Reflecting on this year's bullish U.S. market, AI stocks have shone brightly and become the main driving force of the market.

$NVIDIA Corp(NVDA)$ completed a stock split in June, and the soaring prices before the split are still fresh in investors' minds. Looking ahead, $Broadcom(AVGO)$ 's split plan will also be executed—specifically, a "1 for 10" split after the market closes on July 12th, with trading of the split shares commencing before market open on July 15th.

Broadcom's CFO has noted that the split will "make it easier for investors and employees to access Broadcom stock." In terms of stock performance, Broadcom has already surged over 14% since announcing the split.

Even Pelosi recently made moves in Broadcom, purchasing 20 call options with a strike price of $800 and expiration date in June 2025. The transaction's total value is estimated between $1,000,001 to $5,000,000.

What impact will the split have?

In fact, a stock split itself won't lead to higher returns or affect a company's overall value—the total market value remains unchanged. However, a split does help specific investors afford shares and increases stock liquidity, thereby lowering bid-ask spreads and attracting more funds into buying stocks.

An earlier report from Bank of America indicated that while a split doesn't affect a company's fundamentals or market value, historically, especially positive splits are often seen as bullish signals by the market.

According to their data since 1980, $S&P 500(.SPX)$ index companies announcing splits have typically outperformed the index significantly in the 3, 6, and 12 months following the split announcement, with average stock price increases of 25.4%, compared to the index's average rise of 11.9% over the same period.

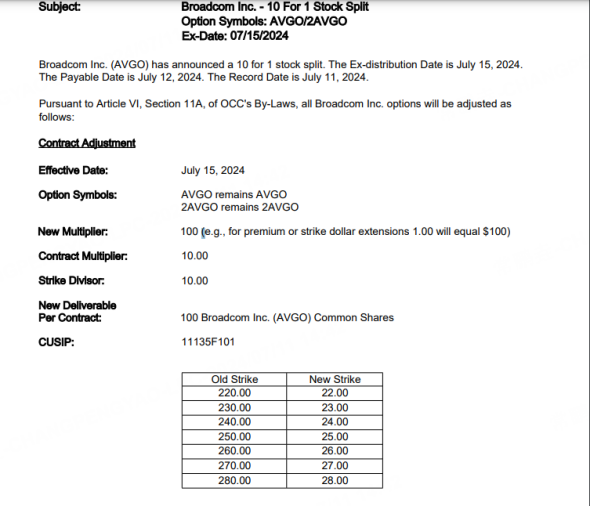

Post-split, options contract terms will adjust accordingly.

How will options and stocks change after split?

Broadcom's 1 for 10 split will increase the number of shares by 9 times and reduce the price to one-tenth.

For instance, if an investor held 100 shares of Broadcom at $1,745 before the split, they will now hold 1,000 shares priced at $174.5 post-split—same total value, but more shares.

Option holders will have their contracts increase by a factor of ten post-split, with strike prices adjusting to one-tenth. For example, a contract originally with a strike price of $220 will become 10 contracts with a strike price of $22, while the overall option price remains unchanged. The ticker symbol for these options remains AVGO.

What options strategies can investors use?

In anticipation of a post-split surge, investors may consider employing bullish spread strategies to go long on Broadcom while managing risks.

For instance, selling put options expiring on July 19th with a strike price of $1,890, and simultaneously buying put options with the same expiration date at a strike price of $1,730. This strategy carries a maximum loss of $4,489 and a maximum gain of $11,500.

If concerned about a potential post-split decline in Broadcom, investors may opt for risk-managed Collar Strategies.

Comments