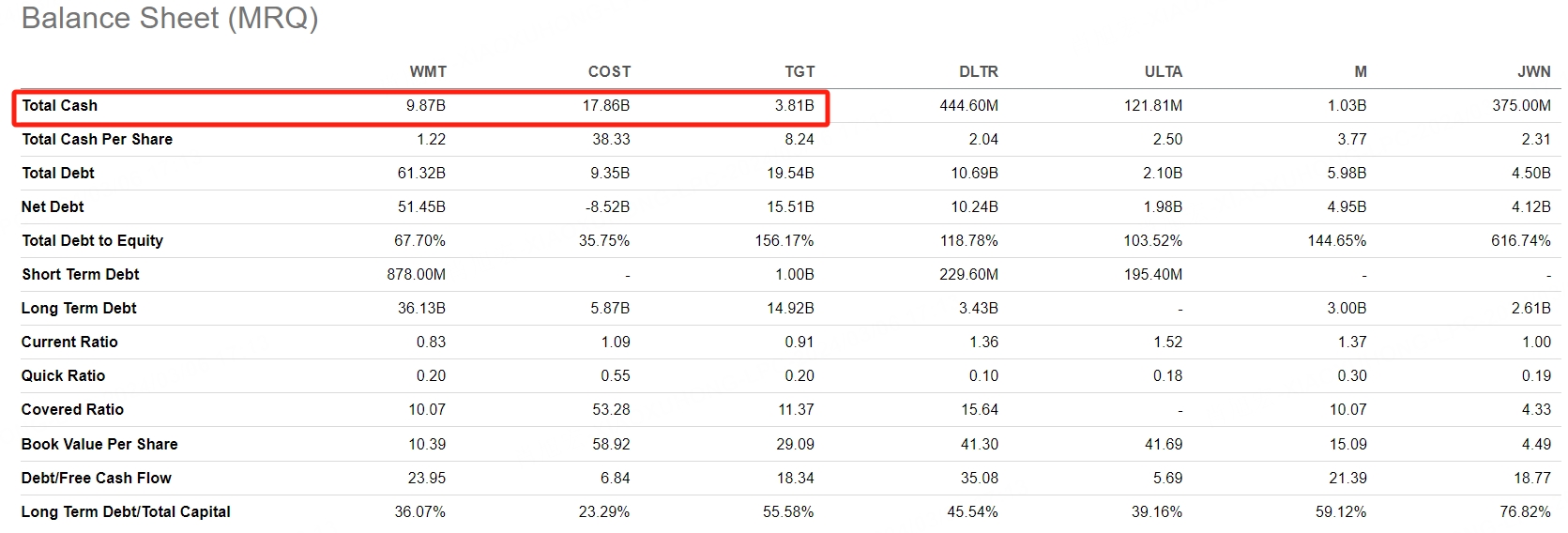

In terms of company cash capability, the top three are Walmart, Costco, and Target.

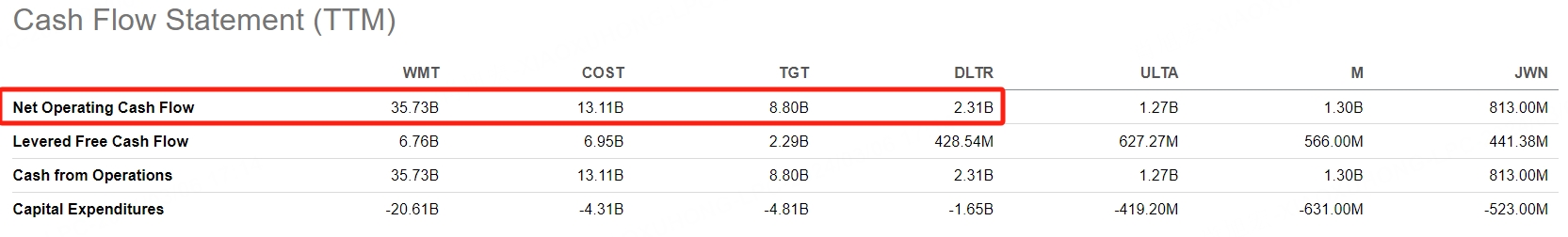

In terms of operating cash flow capability, Walmart > Costco > Target > Dollar Tree.

These are some comparisons of the performance of large retailers and supermarkets with different characteristics. The retail industry belongs to a defensive industry.

Compared with that, companies in necessity consumption ( $Wal-Mart(WMT)$ , $Costco(COST)$ , $Target(TGT)$ , $Dollar Tree(DLTR)$ ) performed slightly better than companies in optional/(high-end consumer) retail ( $Ulta Salon Cosmetics & Fragrance(ULTA)$ , $Macy's(M)$ , $Nordstrom(JWN)$ ).

The future performance expectations of companies in necessity consumption are relatively stable. Companies in this category often have stable performance expectations, even in recessions or bear markets, their declines are smaller than the market, and some even show an upward trend, making them a kind of asset for risk aversion.

These are the comprehensive data of today's retail and supermarket stocks.

Feel free to leave a comment in the comment section about which retail or supermarket stocks you are most optimistic about.

Comments